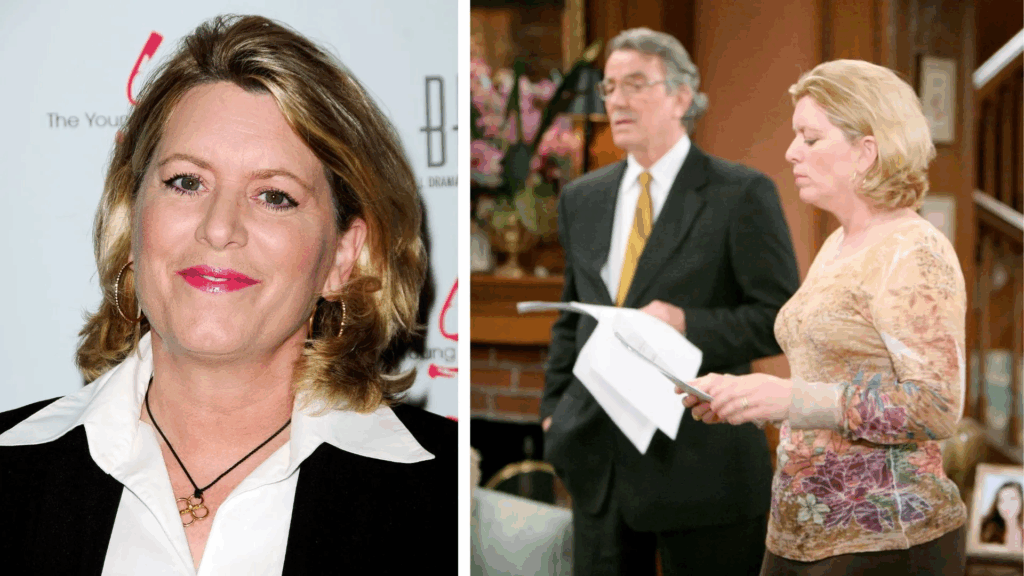

The Young and the Restless has promoted director and former Y&R producer Sally McDonald to the position of co-executive producer. The veteran has a long history with the top-rated soap opera and CBS, the network on which the show airs.

The Young and the Restless, Sally McDonald gets promoted

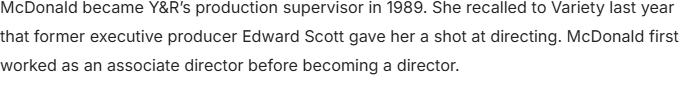

Sally McDonald has been directing actors, including Eric Braeden (Victor), for years on The Young and the Restless | Image: JPI

Soap Opera Digest broke the news of McDonald’s appointment. She will be working with Josh Griffith, head writer/executive producer, Y&R. She began her career at CBS Television City over 40 years ago, working as a typist. She later became a production supervisor on such shows as Win, Lose, or Draw, Card Sharks, and The $10,000 Pyramid.

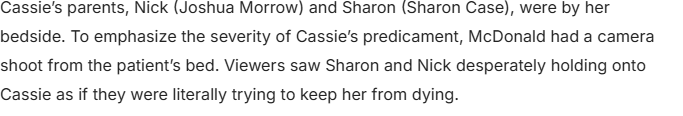

Cassie’s death

America’s Top 10 Housing Markets Poised for Explosive Growth in 2025: An Expert’s Deep Dive

The real estate landscape is a dynamic beast, constantly shifting with economic tides, demographic movements, and evolving consumer preferences. As we step firmly into 2025, the narrative around the U.S. housing market continues to be one of fascinating contradictions. While national headlines often trumpet concerns over persistent inflation, stubbornly high mortgage rates, and ongoing affordability hurdles for burgeoning homeowners, a seasoned eye reveals a different story unfolding in specific, high-velocity local markets. My decade navigating the intricate currents of real estate investment and homeownership strategies has taught me one undeniable truth: opportunity often blossoms where others see only challenge.

This year, the spotlight shines brightly on a collection of metros, predominantly dotting the Northeast and Midwest, that are not just defying national slowdowns but are actively experiencing robust real estate booms. These aren’t random surges; they are meticulously driven by a confluence of factors: relative affordability, impressive job growth, and intensely competitive buyer demand. For those looking to make strategic moves, whether as a first-time homebuyer or a shrewd property investor, understanding these burgeoning hotspots is paramount. In these markets, homes aren’t just selling; they’re flying off the shelves, often in less than two weeks, a stark contrast to the national average. This fierce demand naturally leads to real estate appreciation, although, encouragingly for buyers, the pace of price growth is projected to moderate compared to the frenzied sprints of previous years. This recalibration offers a valuable window for buyers to secure assets before another acceleration.

Unpacking the Anatomy of a “Hot” Market in 2025

From my vantage point, discerning what truly designates a market as “hot” goes beyond simple anecdotal observations. It requires a robust analytical framework, one that dissects multiple layers of economic and social indicators. My methodology for identifying these 2025 powerhouses hinges on several critical metrics, each a potent predictor of future growth and home equity growth potential:

Projected Home Value Appreciation: This is the most straightforward indicator. We look for markets with strong, sustainable forecasts for property value increases. Sustainable growth, not speculative bubbles, is key for long-term appreciation and return on investment (ROI).

Owner-Occupied Household Growth: A rising tide of owner-occupied households signifies robust family formation and population influx. This demographic shift directly translates into sustained demand for housing and underpins market stability, making these attractive property investment opportunities.

Job Market Vitality Relative to New Construction: New jobs are magnets for new residents. When job creation significantly outpaces the rate of new home construction, it inevitably tightens inventory, driving prices upwards. This imbalance creates a seller’s market and fuels rapid sales velocity.

Market Speed (Days on Market): How quickly homes go from listing to pending offers is a direct measure of buyer urgency and market intensity. In these competitive markets, buyers must be prepared to act with unparalleled swiftness.

Economic Diversification and Resilience: Markets with diversified economies (tech, healthcare, education, manufacturing) tend to be more resilient to economic headwinds, offering more stable housing market predictions and mitigating risks for real estate investors.

Affordability Index: While demand drives prices, initial relative affordability plays a crucial role in attracting new residents and sustaining long-term growth, especially for first-time homebuyers.

Through this lens, my analysis for 2025 reveals a distinct geographical shift, moving away from some of the previously red-hot locales in the Sun Belt towards a renewed focus on cities with robust internal economies and attractive value propositions. Only four markets from last year’s top performers retained their coveted spots, signaling a notable rebalancing.

The Elite 10: America’s Hottest Housing Markets for 2025

Let’s delve into the specifics, offering a granular look at what makes each of these markets tick, and what homeowners and investors can anticipate.

Salt Lake City, UT

Nestled majestically amidst the Wasatch Mountains, Salt Lake City is far more than just a gateway to world-class skiing and outdoor adventure; it’s an economic powerhouse undergoing significant transformation. This market’s inclusion on our list stems from its burgeoning, increasingly diverse population, which has injected considerable vitality into the local real estate market. The tech sector, often dubbed “Silicon Slopes,” continues its expansion, attracting high-earning professionals and driving demand for both luxury real estate and more attainable family homes.

For 2025, we project home values in Salt Lake City to appreciate by a healthy 2.3%, pushing the typical home value to an estimated $555,858. While this represents a moderation from previous years’ stratospheric gains, it signifies sustainable growth. Homes here move swiftly, often going pending in about 19 days. This quick turnaround underscores the ongoing competition and the necessity for buyers to be pre-approved and agile. Property investment opportunities here are strong, particularly in segments catering to the influx of young professionals and families.

Richmond, VA

Richmond, the historic capital of Virginia, beautifully blends its rich colonial heritage with a vibrant, modern social, dining, and arts scene. This dynamism has fueled a property market that has been on a tear, and while 2025 forecasts a calmer trajectory, it remains a fiercely competitive environment. The city benefits from a strategic location within the Mid-Atlantic, strong state government employment, and a growing healthcare sector.

We anticipate a modest yet solid 2.9% growth in home values for 2025. Don’t let the term “modest” fool you; homes in Richmond are still highly sought after, often selling in an astonishing average of 9 days. This rapid sales pace indicates that even with slower real estate appreciation, buyer urgency remains exceptionally high. Investors seeking stable rental income potential will find Richmond’s burgeoning renter population attractive, while homeowners benefit from consistent home equity growth.

Kansas City, MO

Straddling the Missouri-Kansas border, Kansas City is celebrated for its distinctive jazz heritage, legendary barbecue, and an unexpected abundance of fountains. Beyond its cultural charms, Kansas City boasts a resilient and growing economy, particularly in logistics, animal health, and technology. This economic diversification contributes significantly to its inclusion as a top market. Its relative affordability, compared to coastal hubs, continues to draw new residents seeking a high quality of life without the exorbitant price tag.

Home values in Kansas City are projected to increase by 2.7% in 2025, bringing the typical home value to approximately $307,334. This makes it one of the more accessible markets on our list, appealing to both first-time buyers and property investors seeking value. The market speed here is truly exceptional, with homes routinely going from listing to pending in just 9 days. This necessitates robust preparation for buyers, including securing pre-approval benefits to make competitive, non-contingent offers.

Charlotte, NC

The “Queen City” of Charlotte, North Carolina, reigns supreme as an enthusiastic sports town and a hub of outdoor recreation, all under a temperate climate. Its true economic might, however, lies in its position as a major banking and financial services center, second only to New York City. This robust financial sector, coupled with strong growth in healthcare and logistics, underpins its consistently competitive housing market.

For 2025, Charlotte’s typical home value is expected to appreciate by about 3.2%, reaching an estimated $389,383 by year-end. While homes here sell rapidly (around 20 days to pending), the slightly longer timeframe compared to some others on this list offers a fraction more breathing room for buyers, though strategic planning remains crucial. The potential for home equity growth and its vibrant economy makes Charlotte a compelling prospect for both residents and real estate investment strategies.

St. Louis, MO

St. Louis, a Midwestern gem, earned significant accolades in 2024, particularly as a prime market for first-time buyers, largely due to its remarkable affordability. This continues into 2025, where it maintains the lowest typical home value on our top 10 list. The city’s economy is diversified, with strong anchors in healthcare, biosciences, and education, supported by major institutions and a burgeoning startup scene. Infrastructure investments, particularly around its revitalized downtown and riverfront, are also attracting renewed interest.

Projected home value growth in St. Louis for 2025 stands at 1.9%, which would bring the typical home value to an incredibly accessible $254,847. This affordability makes it an excellent entry point for new buyers and a high-yield option for property investors seeking strong rental income potential. Despite the modest appreciation forecast, the market’s speed is anything but slow; homes here typically go off-market in an astounding eight days. This lightning-fast pace is a clear indicator of intense buyer demand relative to available inventory.

Philadelphia, PA

The City of Brotherly Love, Philadelphia, offers an unparalleled walking experience, with history echoing around every corner. Beyond its historic allure, Philly’s economy is a formidable force, anchored by its burgeoning “eds and meds” sectors (education and medical institutions), a growing tech presence, and a thriving cultural scene. After a particularly fervent 2024, Philadelphia’s real estate market is expected to normalize slightly in 2025, but the underlying demand remains robust.

We forecast a modest but steady 2.6% growth in home values for 2025, reflecting a healthy, rather than overheated, trajectory. Despite this moderation, buyers must be prepared for a fast-paced environment; new listings typically go pending in an average of 11 days. For investors, Philadelphia offers a diverse portfolio of property investment opportunities, from historic townhouses to modern condos, with sustained demand across various price points. Understanding mortgage rate forecasts and securing competitive financing will be crucial for navigating this consistently competitive market.

Hartford, CT

Hartford, the capital of Connecticut, is poised for significant resurgence in 2025. After experiencing a substantial 7.4% jump in home values in 2024, the market is set to see another impressive, albeit slightly slower, increase. Hartford’s economy is heavily influenced by the insurance industry, but it’s diversifying with growth in advanced manufacturing, healthcare, and biotech. Its relatively lower cost of living compared to other Northeast cities is a major draw for both families and businesses.

Homes in Hartford are projected to reach an average value of $378,693 in 2025, representing a robust 4.2% increase over the previous year. This substantial bump makes it the market with the largest forecasted appreciation within our top 10. The speed of sale here is intense, with homes typically going pending in just 7 days. This hyper-competitive environment underscores the absolute necessity for buyers to have their financing meticulously pre-arranged, exploring all options from conventional to jumbo loans where applicable, to ensure they can move decisively. For those seeking high-net-worth real estate investment opportunities in the Northeast, Hartford’s growth trajectory makes it compelling.

Providence, RI

Providence, Rhode Island, offers a unique blend of quaint charm and sophisticated urbanity, all set against a stunning waterfront backdrop. Home to prestigious institutions like Brown University and the Rhode Island School of Design, the city boasts a vibrant intellectual and artistic scene. Its strategic location, proximity to Boston, and ongoing investments in infrastructure and public spaces contribute to its increasing desirability.

Home values in Providence are expected to grow by a solid 3.7% in 2025, a moderation from the impressive 7% appreciation seen in 2024. However, underlying demand remains incredibly robust, evidenced by homes consistently going pending in a rapid 12 days. This continued velocity, coupled with its cultural appeal and economic stability, makes Providence a strong contender for sustained home equity growth. Real estate investors will find opportunities in both single-family homes and multi-unit properties, catering to a diverse population including students and professionals.

Indianapolis, IN

Indianapolis, a centrally located gem in the Hoosier state, is internationally renowned for its auto racing heritage and the iconic Indianapolis Motor Speedway. Beyond the track, the city is a significant economic player, home to pharmaceutical giant Eli Lilly and a growing logistics and tech sector. Its strategic location and continued investment in urban development have made it an increasingly attractive destination for residents and businesses alike.

While the market here might subtly favor buyers more than some others on this list, speed remains a defining characteristic. The typical home value is expected to rise to $285,086 in 2025, showcasing consistent, healthy real estate appreciation. New listings in Indianapolis typically go pending in about two weeks, a brisk pace that still demands preparedness from buyers. This market offers excellent affordability index for first-time buyers and solid property investment opportunities with promising rental income potential.

Buffalo, NY

For the second consecutive year, Buffalo, New York, claims the top spot on our hottest markets list. Famous for its epic snowstorms and close proximity to the natural wonder of Niagara Falls, Buffalo has undergone a remarkable revitalization. Its affordability, coupled with significant investments in its waterfront, cultural institutions, and a burgeoning medical campus, has transformed its economic outlook. The city’s resilient community and strategic location near the Canadian border also contribute to its steady growth.

After seeing impressive 5.8% year-over-year growth in 2024, Buffalo’s market is expected to moderate slightly in 2025, with a forecasted 2.8% increase, bringing the typical home value to $267,878. This moderation signals a healthy, sustainable growth trajectory. Despite the anticipated slower appreciation, homes in Buffalo continue to fly off the market, going from listing to pending in only 12 days. This sustained velocity underscores strong buyer confidence and demand, making Buffalo a prime location for long-term appreciation and a standout for real estate investment strategies in 2025.

Mastering Your Strategy in a Velocity-Driven Market

Understanding these top markets is only the first step. For buyers and investors looking to thrive in these competitive environments, a strategic, disciplined approach is not just advisable—it’s essential. My decade of experience has shown that success in hot markets hinges on foresight and swift execution.

Financial Fortification is Non-Negotiable: Your first and most critical move is to get your finances impeccably in order. This isn’t just about knowing your budget; it’s about securing a full pre-approval with a reputable lender. A pre-approval demonstrates your financial readiness and commitment, making your offer significantly more attractive to sellers. Explore different loan products—conventional, FHA, VA, or even exploring jumbo loans if applicable. Understanding the various mortgage rate forecasts for 2025 will also empower you to make informed decisions about locking in rates or opting for adjustable-rate mortgages if suitable for your risk profile. Don’t forget to budget for closing costs and understand the potential for down payment assistance programs that might be available.

The Indispensable Role of an Expert Buyer’s Agent: In markets where homes sell in days, not weeks, an experienced buyer’s agent is your most potent weapon. This isn’t merely about finding listings; it’s about gaining an edge. A top-tier agent will:

Possess deep local market intelligence, understanding specific neighborhood dynamics, hidden gems, and areas poised for future growth.

Provide real-time updates on inventory levels and off-market opportunities.

Help you craft highly competitive offers, navigating everything from contingency clauses to knowing when (and if) to consider an inspection waiver (a risky move, but sometimes necessary in a seller’s market).

Master negotiation tactics to secure the best terms possible, even in a competitive bidding scenario with multiple offers. They can help you understand the nuances of what sellers truly value beyond the highest price.

Understanding Market Equilibrium: While these are designated “hot” markets, it’s vital to continually assess whether specific micro-markets within these cities favor buyers or sellers, or if they’re in a state of relative balance. Factors like price point, property type (e.g., luxury condos vs. entry-level single-family homes), and even specific school districts can create different dynamics. Online tools can provide a snapshot, but your agent’s real-time insight is invaluable. This ongoing assessment helps in refining your real estate investment strategies.

Patience and Resilience: The Psychological Edge: Buying in a fast-paced market can be emotionally taxing. You might lose out on several homes before securing one. Maintaining patience, managing expectations, and staying resilient are crucial. Remember that each property is a unique opportunity, and the right one will emerge. For real estate investors, this means not chasing every deal but waiting for the ones that align with their desired return on investment (ROI) and risk profile.

Leveraging Technology with a Human Touch: Utilize online search platforms to identify potential properties, set up instant alerts, and even take advantage of virtual tours. However, combine this technological prowess with the personalized guidance of your agent. Digital tools provide data; an expert agent provides wisdom and strategy.

Your Future in Focus: Seizing Opportunity in 2025

The 2025 housing market is not a monolith; it’s a vibrant tapestry of localized opportunities and strategic entry points. For those prepared to understand its nuances and act decisively, the rewards of home equity growth and substantial real estate appreciation in these top markets are well within reach. This isn’t merely about acquiring property; it’s about making astute financial decisions that lay the foundation for future prosperity.

Are you ready to transform these insights into action and secure your place in America’s most dynamic housing markets? Don’t let opportunity pass you by. Connect with a trusted local real estate expert today to craft your personalized strategy and navigate the unique currents of these explosive markets. Your journey toward significant homeownership or property investment opportunities begins now.