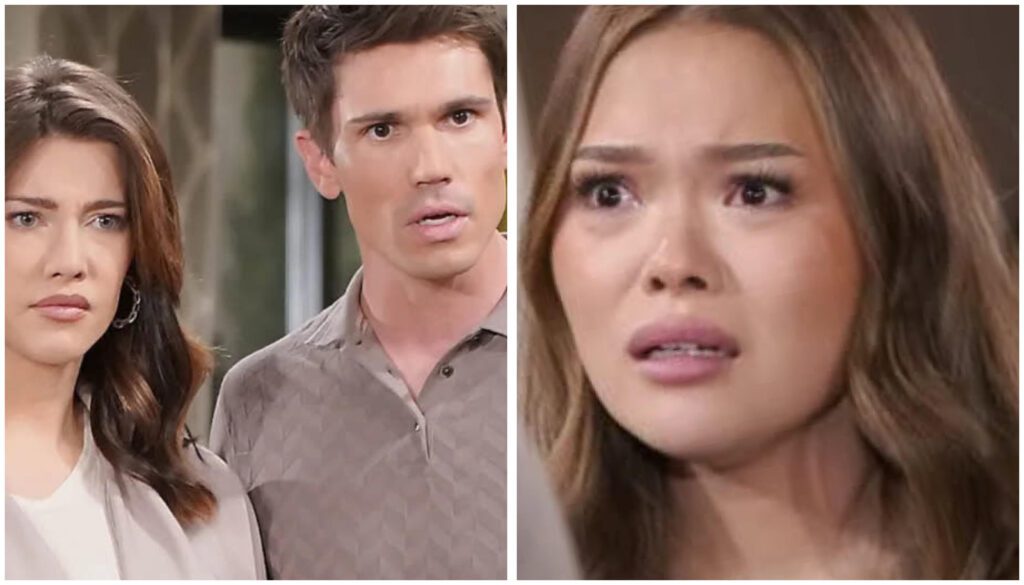

Finn returns home to find daughter Luna attacking wife Steffy in explosive B&B confrontation. Luna blames Steffy for ruining her chance with Finn. See who Finn chooses!

FINN’S HORROR SHOW HOMECOMING EXPLODES AS LUNA ATTACKS STEFFY IN DEVASTATING FATHER-DAUGHTER SHOWDOWN

A Family Torn Apart by Obsession

John “Finn” Finnegan thought he was coming home from the hospital to peace and quiet. Instead, he walked straight into his worst nightmare. The man found his biological daughter Luna Nozawa in a heated confrontation with his wife Steffy Forrester, and what happened next will leave viewers absolutely stunned.

Luna’s Explosive Accusations Rock the Forrester Home

The confrontation had been building for weeks, ever since the shocking revelation that Luna is Finn’s daughter from a past affair with Poppy Nozawa. But nobody could have predicted the violence of Luna’s attack on Steffy.

Navigating the 2025 US Real Estate Landscape: An Expert’s Guide to High-Potential Markets

As we step into 2025, the U.S. real estate market continues its dynamic dance, influenced by a confluence of economic shifts, demographic movements, and evolving lifestyle priorities. Having navigated these waters for over a decade, I’ve witnessed firsthand how resilience, innovation, and strategic insight define success in this ever-changing environment. This isn’t your parents’ market; it’s a complex, opportunity-rich arena demanding a sophisticated understanding of both macro trends and hyper-local nuances.

The past few years have laid the groundwork for a fascinating 2025. We’ve seen persistent demand, fluctuating interest rates, ongoing inventory challenges, and the lasting impact of remote work on migration patterns. For investors and homebuyers alike, the question isn’t whether opportunities exist, but where to find the highest potential and how to align those opportunities with their personal and financial goals. Forget the simplistic “hotlist”; a true expert understands that “top” is subjective and dependent on your investment thesis.

In this comprehensive guide, I’ll distill the critical insights needed to identify prime real estate markets across the nation, whether you’re chasing high ROI, stable rental income, long-term appreciation, or simply the perfect place to call home. We’ll delve into the categories that truly matter, showcasing cities and regions poised for significant activity in the year ahead.

The Growth Dynamos: High-Appreciation Markets Fueling Wealth Creation

For investors prioritizing capital appreciation and robust ROI, the sweet spot lies in markets experiencing significant economic growth, population influx, and strategic infrastructure development. These are the urban centers and burgeoning metros that consistently defy broader slowdowns, powered by strong job creation and an attractive quality of life.

Key Drivers for 2025:

Persistent In-Migration: Cities attracting a steady stream of new residents, especially younger demographics and skilled professionals.

Diversified Economic Base: Markets not overly reliant on a single industry, offering resilience against sector-specific downturns.

Infrastructure Investment: Regions benefiting from public and private investment in transportation, technology, and community amenities.

Where to Look in 2025:

Southeastern Powerhouses (Raleigh-Durham, Nashville, Atlanta): These cities continue their reign as magnets for corporate relocations and talent. The “Research Triangle” in North Carolina, with its booming tech and biotech sectors, ensures sustained demand for both residential and commercial properties. Nashville’s dynamic music, healthcare, and corporate scenes drive its relentless growth. Atlanta, a major transportation hub and diverse economic engine, benefits from affordability relative to coastal hubs and continued expansion of its tech and film industries. Expect high ROI real estate opportunities in these areas, particularly in developing suburbs and transit-oriented communities.

Texas Titans (Austin, Dallas-Fort Worth): Texas remains a beacon for business relocation and population growth, largely due to its favorable tax environment and pro-business policies. Austin’s tech boom, while maturing, continues to drive demand, albeit with increased housing costs. Dallas-Fort Worth presents a more diversified and slightly more accessible entry point, with massive corporate expansion and a robust job market spanning finance, logistics, and healthcare. These markets are consistently ranked among the fastest growing cities in the US, offering compelling real estate investment opportunities for those seeking long-term appreciation.

Mountain West Ascenders (Boise, Salt Lake City): These regions, while facing challenges with affordability, continue to see strong demand from those seeking a balance of outdoor lifestyle and growing job markets. Boise has emerged as a tech and remote-work haven, while Salt Lake City benefits from its burgeoning tech sector (“Silicon Slopes”) and strategic location. The limited inventory coupled with strong demand makes these some of the hottest housing markets 2025, presenting unique opportunities for savvy investors willing to navigate competitive landscapes.

The Income Generators: Crafting a Portfolio for Passive Cash Flow

For many seasoned investors, real estate isn’t just about appreciation; it’s about generating consistent, reliable cash flow. In 2025, markets conducive to strong rental yields—whether through traditional long-term leases or the increasingly popular short-term rental model—are paramount.

Key Drivers for 2025:

Strong Renter Demographics: High percentages of younger professionals, students, or transient workers.

Tourism & Event-Driven Economies: Essential for robust short-term rental performance.

Affordability & Accessibility: Markets where property acquisition costs allow for positive cash flow after expenses.

Where to Look in 2025:

Traditional Rental Havens (Indianapolis, Kansas City, Orlando): Mid-sized cities with strong employment bases, diverse economies, and a relatively affordable cost of living often translate into excellent rental property investment potential. Indianapolis offers consistent tenant demand, particularly near its growing tech and logistics hubs. Kansas City’s revitalization, coupled with stable job growth, makes it an attractive market for traditional rentals. Orlando, while also a major short-term market, boasts a massive service industry workforce and growing tech sector that fuels a robust long-term rental market. These cities offer a more accessible entry point for investors seeking passive income real estate.

Short-Term Rental Goldmines (Gatlinburg, TN; Myrtle Beach, SC; Gulf Shores, AL): For those embracing the dynamism of platforms like Airbnb, focusing on established tourist destinations with year-round appeal or distinct seasonal peaks is key. Gatlinburg, nestled in the Great Smoky Mountains, enjoys consistent tourist traffic. Myrtle Beach’s extensive coastline and attractions ensure high demand for vacation rentals. Gulf Shores benefits from its beautiful beaches and family-friendly appeal. Understanding local regulations and short-term rental ROI potential is crucial here, as these markets can be highly lucrative but also subject to stricter oversight. Savvy investors will research Airbnb lucrative markets with strong management infrastructure.

The Value Sanctuaries: Unearthing Affordability and Emerging Potential

In an environment where housing affordability remains a significant concern for many, identifying markets that offer a lower entry point without sacrificing long-term potential is a strategic move. These aren’t necessarily the “hottest” markets but represent areas where the balance of cost and future growth is favorable.

Key Drivers for 2025:

Below-Average Median Home Prices: Allowing for higher purchasing power and potentially better cash flow.

Early Stage Growth Indicators: Emerging job markets, new infrastructure projects, or signs of increasing migration.

Proximity to Major Metros: “Secondary cities” that benefit from spillover demand from expensive primary markets.

Where to Look in 2025:

Midwestern Gems (St. Louis, Cleveland, Pittsburgh): Often overlooked, these legacy cities are undergoing significant revitalization efforts, attracting new businesses and residents drawn to their affordability and cultural richness. St. Louis is seeing investment in its biotech and innovation corridors. Cleveland’s healthcare industry is a massive employer, and its lakefront development is creating new opportunities. Pittsburgh, a former industrial giant, has reinvented itself as a robotics and healthcare hub. These markets represent some of the most affordable cities to buy a home 2025, offering solid potential for appreciation as their revitalization continues. They also present compelling opportunities for low-cost real estate investment with reasonable rental yields.

Sun Belt Sleepers (Oklahoma City, Little Rock, Memphis): While the broader Sun Belt has seen massive price hikes, these cities offer a more subdued yet stable growth trajectory. Oklahoma City, with its strong energy sector and growing aerospace industry, combines affordability with a forward-looking economy. Little Rock, as a regional hub, benefits from its steady employment base. Memphis, a logistics powerhouse, is attracting investment in its core. These are emerging housing markets where diligent research can uncover properties with significant upside.

Lifestyle-Driven Havens: Catering to Specific Demographics and Preferences

The pandemic accelerated a trend: people moving for lifestyle reasons. Whether it’s for retirement, raising a family, enjoying the coast, or plugging into a tech ecosystem, these moves create concentrated demand in specific market niches. Understanding these demographic shifts is key to successful long-term investment.

Key Drivers for 2025:

Demographic Shifts: Aging population seeking retirement locales, families desiring specific amenities, or young professionals drawn to innovation hubs.

Amenity Richness: Access to natural beauty, cultural institutions, quality schools, and healthcare.

Connectivity: Robust infrastructure and internet access, particularly for remote workers.

Where to Look in 2025:

Retirement Real Estate Destinations (The Villages, FL; Prescott, AZ; Charleston, SC): As the Baby Boomer generation continues to age, demand for active adult communities and age-friendly cities remains robust. The Villages in Florida remains the quintessential example of purpose-built retirement living. Prescott, Arizona, offers a milder climate and beautiful scenery. Charleston, South Carolina, blends history, culture, and coastal charm. Investing in these areas requires understanding the specific needs and desires of an older demographic, focusing on accessibility, healthcare, and community. These are consistently among the best retirement cities for real estate.

Family-Friendly Neighborhoods (Suburbs of Dallas-Fort Worth, Raleigh, Phoenix): Families prioritize safety, top-tier schools, parks, and community amenities. While specific neighborhoods vary, the broader suburban rings of rapidly growing metros are prime. Areas like Frisco or Prosper outside Dallas, Cary or Apex near Raleigh, and Chandler or Gilbert in the Phoenix metro offer excellent schools, family-oriented facilities, and a strong sense of community. These areas provide stable housing demand and long-term appreciation, often driven by their desirability for raising children.

Tech Hub Expansions (Denver, Austin, Seattle, Boston): While primary tech hubs like San Francisco remain expensive, secondary and emerging tech cities continue to attract talent and investment. Denver’s burgeoning tech scene, coupled with its outdoor lifestyle, fuels strong demand. Austin continues to grow, attracting new tech giants. Seattle and Boston, as established hubs, always present opportunities, albeit at a higher price point. Understanding the tech hub real estate trends involves tracking venture capital investment and corporate expansion plans.

Coastal Real Estate Markets (St. Petersburg, FL; Wilmington, NC; San Diego, CA): The allure of beachfront property and coastal living remains evergreen. St. Petersburg and Wilmington offer more accessible entry points on the East Coast, blending vibrant downtowns with proximity to beaches. San Diego, while premium, offers unparalleled lifestyle and stable demand. Investing in coastal property investment requires careful consideration of climate risks, insurance costs, and unique local regulations, but the lifestyle premium often translates into resilient property values.

Strategic Considerations for the 2025 Investor

Beyond specific geographies, a true expert understands the underlying currents shaping the market.

Interest Rate Environment: While the Fed’s stance for 2025 is anticipated to bring some rate moderation, the era of ultra-low rates is likely behind us. Investors must factor in higher borrowing costs, emphasizing strong cash flow and sustainable debt service coverage. This directly impacts investment property loans and overall real estate portfolio diversification.

Inflation and Economic Outlook: Persistent inflation could keep pressure on operating costs, but real estate historically serves as an excellent hedge against inflation, as property values and rents tend to rise with it. Monitoring the broader economic forecast for 2025 is paramount for anticipating consumer confidence and employment stability.

Inventory Challenges: The persistent lack of new housing construction, especially in desirable areas, continues to underpin demand and prices. This “low inventory housing” scenario means buyers must be agile and prepared in competitive markets.

PropTech and Data Analytics: Leveraging technology—from advanced market analytics to AI-driven property management solutions—is no longer optional. It’s how astute investors gain an edge in identifying opportunities, managing assets, and optimizing returns. Embracing proptech investment strategies can unlock new efficiencies.

Tax Advantages: Don’t overlook the power of smart tax planning. Markets in states with no income tax or low property tax states can significantly enhance your net returns. Understanding mechanisms like the 1031 exchange properties can defer capital gains, crucial for maximizing wealth management real estate strategies.

Your Next Steps: Building Your 2025 Real Estate Legacy

The U.S. real estate market in 2025 is a tapestry of diverse opportunities, each thread woven with unique economic, demographic, and lifestyle narratives. As an investor with a decade of navigating these waters, my most crucial advice is this: know your strategy, understand your risk tolerance, and be relentlessly data-driven.

Whether your focus is on capital growth in a booming tech hub, reliable cash flow from a rental property in an affordable Midwest city, or a lifestyle investment in a vibrant retirement community, the path to success is paved with diligent research and expert guidance. The “top” market is the one that best serves your specific goals.

Don’t let the complexity of the 2025 market deter you. Instead, let it empower you to seek out informed, strategic advantages.

Ready to transform these insights into actionable strategies for your real estate portfolio? Connect with us today for a personalized consultation to identify the high-potential markets best aligned with your investment objectives and navigate the 2025 landscape with confidence.