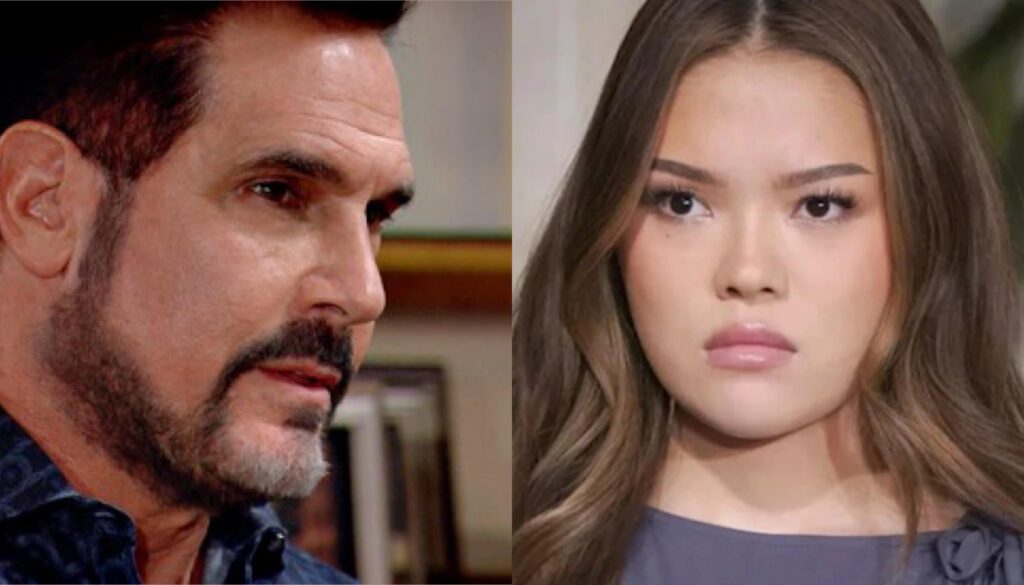

Bill Spencer plans deadly trap as Luna Nozawa buys gun targeting Steffy. Sheila turns to Poppy for help. Finn wavers. June 2-6, 2025 spoilers reveal shocking confrontation.

BILL SPENCER’S DEADLY TRAP: LUNA’S KILLING SPREE COULD END IN DISASTER

Dollar Bill Finally Sees the Monster He Unleashed

Bill Spencer just realized he made the biggest mistake of his life. After helping Luna Nozawa get out of prison, the young killer is back to her murderous ways — and this time, she’s got Steffy Forrester in her crosshairs! The week of June 2-6, 2025, is about to explode with violence, betrayal, and a deadly game of cat and mouse that could leave someone dead.

The 2025 Real Estate Landscape: Navigating Prime Investment Opportunities Across the USA

As a seasoned real estate professional with over a decade immersed in the intricate ebb and flow of property markets, I can confidently assert that 2025 presents a unique confluence of challenges and unparalleled opportunities for discerning investors. The post-pandemic recalibration, combined with persistent inflationary pressures, evolving interest rate dynamics, and significant demographic shifts, has fundamentally reshaped the American housing and investment landscape. This isn’t just about buying property; it’s about strategic wealth creation, understanding localized nuances, and positioning your portfolio for sustained long-term appreciation and robust passive income generation.

Forget the simplistic “hot market” narratives of yesteryear. Today’s success demands a sophisticated understanding of macro-economic indicators, granular demographic data, and forward-looking infrastructure development. We’re moving beyond mere speculation into a realm of informed, data-driven real estate investment. The goal for 2025 is not just to find a property, but to identify a segment of the market poised for significant growth, resilient against economic headwinds, and aligned with future lifestyle trends. This comprehensive guide will dissect the critical factors shaping the 2025 market and illuminate the premier investment pathways across the United States.

The Macro Environment: Catalysts and Constraints for 2025

Before diving into specific markets, it’s crucial to understand the overarching forces at play. The real estate market forecast for 2025 indicates a complex interplay of several key drivers:

Interest Rate Normalization: While the era of ultra-low interest rates is likely behind us, 2025 will see a more stabilized, albeit higher, rate environment. This shifts the focus from purely capital appreciation to a balanced approach considering rental yield and cash flow. Savvy investors will explore innovative financing solutions and understand the impact on borrower affordability.

Inflation and Economic Resilience: Real estate has historically served as a powerful inflation hedge. In 2025, properties in economically diverse regions with strong employment bases will offer superior protection against eroding purchasing power. Identifying markets where local economies are robust and diversified, rather than reliant on a single industry, is paramount.

Demographic Shifts Real Estate: The millennial generation, now firmly in their prime homebuying and family-raising years, continues to drive demand for both suburban single-family homes and urban core rentals. Concurrently, an aging boomer population is fueling demand for retirement communities and lifestyle-focused properties. Understanding these demographic shifts is key to targeting the right property type in the right location.

Remote Work’s Evolving Impact: While the initial mass exodus from major metros has moderated, the lasting impact of hybrid work models continues to redefine desirable locations. Secondary cities and well-connected suburbs with a high quality of life are seeing sustained interest, often providing better value and lower cost of living than traditional hubs. This contributes significantly to emerging housing markets USA.

Supply Chain and Construction Costs: Persistent challenges in material availability and skilled labor shortages continue to impact new construction, keeping inventory levels tight in many desirable areas. This underpins the value of existing, well-maintained properties and creates opportunities in markets where new development is actively addressing supply gaps.

Sustainability and Climate Resilience: Environmental considerations are moving from niche concern to mainstream necessity. Properties incorporating sustainable features or located in areas less prone to climate-related risks are gaining appeal, potentially commanding premium values and lower operating costs in the long run.

Premier Investment Pathways for 2025: Where to Look and Why

Drawing from my decade of market analysis and transactional experience, I’ve identified several distinct investment pathways, each tailored to different investor profiles and objectives, that are poised for success in 2025.

Growth & Appreciation Hubs: The Dynamic Innovators

These markets are characterized by robust job growth, particularly in high-wage sectors like technology, healthcare, and advanced manufacturing, leading to strong population influx and upward pressure on property values. They are the engines of long-term real estate appreciation.

Characteristics: Rapid population growth, significant corporate relocations/expansions, strong university presence, diversified economies, younger demographic profile.

Why 2025: These markets continue to attract talent and investment, driving demand for both rental and owner-occupied housing. High-yield rental properties in these areas often see consistent occupancy and rental growth.

Key High CPC Keywords: Emerging housing markets USA, tech real estate investment, long-term real estate appreciation, wealth creation real estate.

Spotlight Cities:

Austin, TX: Despite its rapid growth, Austin continues to defy expectations. Its tech ecosystem, educational institutions, and burgeoning cultural scene attract a constant stream of high-income earners. The demand for luxury real estate investment and mid-tier housing remains robust. While affordability is a concern, strategic investments in surrounding suburbs or niche urban pockets can still yield significant returns.

Raleigh-Durham, NC (Research Triangle Park): A perennial favorite, the RTP area continues its upward trajectory fueled by biotech, pharma, and IT. Excellent quality of life, top-tier universities, and a lower cost of living compared to coastal tech hubs make it a magnet for families and professionals. This market offers a compelling blend of stability and strong growth potential for both single-family and multifamily assets.

Nashville, TN: Beyond its music fame, Nashville has cemented itself as a major healthcare, corporate, and logistics hub. Its business-friendly environment and strategic location are drawing in significant corporate investment and population migration. Both urban core developments and well-positioned suburban communities offer substantial upside.

Phoenix, AZ: The Valley of the Sun continues to be a powerhouse for population and job growth, especially in tech and manufacturing. Its relatively lower operating costs and warm climate attract businesses and individuals alike. While it’s seen rapid appreciation, the underlying fundamentals of strong demand and diversified economy suggest continued, albeit tempered, growth. Opportunity zone investments are also worth exploring here.

Income & Rental Yield Powerhouses: The Cash Flow Champions

For investors prioritizing consistent cash flow and strong rental returns, certain markets stand out. These areas benefit from high renter demand, often due to affordability challenges in the for-sale market, tourist appeal, or a transient workforce.

Characteristics: High proportion of renters, strong tourist appeal, military bases or large student populations, relatively stable property values, diverse employment opportunities.

Why 2025: With interest rates stabilizing, the focus shifts to predictable income streams. These markets offer robust rental yields that can significantly contribute to passive income real estate portfolios. Short-term rental investment strategies are particularly potent here.

Key High CPC Keywords: High-yield rental properties, passive income real estate, short-term rental investment strategies, rental property management.

Spotlight Cities:

Orlando, FL: A global tourism mecca, Orlando’s short-term rental market (Airbnb) remains incredibly strong. The constant influx of visitors ensures high occupancy rates, and its growing population also supports long-term rentals. Beyond vacation homes, the metro’s burgeoning tech and healthcare sectors create a diverse renter base.

Indianapolis, IN: Often overlooked, Indianapolis boasts a remarkably stable and affordable housing market with strong rental demand. Its diversified economy, growing tech sector, and low cost of living make it attractive to businesses and residents. This market is ideal for traditional long-term buy-and-hold strategies, offering excellent cash-on-cash returns.

Kansas City, MO/KS: Straddling two states, Kansas City is a hidden gem for rental property investment. With a strong job market (logistics, animal health, tech), cultural amenities, and significantly lower entry prices than coastal cities, it offers attractive cap rates and consistent tenant demand.

Certain Submarkets in the Sun Belt: While specific cities might fluctuate, many secondary cities across the Sun Belt (e.g., specific neighborhoods in Jacksonville, FL; Memphis, TN; or even some areas of Dallas-Fort Worth that offer better value) will continue to be strong for rental income due to sustained migration and relative affordability.

Value & Affordability Havens: The Underestimated Opportunities

These markets offer lower entry points for investors, making them attractive for those looking to maximize their buying power or targeting first-time homebuyers. While appreciation may be slower, the potential for long-term growth as these areas develop is significant.

Characteristics: Lower median home prices, manageable property taxes, steady but not explosive job growth, potential for revitalization, strong local community.

Why 2025: As interest rates remain elevated, affordability becomes a primary driver for many homebuyers. These markets allow investors to acquire properties at a lower basis, providing a strong foundation for future equity build-up and excellent cash flow. Affordable housing investment strategies are particularly effective here.

Key High CPC Keywords: Affordable housing investment strategies, lowest property taxes real estate, emerging real estate markets, value-add property investment.

Spotlight Cities:

Cleveland, OH: Cleveland has undergone a remarkable transformation, shedding its old image. Its burgeoning healthcare sector, revitalized downtown, and lakefront appeal offer incredible value. While not a rapid growth market, it provides excellent rental yields and steady appreciation, making it a prime location for tax-advantaged real estate investing due to its affordability.

St. Louis, MO: Another Midwest contender, St. Louis presents compelling opportunities for value investors. A low cost of living, diverse economy (biotech, healthcare, manufacturing), and a wealth of historic architecture offer unique investment propositions. Investing in revitalizing neighborhoods can yield substantial long-term returns.

Oklahoma City, OK: Oklahoma City has quietly built a resilient economy, driven by energy, aerospace, and logistics. Its continued investment in infrastructure and downtown revitalization, coupled with a low cost of doing business and living, makes it an attractive market for both residents and investors seeking affordability and steady growth.

Upstate New York (e.g., Rochester, Buffalo): Beyond NYC, cities like Rochester and Buffalo are experiencing a resurgence. Driven by investments in advanced manufacturing, tech, and healthcare, these cities offer incredibly low entry points, good rental demand, and a high quality of life, positioning them for gradual, sustainable growth.

Lifestyle & Retirement Destinations: Catering to a Golden Age

With a significant portion of the population entering or nearing retirement, markets offering desirable climates, amenities, and a high quality of life for seniors are experiencing consistent demand. These areas also appeal to those seeking a vacation home or a slower pace of life.

Characteristics: Warm climates, access to healthcare, recreational opportunities (golf, beaches), lower property taxes (often), strong community infrastructure.

Why 2025: The “silver tsunami” continues to drive demand in these locales. Retirement real estate planning is a major factor, leading to sustained purchases and a stable market for certain property types. Coastal property investment also falls under this umbrella, attracting both retirees and vacationers.

Key High CPC Keywords: Retirement real estate planning, coastal property investment, senior living investment, amenity-rich communities.

Spotlight Cities:

Sarasota, FL: A jewel on Florida’s Gulf Coast, Sarasota combines stunning beaches, a vibrant arts scene, and excellent healthcare. It consistently ranks high for retirement and quality of life, ensuring a steady stream of affluent buyers. The luxury real estate investment segment here is particularly strong.

Myrtle Beach, SC: Offering affordability compared to some other coastal markets, Myrtle Beach remains a favorite for retirees and vacationers. Its extensive golf courses, beaches, and family-friendly attractions drive both long-term and short-term rental demand.

Boise, ID: While not a traditional “retirement” climate, Boise’s outdoor lifestyle, growing tech scene, and relatively low cost of living are attracting both younger families and active retirees seeking a balance of urban amenities and natural beauty. It’s a compelling example of a market driven by quality of life.

Tucson, AZ: Offering a more relaxed pace than Phoenix, Tucson boasts a unique desert landscape, vibrant arts and culinary scene, and a lower cost of living, making it appealing to retirees and those seeking a warm, culturally rich environment.

Resilient Suburban & Family-Friendly Enclaves: The Enduring Core

The demand for spacious homes, good schools, and community amenities in suburban settings remains strong. These markets offer stability, consistent appreciation, and are often less volatile than urban cores.

Characteristics: Top-rated school districts, low crime rates, community parks and amenities, access to major employment centers, single-family home dominance.

Why 2025: Families continue to prioritize safety, education, and space. Suburban growth trends indicate sustained demand, making these ideal for long-term hold strategies. Investors targeting family-friendly communities real estate will find consistent tenant pools.

Key High CPC Keywords: Family-friendly communities real estate, suburban growth trends, best school district homes, single-family rental investment.

Spotlight Regions (focus on quality suburbs within):

Dallas-Fort Worth Metroplex, TX: While Dallas itself is a growth hub, its vast network of high-quality suburbs (e.g., Frisco, Plano, McKinney) continues to draw families with excellent schools, job opportunities, and master-planned communities.

Atlanta Metro Area, GA: Similar to DFW, Atlanta’s sprawl offers diverse suburban options. Areas like Alpharetta, Roswell, and Johns Creek consistently rank high for families, with strong schools and community infrastructure driving demand.

Charlotte Metro Area, NC: Charlotte’s rapid growth has fueled development in its surrounding suburbs, such as Fort Mill (SC), Huntersville, and Matthews. These areas offer a blend of southern charm, modern amenities, and proximity to Charlotte’s thriving job market.

Chicago Exurbs (e.g., Naperville, Wheaton, Geneva): While Chicago’s urban core faces challenges, its well-established, highly-rated western and northern suburbs offer enduring value, excellent school systems, and a high quality of life, appealing to families seeking stability.

Navigating the 2025 Market Landscape: Expert Insights

Successfully navigating the 2025 real estate market requires more than just identifying promising cities; it demands a sophisticated investment approach:

Due Diligence Real Estate is Non-Negotiable: Never skip thorough research on local zoning laws, property taxes, rental market analysis, and future development plans. Understand the local economy beyond surface-level statistics.

Leverage Data and Local Expertise: Partner with local real estate agents, property managers, and market analysts who have their finger on the pulse of micro-markets. General trends are important, but success lies in hyper-local understanding.

Real Estate Portfolio Diversification: Don’t put all your eggs in one basket. Consider diversifying across different property types (single-family, multifamily, short-term rentals) and geographic regions to mitigate risk and optimize returns.

Consider Niche Opportunities: Explore build-to-rent communities, adaptive reuse projects, or even specific commercial real estate segments (e.g., last-mile logistics, medical office space) that align with macro trends.

Focus on Value-Add Strategies: Look for properties where smart renovations or operational efficiencies can significantly increase their value and rental income. This is a crucial component of wealth creation real estate.

Understand Tax Implications: Leverage tax-advantaged real estate investing strategies, such as 1031 exchanges, depreciation, and opportunity zones, to maximize your net returns. Consult with a qualified tax advisor.

Your Next Step in the 2025 Real Estate Journey

The American real estate market in 2025 is not just about transactions; it’s about strategic planning, informed decision-making, and leveraging expert knowledge to build lasting wealth. The opportunities are abundant for those willing to look beyond the headlines and delve into the fundamental drivers of growth and value. Whether your goal is to generate robust passive income, achieve significant long-term appreciation, or diversify your investment portfolio, the time for strategic action is now.

Don’t let the complexity of the current market deter you. Instead, view it as an invitation to engage with greater intention and foresight. The insights provided here are a starting point, a compass for the vast landscape ahead.

Are you ready to transform these insights into tangible investment success? Connect with a trusted real estate investment advisor today to craft a personalized strategy that aligns with your financial goals and capitalizes on the prime opportunities of 2025.