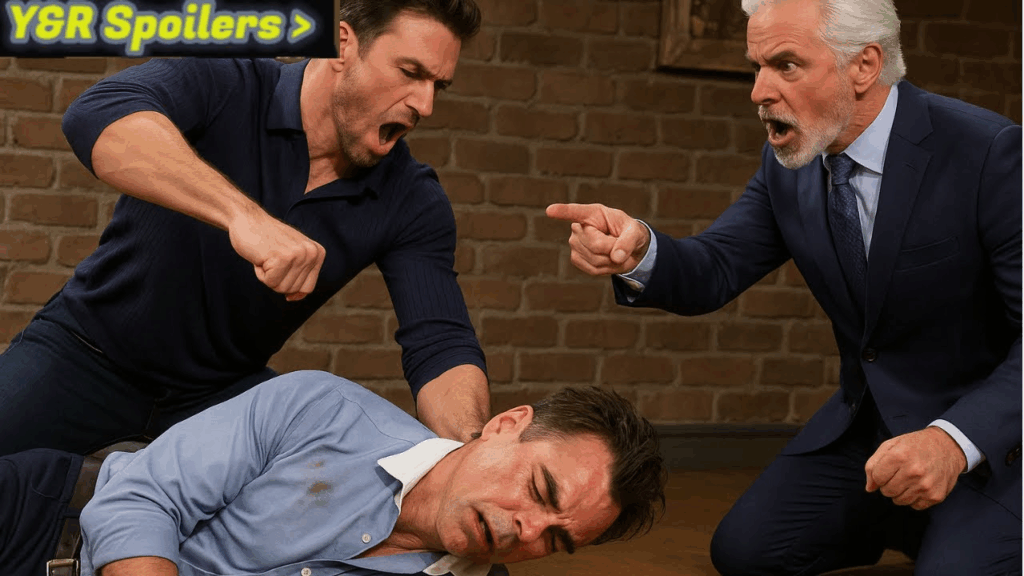

Headline: Tensions Ignite in Genoa City: Billy’s Revenge Plot Unfolds in The Young and The Restless

The Hottest Housing Markets of 2025: Your Blueprint for Success

The American housing market in 2025 is a tapestry of paradoxes. National headlines often spotlight the ongoing dance between fluctuating mortgage rates and the persistent affordability crunch that challenges aspiring homeowners, particularly first-time buyers. Yet, beneath this broad narrative, specific local economies are not just holding their own; they’re experiencing nothing short of a real estate boom. As someone who has navigated these currents for over a decade, I can tell you that understanding these localized surges is paramount for anyone looking to buy, sell, or invest in property this year.

Zillow’s economists, a team whose insights I frequently consult, are forecasting a compelling rise in activity across numerous metros, predominantly clustered in the Northeast and Midwest. These are regions where a potent cocktail of relatively accessible home prices, robust job creation, and fierce buyer competition has propelled a new cohort of cities onto the coveted list of America’s hottest housing markets for 2025. This isn’t just about rising prices; it’s about a frenetic pace of sales, where homes can go from listed to pending in a matter of days – sometimes less than a week. This rapid absorption rate is significantly faster than the national average, indicating exceptionally strong demand. While home values are expected to climb in these markets, the good news for savvy buyers is that the pace of appreciation is generally projected to be more tempered than the exponential leaps seen in previous years, allowing a window for careful planning.

For those ready to plant roots or expand their portfolios, this article is your essential guide. We’ll delve into what truly defines a “hot” market in today’s landscape, reveal the top 10 cities poised for significant activity in 2025, and, crucially, equip you with the expert strategies needed to gain a decisive edge in these competitive arenas.

Decoding the Dynamics: What Makes a Market “Hot” in 2025?

Identifying a “hot” housing market isn’t merely about observing the highest prices or the most dramatic year-over-year gains. Instead, it’s a nuanced analysis of underlying economic health and housing market indicators that signal sustainable growth and strong demand. From my vantage point, having seen multiple market cycles, the criteria used by leading analysts like Zillow are spot-on, focusing on fundamentals rather than fleeting trends.

Here’s a deeper look into the critical factors that coalesce to create these vibrant real estate environments:

Home Value Growth Trajectory: This is the most straightforward indicator, but it’s the projected growth that matters most. We’re looking for markets where home values are not just appreciating, but doing so at a healthy, consistent pace that outstrips national averages or shows strong resilience. A significant bump implies both demand and buyer confidence, making them attractive for long-term real estate investment and equity building.

Projected Change in Owner-Occupied Households: This metric is a powerful barometer of true population growth and community formation. A rising number of owner-occupied households signifies that people are moving into an area, settling down, and committing to the community. This isn’t just about transient renters; it’s about individuals and families investing in their future within that locale, creating a stable base for housing demand. It often correlates with new family formations, job relocations, and a general sense of optimism about the area’s future.

Job Growth Relative to New Construction Activity: This is perhaps the most critical demand-supply equation. Strong job growth acts as a magnet, drawing new residents seeking economic opportunity. When the rate of job creation significantly outpaces the rate at which new housing units are being built, you inevitably create a supply deficit. This imbalance drives competition for existing homes, pushing up prices and reducing the time homes spend on the market. Markets where construction can’t keep pace with demand are, by definition, hotbeds of activity. Understanding the specific industries fueling this job growth – be it tech, healthcare, manufacturing, or logistics – can provide insights into the market’s resilience and future prospects.

Speed of Home Sales (Days on Market): This is the ultimate real-time indicator of buyer urgency and market competitiveness. In a truly hot market, homes don’t linger. A property going from “for sale” to “pending” in under two weeks – or even under 10 days – screams high demand. It signifies that buyers are well-prepared, motivated, and willing to act swiftly, often in multiple-offer scenarios. This quick turnover is a clear sign of a seller’s market, where inventory is tight and buyer competition is intense. For buyers, it underscores the absolute necessity of being financially ready and having an agile strategy.

These interwoven factors paint a comprehensive picture of market vitality. When a city demonstrates strength across these categories, it’s not just experiencing a temporary blip; it’s undergoing a fundamental shift that makes it a prime target for anyone engaged in the real estate game.

The Vanguard: America’s 10 Hottest Large Metros for 2025

The 2025 list reveals a notable geographical pivot, with only four metros from last year’s rankings making a return appearance. This indicates a strategic shift away from some of the previously red-hot markets in Florida and Ohio, signaling that the drivers of demand are evolving. The Midwest and Northeast are now seizing the spotlight, offering relatively strong value and growth potential. Let’s explore these standout markets:

Salt Lake City, UT

Typical Home Value Projection (2025): $555,858 (2.3% growth)

Average Days to Pending: 19 days

Nestled amidst the majestic Wasatch Mountains, Salt Lake City is far more than just a gateway to world-class skiing; it’s a burgeoning economic hub. The metropolitan area boasts a rapidly diversifying economy, particularly strong in tech, healthcare, and logistics, attracting a steady stream of new residents. This influx has fueled its housing market, creating consistent demand. While its typical home value is on the higher end of this list, the projected growth remains robust. Buyers here are often drawn by the unparalleled outdoor lifestyle, coupled with a vibrant urban core. The slightly longer sales cycle compared to some others on this list offers a minor reprieve, but strong financial preparation and an understanding of specific neighborhood values are still crucial. For those eyeing investment properties 2025, Salt Lake’s stable growth and desirable lifestyle make it an attractive long-term play.

Richmond, VA

Typical Home Value Projection (2025): [Data not explicitly stated for 2025, implied modest growth around 2.9%]

Average Days to Pending: 9 days

Richmond, Virginia’s historic capital, seamlessly blends its deep colonial roots with a modern, dynamic cultural scene. A thriving arts, dining, and social landscape makes it a magnet for young professionals and families. The real estate market has been exceptionally strong, and while 2025 is expected to see a more modest appreciation, the speed of sales tells a different story. Homes here fly off the market in just nine days, on average. This necessitates extreme agility from buyers. Securing mortgage pre-approval is not just advised; it’s a prerequisite to even compete. Richmond’s affordability relative to other East Coast cities, coupled with strong employment sectors (government, healthcare, finance), underpins its sustained appeal.

Kansas City, MO

Typical Home Value Projection (2025): $307,334 (2.7% growth)

Average Days to Pending: 9 days

Kansas City, straddling the Missouri-Kansas border, is a city rich in cultural heritage, famous for its jazz, barbecue, and an impressive array of fountains. Beyond its charming reputation, Kansas City has quietly become a significant economic player in the Midwest, with strengths in logistics, animal health, and technology. This economic vitality translates directly to its housing market. With home values projected for a healthy increase and homes selling in a blistering nine days, Kansas City demands swift, decisive action from buyers. Its relative affordability, particularly compared to coastal cities, makes it an attractive option for first-time home buyers looking for strong value and community. Engaging a real estate agent with deep local market knowledge is non-negotiable here.

Charlotte, NC

Typical Home Value Projection (2025): $389,383 (3.2% growth)

Average Days to Pending: 20 days

The “Queen City” of Charlotte, North Carolina, continues its reign as a dynamic Southern powerhouse. Known for its pleasant climate, abundant green spaces, and passionate sports culture, Charlotte is a major financial center and has a rapidly diversifying economy, attracting corporate relocations and fostering job growth. While homes sell in about 20 days, which might seem slower than some other top markets, it still reflects a highly competitive environment for a city of its size and economic prominence. The projected 3.2% appreciation demonstrates sustained demand. Buyers eyeing Charlotte should understand the nuances of its diverse neighborhoods, from urban cores to suburban family-friendly areas, and ensure their financing is robust. Financing solutions should be explored well in advance to ensure competitiveness.

St. Louis, MO

Typical Home Value Projection (2025): $254,847 (1.9% growth)

Average Days to Pending: 8 days

St. Louis, Missouri, was notably recognized as a top market for first-time buyers in 2024, a distinction largely due to its remarkable affordability. In 2025, it maintains its appeal, offering the lowest typical home value on this list, making it highly attractive for those navigating a tight budget. Despite the more modest projected growth in home values, the speed at which homes are sold is astonishing: an average of eight days. This lightning-fast pace underscores extreme buyer competition for available inventory. St. Louis benefits from a strong healthcare sector, prominent universities, and a growing innovation scene. Buyers must be hyper-prepared, with mortgage pre-approval locked in and a clear understanding of their purchasing power to succeed in this exceptionally quick market.

Philadelphia, PA

Typical Home Value Projection (2025): [Data not explicitly stated for 2025, implied modest growth around 2.6%]

Average Days to Pending: 11 days

Philadelphia, the historic “City of Brotherly Love,” offers a rich tapestry of history, culture, and urban vibrancy. Its walkable neighborhoods and diverse culinary scene make it a desirable place to live. While 2024 saw a particularly heated market, 2025 is projected for a more stabilized, yet healthy, growth trajectory. What hasn’t calmed down, however, is the pace of sales; homes go pending in an average of 11 days. This rapid turnover is driven by a strong local economy with anchors in healthcare, education, and biotechnology, coupled with its strategic location on the East Coast. For buyers, being decisive is key. An experienced real estate agent can be invaluable in navigating Philadelphia’s varied sub-markets and ensuring your offer stands out.

Hartford, CT

Typical Home Value Projection (2025): $378,693 (4.2% growth)

Average Days to Pending: 7 days

Hartford, Connecticut, stands out with the highest projected home value increase in our top 10 for 2025 at 4.2%, albeit slower than its 2024 surge. The city’s housing market is extraordinarily competitive, with homes selling in an astonishing seven days. This puts intense pressure on buyers to be ready to act instantly. Hartford’s economy is strongly influenced by the insurance industry, healthcare, and education. Its proximity to both New York City and Boston, coupled with relatively more affordable housing than its larger neighbors, makes it an increasingly attractive option for commuters and those seeking a New England lifestyle without the exorbitant price tag. Securing watertight financing solutions and being ready with a robust offer strategy are non-negotiable for success here.

Providence, RI

Typical Home Value Projection (2025): [Data not explicitly stated for 2025, implied growth around 3.7%]

Average Days to Pending: 12 days

Providence, Rhode Island, is a captivating waterfront city that blends historical charm with academic sophistication, home to institutions like Brown University and the Rhode Island School of Design. Its revitalized downtown, complete with Venice-like bridges, adds to its unique appeal. While the 3.7% projected growth in home values for 2025 is a moderation from the previous year’s blistering pace, demand remains incredibly strong, evidenced by homes consistently going pending in just 12 days. Providence’s appeal lies in its vibrant cultural scene, educational opportunities, and strategic location. For buyers, understanding the specific micro-markets within Providence, from historic Federal Hill to the East Side, is crucial for competitive advantage. The potential for home equity growth here makes it attractive to long-term investors.

Indianapolis, IN

Typical Home Value Projection (2025): $285,086 (Implied rise to this value)

Average Days to Pending: 14 days

Indianapolis, the bustling heart of Indiana, is known globally for its auto racing heritage but is also a significant economic engine in the Midwest. With major employers like pharmaceutical giant Eli Lilly, and a growing logistics and tech sector, the city offers diverse job opportunities. The housing market, while still competitive, presents a nuanced scenario where the balance might tilt ever so slightly in buyers’ favor compared to some other red-hot locales, yet homes still sell remarkably quickly, typically within two weeks. The projected rise to a typical home value of $285,086 positions Indianapolis as an excellent market for affordability and sustained growth. Both first-time home buyers and real estate investors will find compelling opportunities in this dynamic city.

Buffalo, NY

Typical Home Value Projection (2025): $267,878 (2.8% growth)

Average Days to Pending: 12 days

Buffalo, New York, claims the top spot for the second consecutive year, a testament to its remarkable resurgence. Beyond its reputation for epic snowstorms and proximity to Niagara Falls, Buffalo has transformed into a vibrant and highly attractive housing market. While the scorching 5.8% home value growth of 2024 is projected to moderate to a still healthy 2.8% in 2025, the pace of sales remains incredibly swift, with homes going pending in just 12 days. Its affordability, compared to other major East Coast cities, coupled with significant investments in its waterfront, medical campus, and growing tech sector, makes it a prime destination. Buffalo is an undeniable hot spot, particularly for those seeking strong value and a revitalized urban experience. For those looking for excellent real estate investment opportunities, Buffalo’s sustained growth and affordability are hard to beat.

Navigating the Rapids: Strategies for Success in Competitive Markets

Operating in these red-hot markets demands a strategic, agile, and well-informed approach. As an expert with a decade of experience, I’ve seen firsthand how preparation can make or break a deal. Whether you’re a buyer vying for your dream home or a seller looking to maximize your return, here’s how to gain an edge:

For Buyers: Precision and Preparedness are Paramount

Financial Fortification is Non-Negotiable: Before you even begin house hunting, ensure your finances are in impeccable order. This means scrutinizing your credit score, minimizing debt, and having a clear picture of your budget. Crucially, get a full mortgage pre-approval (not just a pre-qualification) from a reputable lender. In markets where homes sell in days, a solid pre-approval letter signals to sellers that you are a serious and capable buyer, often making your offer more attractive than one from a less-prepared contender. Explore various financing solutions and understand your maximum affordable price point.

Act with Urgency, But Don’t Panic: Speed is critical, especially in markets like Hartford or Kansas City where homes disappear within a week. Be ready to view properties immediately after they hit the market. If you find a home you love, be prepared to submit an offer quickly. This doesn’t mean skipping due diligence, but it means having your decision-making framework already established.

Forge a Partnership with a Top-Tier Real Estate Agent: This cannot be overstated. A local, experienced real estate agent is your most valuable asset. They possess intimate knowledge of market conditions, recent comparable sales, and often have off-market leads. They can advise on competitive offer strategies, including escalation clauses, waiving certain contingencies (with caution), or even writing a compelling personal letter to the seller. Their negotiation skills and ability to provide accurate property valuation are indispensable in these fast-moving environments.

Strategic Offer Crafting: In multiple-offer situations, your offer needs to stand out. Beyond price, consider factors like a flexible closing date, a larger earnest money deposit, or even a lease-back option for the seller. Your agent can guide you on which levers to pull based on the seller’s specific needs. Be realistic about inspection contingencies; while never advised to waive entirely, understanding which items are truly deal-breakers versus negotiable can be crucial.

Be Adaptable and Realistic: Understand that in a seller’s market, you might not get every single item on your wish list. Be prepared for some compromises. Having a clear understanding of your “must-haves” versus “nice-to-haves” will help you make swift, confident decisions. Explore options for refinance rates if mortgage rates fluctuate after your purchase.

For Sellers: Capitalize on Demand, But Price Strategically

Professional Presentation is Key: Even in a hot market, a well-presented home commands higher interest and potentially higher offers. Invest in professional staging, photography, and potentially minor repairs or upgrades that yield a strong return. Your home’s online presence is its first showing.

Strategic Pricing: While demand is high, overpricing can still deter buyers. Work with your agent to set a competitive price that attracts a flurry of interest, potentially leading to a bidding war. An accurate property valuation is critical.

Navigating Multiple Offers: Your agent will be crucial in evaluating not just the highest offer, but the strongest offer – considering financing, contingencies, and buyer stability.

The Broader Outlook: Beyond 2025

The underlying currents driving these hot markets — sustained job growth, relative affordability, and a persistent supply-demand imbalance — are not ephemeral. While the pace of growth may moderate in some areas, the fundamental appeal of these metros as vibrant places to live and work is likely to continue. For those considering investment properties 2025, these markets represent regions with strong long-term potential for home equity growth and rental income stability.

Understanding your personal BuyAbility℠, an up-to-date snapshot of what you can comfortably afford given your financial situation and current mortgage interest rates, is a crucial first step for anyone. This tool, combined with the insights of an experienced professional, will empower you to make intelligent decisions.

The 2025 housing market is not just a statistical phenomenon; it’s a dynamic landscape brimming with opportunity for those who are prepared, informed, and ready to act. Whether you’re a first-time home buyer eager to enter the market, a seasoned investor seeking the next growth frontier, or looking to sell and capitalize on demand, clarity and expert guidance are your greatest allies. Don’t leave your real estate aspirations to chance.

Ready to explore the opportunities in these vibrant markets or understand how to strategically navigate your local real estate landscape? Connect with our team of seasoned professionals today. Let us provide the personalized insights and tailored strategies you need to achieve your property goals in 2025 and beyond.