Navigating 2025’s Hottest Real Estate: An Expert’s Guide to High-Growth U.S. Markets

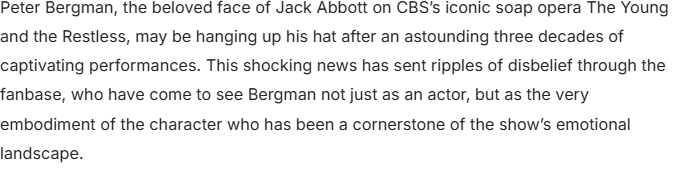

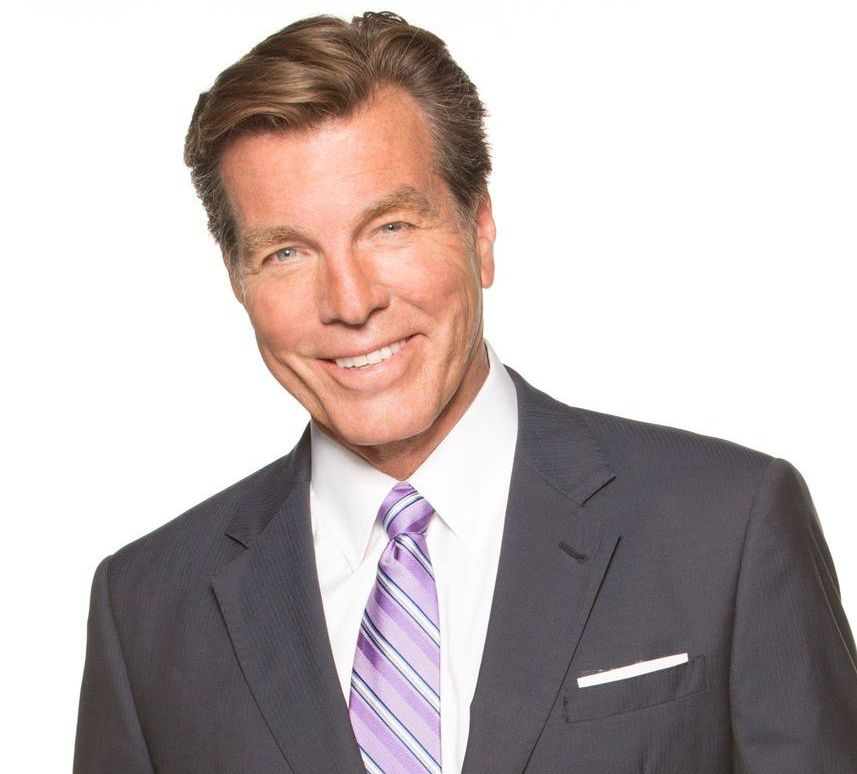

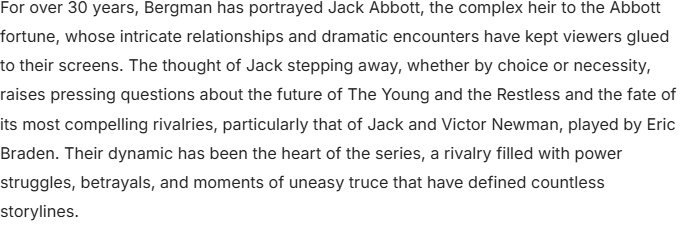

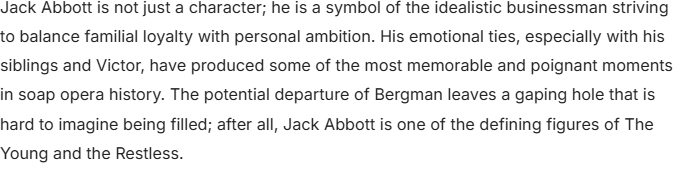

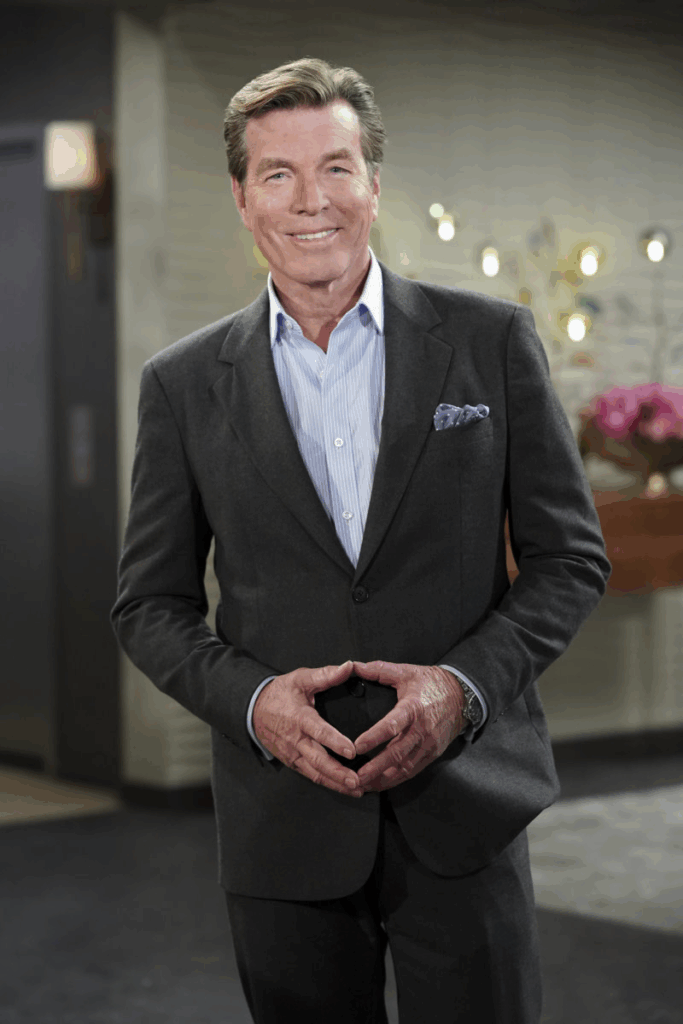

As we delve deeper into 2025, the U.S. housing market continues its intricate dance of opportunity and challenge. While whispers of volatile mortgage rates and persistent affordability hurdles for first-time homebuyers might paint a picture of apprehension, my decade of experience in this dynamic field reveals a more nuanced reality: pockets of exceptional growth and robust activity. The market isn’t a monolith; it’s a tapestry of diverse regional narratives, and understanding these local booms is paramount for both savvy investors and aspiring homeowners. This year, we’re witnessing a compelling shift, with several metros in the Northeast and Midwest stepping into the spotlight, driven by a confluence of relatively competitive home prices, impressive job growth, and an undeniable surge in buyer demand.

What truly defines a “hot” market in 2025 isn’t merely rapid appreciation—it’s a blend of sustainable growth drivers, fundamental economic strength, and a vibrant community pulse. The data, consistently compiled by leading real estate analytics firms like Zillow, underscores this emerging trend. We’re observing a market where homes often sell in a matter of days, significantly faster than the national average, indicating a fierce demand that continues to push values upward, albeit with a more measured pace than the frenetic gains of recent years. This slower, more sustainable appreciation is, in fact, good news, offering a firmer foundation for long-term equity growth and a more predictable landscape for those meticulously saving for a down payment. For those ready to capitalize on these shifts, the strategic acquisition of investment properties 2025 or securing that dream home requires both insight and agility.

Deciphering the DNA of a Hot Housing Market in 2025

From an expert’s vantage point, the indicators of a truly hot market in 2025 extend beyond surface-level statistics. My analysis, aligning with comprehensive market reports, focuses on several critical metrics that collectively paint a picture of robust health and future potential:

Sustained Home Value Growth: This isn’t about speculative bubbles. We’re looking for markets exhibiting consistent, fundamentally-driven appreciation. Factors like strong local economies, limited inventory, and attractive property value appreciation forecasts contribute to this healthy upward trend. It’s about equity building, not fleeting gains.

Projected Change in Owner-Occupied Households (Demographic Shifts): This is a powerful long-term indicator. An increase signifies population growth, family formation, and a commitment to the community. Millennial homebuyers and Gen Z housing trends are driving much of this growth, seeking areas that offer a balance of opportunity and lifestyle. Understanding demographic shifts affecting housing is key to predicting future demand.

Job Growth vs. New Construction: The Supply-Demand Conundrum: New jobs are the lifeblood of a thriving community, attracting new residents and fueling demand. However, if new housing construction can’t keep pace, prices inevitably rise. We closely monitor housing supply shortages and the construction industry outlook to identify markets where demand is outstripping supply, creating a competitive environment and signaling local economic growth.

Market Velocity (Speed of Sales): When homes go pending in a week or less, it’s a clear signal of high buyer confidence and extremely low inventory. This seller’s market strategies 2025 situation means buyers need to be prepared with mortgage pre-approval and competitive offers. Fast markets also often indicate strong rental market performance, making them appealing for high-yield rental properties USA.

Beyond these core metrics, I also consider infrastructure development, quality of life factors, tax incentives, and the overall economic drivers of housing growth that contribute to a region’s long-term desirability. This holistic approach ensures we identify markets with not just short-term heat, but enduring resilience.

The Top 10 U.S. Housing Markets Primed for Growth in 2025

The 2025 landscape sees a significant recalibration from previous years, moving away from some of the Florida and Ohio hotspots that dominated recent lists. This year’s contenders highlight the enduring appeal of affordability, economic diversification, and a vibrant community spirit, particularly across the Northeast and Midwest. For real estate investment strategies 2025, these cities represent prime targets.

Salt Lake City, UT

Nestled amidst the breathtaking Wasatch Mountains, Salt Lake City is far more than just a world-class outdoor recreation hub with ten ski resorts within an hour’s drive. It’s a rapidly diversifying economic powerhouse, attracting tech firms and a younger demographic. This Salt Lake City real estate investment market has seen consistent growth, fueled by both natural beauty and robust job creation in sectors like software and healthcare. While its typical home value of $555,858 is on the higher end of this list, the projected 2.3% growth in 2025, following a period of substantial appreciation, suggests a healthy, sustainable market. Homes here move quickly, averaging 19 days to pending, signaling strong buyer interest. Investors eyeing luxury real estate market trends 2025 will find specific high-end neighborhoods attractive, while general property value appreciation forecast remains positive for the broader market. The quality of life and continued inbound migration underpin its long-term appeal.

Richmond, VA

Richmond, Virginia, a city steeped in colonial history, has masterfully blended its rich past with a vibrant, modern present. Its thriving social, dining, and arts scene, coupled with a growing economy driven by state government, healthcare, and education, makes it an increasingly attractive destination. This Richmond VA property market has been on an upward trajectory, and while 2025 anticipates a calmer 2.9% growth in home values, reaching a typical value around $370,000, the underlying demand remains fierce. Homes here sell incredibly fast, averaging just 9 days on the market. This speed demands a prepared buyer with pre-approved financing and a clear understanding of their priorities. Its strategic location on the East Coast and continuous urban revitalization efforts promise continued stability and long-term equity growth.

Kansas City, MO

Known globally for its distinctive barbecue, jazz heritage, and an astonishing number of fountains, Kansas City, Missouri, continues to charm and attract. Strategically positioned on the western border of Missouri, it boasts a remarkably resilient and diverse economy, anchored by sectors like agriculture, bioscience, and finance. The Kansas City housing market trends show impressive strength, with home values expected to increase by 2.7% in 2025, pushing the typical home value to an attractive $307,334. For investors seeking affordable housing markets 2025 with strong growth potential, Kansas City is a standout. The market’s velocity is remarkable, with homes going from listing to pending in a mere 9 days, underscoring the intense competition and the importance of having a top real estate agent on your side.

Charlotte, NC

The “Queen City,” Charlotte, North Carolina, effortlessly combines Southern charm with big-city ambition. Celebrated for its expansive outdoor spaces, temperate climate, and passionate sports culture (boasting multiple professional teams), Charlotte’s appeal is undeniable. As a major financial hub and a rapidly expanding tech center, its Charlotte NC real estate forecast is robust. The typical home value is expected to appreciate about 3.2% in 2025, reaching approximately $389,383 by year-end. This vibrant market remains competitive, with homes typically going pending in around 20 days. The continuous influx of new residents, drawn by job growth and a high quality of life, ensures sustained demand and positions Charlotte as a compelling location for real estate investment opportunities.

St. Louis, MO

St. Louis, Missouri, often recognized for its iconic Gateway Arch, earned accolades as Zillow’s top market for first-time buyers in 2024, a testament to its exceptional affordability. This strength continues into 2025, making it an attractive destination for those seeking entry into homeownership. With home values projected to grow by 1.9% in 2025, the typical home value remains the lowest on our top 10 list at $254,847. For investors, this translates to excellent high-yield rental properties potential. The market velocity is blistering, with homes flying off the market in about 8 days. The St. Louis affordable homes market provides a unique blend of historical charm, cultural richness, and a burgeoning innovation district, making it a compelling option for investing in real estate for passive income.

Philadelphia, PA

Philadelphia, the venerable “City of Brotherly Love,” is a walkable urban treasure, where history intertwines seamlessly with modern vibrancy. Its Philadelphia investment properties market experienced significant heat in 2024, and while 2025 anticipates a more modest 2.6% growth in home values, the demand remains robust. The projected typical home value hovers around $345,000. Buyers here must be prepared for swift action; new listings typically go pending in an average of 11 days. Philadelphia’s diverse economy, anchored by higher education, healthcare, and biotech, combined with its strategic Mid-Atlantic location and extensive public transit, ensures its enduring appeal. The ongoing revitalization of various neighborhoods offers exciting prospects for both residents and real estate investment strategies.

Hartford, CT

Hartford, Connecticut, is emerging as a surprising dark horse in the 2025 housing market. Forecasts indicate homes here will reach an average value of $378,693, marking a significant 4.2% increase over 2024 – the largest projected bump among our top 10 cities this year. While this is a slowdown from 2024’s impressive 7.4% surge, it still represents robust Hartford CT housing growth. The market’s intensity is striking, with homes selling in approximately 7 days. This extreme competition underscores the critical need for buyers to have their financing meticulously pre-approved. As the “Insurance Capital of the World,” Hartford benefits from a stable employment base, a concerted effort towards urban renewal, and its strategic location between Boston and New York City, making real estate investment opportunities here increasingly appealing.

Providence, RI

Providence, Rhode Island, a picturesque waterfront city, artfully balances quaint charm with sophisticated urbanity. Home to prestigious institutions like Brown University and the Rhode Island School of Design, its intellectual and creative energy is palpable. The city’s scenic downtown, graced by Venice-style bridges over the Woonasquatucket River, adds to its unique allure. Providence RI real estate opportunities are plentiful, with home values expected to grow by about 3.7% in 2025. While this signifies a slowdown from 2024’s 7% appreciation, demand remains exceptionally strong, with homes consistently going pending in just 12 days. The city’s thriving arts scene, growing tech sector, and continued investment in its waterfront district ensure its desirability for both residents and property investors.

Indianapolis, IN

Indianapolis, Indiana, is much more than the “Racing Capital of the World.” This centrally located city, along the banks of the White River, boasts a diversified economy with major players like pharmaceutical giant Eli Lilly as its largest private employer. The Indianapolis housing market analysis reveals a resilient market that, while tilting slightly in buyers’ favor, still experiences rapid sales. The typical home value is expected to rise to $285,086 in 2025, with new listings typically going pending in about two weeks. The city’s continuous investment in its downtown area, expanding tech ecosystem, and relatively affordable housing markets make it a magnet for both young professionals and families. For investors, Indianapolis represents a steady market with consistent rental demand and solid property value appreciation.

Buffalo, NY

For the second consecutive year, Buffalo, New York, claims the top spot on our hottest markets list, a testament to its enduring appeal and robust fundamentals. This city, famous for its epic snowstorms and proximity to the majestic Niagara Falls, saw impressive 5.8% year-over-year home value growth in 2024. While 2025 is expected to see a more tempered 2.8% rise, pushing the typical home value to $267,878, the market’s velocity remains incredibly high, with homes moving from listing to pending in just 12 days. The Buffalo NY property values 2025 continue to benefit from significant revitalization efforts, a growing tech sector, and its strategic location near the Canadian border. Its affordability, strong community spirit, and access to natural wonders make it an undisputed champion for both homeowners and real estate investment strategies.

Mastering the Art of Buying in a Competitive 2025 Market

Entering any of these hottest housing markets 2025 demands a strategic, informed, and agile approach. As an expert, I can tell you that success in these environments isn’t about luck; it’s about preparation and execution. Here’s how to position yourself for victory:

Fortify Your Finances – Beyond Pre-Qualification:

Get Pre-Approved, Not Just Pre-Qualified: A mortgage pre-approval is a lender’s commitment to lend you a specific amount, making your offer significantly stronger and more credible than a mere pre-qualification. This is non-negotiable in a fast-paced market.

Understand Down Payment Strategies: Explore all options, from conventional loans requiring 20% down to FHA, VA, and USDA loans with lower or no down payment requirements. Be aware of first-time homebuyer grants 2025 and local assistance programs.

Factor in Closing Costs: These often overlooked expenses can add 2-5% to your purchase price. Budget for them upfront.

Monitor Mortgage Interest Rates Forecast 2025: Work closely with your lender on interest rate lock strategies to protect yourself against potential fluctuations.

Assemble Your A-Team:

The Right Real Estate Agent is Your Linchpin: In a seller’s market strategies 2025 environment, a top real estate agent with deep local expertise is invaluable. They understand neighborhood nuances, can provide insights on specific property types, and, crucially, possess strong negotiation skills. They’re your eyes and ears, helping you identify opportunities before they hit the broader market and crafting competitive offer strategies.

A Responsive Lender: Choose a lender known for speed and efficiency. In markets where homes sell in days, a slow lender can cost you your dream home.

Professional Support: Don’t skimp on a thorough home inspection, even if the market is hot. A good inspector can save you from costly surprises.

Crafting a Winning Offer:

Be Decisive, Not Rash: While speed is critical, never compromise on due diligence. Your agent can guide you on the acceptable level of risk.

Consider an Escalation Clause: In highly competitive situations, an escalation clause can automatically increase your offer by a set amount if a higher offer comes in, up to a pre-determined cap.

Minimize Contingencies (Cautiously): While risky, waiving certain contingencies (like inspection or appraisal) can make your offer more attractive. Discuss the pros and cons thoroughly with your agent.

Offer Flexible Terms: Sometimes, a seller values a flexible closing date or a lease-back option more than a slightly higher price.

Patience, Persistence, and Perspective:

The search can be emotionally taxing. It’s okay to feel frustrated, but don’t let it lead to overpaying or making impulsive decisions. Stick to your budget and your criteria.

Explore new construction homes as an alternative if existing home inventory is severely limited. This can sometimes offer a less competitive buying experience.

The 2025 housing market forecast is not just about challenges; it’s about incredible opportunities for those who are prepared and well-advised. These best places to buy a home 2025 are showing the strength and resilience that define true market leaders. Whether you’re a first-time homebuyer seeking a stable foundation or a seasoned investor eyeing real estate investment opportunities with significant growth potential, understanding these dynamics is your first step.

Ready to transform these insights into action and secure your place in one of 2025’s most promising real estate landscapes? Whether you’re a first-time homebuyer seeking stability or an investor eyeing strategic growth, the time to act is now. Connect with a trusted real estate advisor today to navigate these exciting markets and transform these predictions into your next successful property acquisition. Your future in real estate starts with an informed conversation.