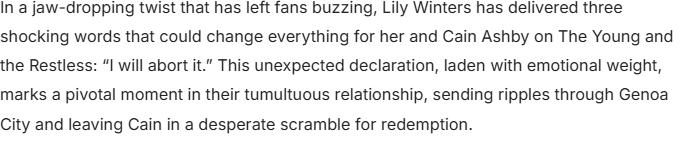

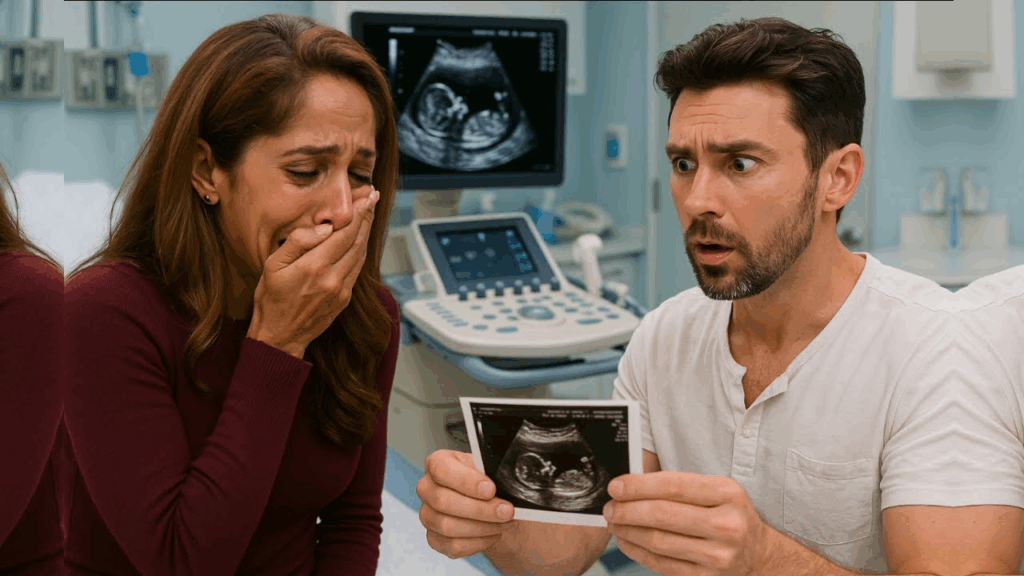

Lily’s Shocking Decision Leaves Cain Begging: A Turning Point in Genoa City’s Drama

Navigating the Shifting Tides: America’s Top 10 Housing Markets Poised for Growth in 2025

As we stand on the cusp of 2025, the American housing market continues its fascinating dance of evolution. Gone are the frenzied, often unsustainable surges of yesteryear. In their place, we’re witnessing a nuanced landscape where opportunity blossoms in specific locales, driven by robust economic fundamentals, strategic infrastructure investments, and an unwavering demand for quality of life. From my vantage point, having navigated these complex currents for over a decade, I can tell you that the secret to success in this environment lies in understanding the granular details, not just the sweeping national headlines.

Many prospective homeowners and seasoned investors alike might feel a lingering apprehension, perhaps a phantom limb sensation from the high interest rates and persistent affordability challenges that defined recent years. Yet, paradoxically, a select group of metropolitan areas is not just defying these pressures but actively thriving. This isn’t a speculative bubble in the making; it’s a calculated forecast based on deep analysis of underlying market health: job growth outstripping new construction, an expanding base of owner-occupied households signaling long-term community commitment, and the sheer velocity at which properties are changing hands. These are the indicators that whisper of sustainable growth, making these markets prime targets for those seeking strategic homeownership or discerning real estate investment opportunities.

The year 2025 promises a stabilization of mortgage rates, albeit at levels higher than the historical lows of the pandemic era. This normalization, coupled with a persistent inventory deficit in many desirable areas, sets the stage for what I predict will be a period of steady, healthy appreciation in these identified hotspots. Unlike the preceding years, where some markets experienced meteoric, almost dizzying home value appreciation, 2025’s growth is projected to be more tempered. This moderation is a welcome development, offering a breath of fresh air for first-time home buyers who are diligently saving for down payments and seeking an entry point into a competitive landscape. For the savvy investor, this signifies a more predictable environment for rental income potential and long-term wealth building through real estate.

Our meticulous methodology, refined over years of market observation and data crunching, delves far deeper than surface-level statistics. To identify the hottest housing markets for 2025, we’ve rigorously examined the 50 largest U.S. metro areas through a multifaceted lens:

Projected Home Value Growth: This isn’t merely about past performance but a forward-looking assessment of where values are set to appreciate most robustly, balancing demand against supply. Sustainable growth, even if slower than peak, indicates market strength.

Change in Owner-Occupied Households: A rising tide of owner-occupied homes signals strong population growth, family formation, and an enduring commitment to the community. It speaks to a healthy, expanding demographic base that underpins long-term housing demand.

Job Growth vs. New Construction: This is a critical indicator of market balance. When new jobs attract new residents faster than new homes can be built, it creates natural upward pressure on prices. Markets where construction lags behind employment expansion are inherently more competitive.

Speed of Home Sales: The time from listing to contract — the “days on market” — is a crucial barometer of buyer demand and market intensity. Faster sales indicate strong competition and high desirability, a hallmark of a truly “hot” market.

What we’ve observed is a fascinating geographic shift. While previous years saw certain Sun Belt states dominate the “hottest markets” conversation, 2025 brings a renewed focus on the Northeast and Midwest. These regions, often overlooked in recent booms, are now demonstrating compelling dynamics of relative affordability, robust employment expansion, and burgeoning urban revitalization. This shift underscores a broader trend: buyers are increasingly prioritizing value, community, and accessible employment opportunities, even if it means braving a colder climate. It’s an exciting time to be an expert in property market analysis, as these emerging patterns redefine traditional notions of real estate desirability.

The Elite Ten: America’s Most Dynamic Housing Markets for 2025

Let’s dive into the markets that, based on our rigorous analysis and expert foresight, are poised to lead the nation in housing dynamism in 2025. These are the locales where strategic investment and informed home buying decisions will yield the most significant advantages.

Salt Lake City, UT – The Mountain West’s Rising Star

Nestled amidst the majestic Wasatch Mountains, Salt Lake City is far more than a gateway to world-class skiing; it’s a burgeoning economic powerhouse with a unique blend of natural beauty and urban sophistication. Over the past decade, I’ve watched Salt Lake transform from a regional hub into a magnet for young professionals and tech companies, often dubbed “Silicon Slopes.” The city’s thriving tech sector, coupled with strong healthcare and outdoor recreation industries, fuels consistent job growth that continues to attract new residents. This influx of talent, often seeking a lifestyle rich in outdoor adventure, translates directly into fierce demand for housing.

While home values here are already substantial, projected growth of 2.3% in 2025, pushing the typical home value towards $555,858, reflects a market that’s maturing but still appreciating. What truly makes Salt Lake City a hot housing market 2025 is the sheer speed of transactions; homes typically go pending in a mere 19 days. This velocity, combined with ongoing urban development and a diversifying population, makes it a compelling option for those seeking real estate investment opportunities in a dynamic Western city. Investors might look to its burgeoning peripheral communities for future upside.

Richmond, VA – Southern Charm Meets Economic Vigor

Richmond, Virginia’s historic capital, has quietly been undergoing a profound transformation. This isn’t just a city steeped in colonial history; it’s a vibrant, forward-looking metropolis with an increasingly diverse economy driven by government, finance, healthcare, and a burgeoning creative class. From my perspective, Richmond offers an enticing blend of affordability (relative to other East Coast hubs), a rich cultural scene, and a strategic location within easy reach of Washington D.C. and the Atlantic coast.

The market here has been on an upward trajectory, and while 2025 is projected for a more modest 2.9% growth in home values, don’t mistake moderation for stagnation. Richmond’s market is fiercely competitive, with homes selling in an astonishing average of just 9 days. This rapid turnover is a testament to strong local demand, fueled by job opportunities and a high quality of life. For buyers, preparing with a mortgage pre-approval is non-negotiable. For investors, Richmond presents attractive rental income potential, particularly given its popularity with young professionals and families seeking a balance of urban amenities and Southern charm.

Kansas City, MO – The Heartland’s Unexpected Gem

Kansas City, straddling the Missouri-Kansas border, is a testament to the power of cultural identity and strategic growth. Known globally for its legendary barbecue, jazz heritage, and an impressive array of public fountains, KC is also rapidly becoming a hub for logistics, animal health, and technology. What makes Kansas City particularly appealing in 2025 is its compelling combination of affordability and strong economic momentum. From my experience, cities that combine cultural vibrancy with robust, diversified employment bases tend to sustain long-term home equity growth.

With home values expected to increase by 2.7% in 2025, bringing the typical value to an accessible $307,334, Kansas City offers a compelling value proposition. But don’t let the affordability fool you; this is a highly competitive market where homes typically go pending in just 9 days. This blistering pace underscores intense buyer demand, driven by both local residents and an influx of those seeking a lower cost of living without sacrificing urban amenities. Strategic infrastructure investments, including its modern airport, further bolster its appeal for property investment strategy and relocation alike.

Charlotte, NC – The Queen City’s Unabated Reign

Charlotte, North Carolina, proudly wears its “Queen City” moniker, and for good reason. As a leading financial center (second only to New York City in banking assets), its economic engine is consistently robust. Beyond finance, Charlotte boasts a diverse economy in energy, healthcare, and a rapidly expanding tech sector, all contributing to a steady stream of job creation and population growth. Its temperate climate, abundant green spaces, and enthusiastic sports culture add layers of desirability that continue to attract new residents from across the nation.

Projected home value appreciation of 3.2% in 2025, pushing the typical value towards $389,383, indicates a healthy, appreciating market. While the 20-day average for homes going pending is slightly slower than some others on this list, it still signals a highly competitive environment. My observations show that Charlotte continues to attract significant corporate relocation and expansion, driving sustained housing demand. For those interested in luxury real estate trends within a growing metro, Charlotte offers increasingly sophisticated options. The city’s ongoing transit and urban development projects also promise continued long-term upside for real estate market analysis.

St. Louis, MO – Affordability Meets Opportunity

St. Louis often surprises those who haven’t experienced its resurgence firsthand. In 2024, it was lauded as a top market for first-time home buyers, and that appeal only strengthens in 2025. This historic city, famous for the Gateway Arch, is undergoing a profound revitalization, with a burgeoning medical and biotech corridor, a vibrant arts scene, and renewed interest in its diverse neighborhoods. Its relative affordability, particularly compared to coastal metros, is its strongest draw, attracting those seeking significant value for their housing dollar.

With a forecasted 1.9% growth in home values for 2025, bringing the typical home to an incredibly accessible $254,847 (the lowest on our top 10 list), St. Louis offers an exceptional entry point into homeownership. Yet, don’t mistake affordability for a slow market; homes here are flying off the shelves in an average of just 8 days. This ferocious pace indicates an incredibly high demand relative to available inventory, particularly for well-priced properties. St. Louis provides compelling real estate investment opportunities for those looking for strong cash flow and long-term appreciation in an undervalued urban market.

Philadelphia, PA – The City of Brotherly Love’s Revival

Philadelphia, with its unparalleled historical significance and walkable urban fabric, is experiencing a profound renaissance. This isn’t just about Liberty Bell and Independence Hall; it’s about a dynamic city fueled by world-class educational institutions (think “eds and meds” economy), a robust healthcare sector, and a growing tech startup scene. From my perspective, Philadelphia represents a compelling narrative of urban reinvestment, drawing residents back to its diverse neighborhoods and vibrant cultural offerings.

While its market showed fervent activity in 2024, 2025 projects a more settled but still strong 2.6% growth in home values. However, don’t let this moderate appreciation fool you: the market remains highly competitive, with new listings typically going pending in an average of 11 days. This speed is indicative of a deep pool of eager buyers. Philadelphia’s unique blend of historic charm, urban amenities, and a strategic location on the Northeast Corridor makes it an attractive proposition for both homeowners and property investors seeking stable returns and housing market predictions 2025 that favor sustained growth in a major metropolitan area.

Hartford, CT – The Insurance Capital’s Surprising Surge

Hartford, Connecticut, the longtime hub of the insurance industry, is demonstrating some of the most impressive housing market momentum in 2025. Often overshadowed by its larger Northeast neighbors, Hartford is emerging as a compelling option for those seeking relative affordability within the high-cost Northeast corridor. The city is experiencing renewed urban development, strategic investment in its downtown core, and leveraging its connectivity to Boston and New York City. This combination creates a powerful draw for those seeking a more accessible lifestyle without sacrificing professional opportunities.

Homes in Hartford are forecast to experience a significant 4.2% increase in value in 2025, pushing the typical home price to $378,693. This represents the largest projected bump within our top 10, indicating a market with substantial upside potential. The competitiveness here is extreme, with homes selling in an astonishing 7 days on average. This makes it imperative for prospective buyers to have their finances in order and to secure full mortgage pre-approval benefits to act with lightning speed. For investors, Hartford offers an intriguing prospect for investment property strategy within a historically stable, yet rapidly appreciating, market.

Providence, RI – New England’s Waterfront Jewel

Providence, Rhode Island, is a city that effortlessly blends quaint New England charm with sophisticated urban flair. Home to prestigious institutions like Brown University and the Rhode Island School of Design, it boasts a vibrant creative economy, a stunning waterfront, and an increasingly dynamic culinary scene. What I find particularly appealing about Providence is its unique character and its growing appeal to those seeking a high quality of life without the exorbitant price tags of Boston or New York.

While home values are expected to grow by a robust 3.7% in 2025, marking a moderation from 2024’s 7% appreciation, demand remains exceptionally strong. Homes typically go pending in a brisk 12 days, signaling a market where competition is fierce. The ongoing urban revitalization efforts, particularly along its rivers and in its historic districts, are continuously enhancing its appeal. Providence offers a strong case for real estate market trends 2025 in the Northeast, combining academic prestige, cultural richness, and strong economic fundamentals, making it a sound choice for both primary residences and property investment analysis.

Indianapolis, IN – The Crossroads of America’s Consistent Performer

Indianapolis, Indiana, is far more than just the “Racing Capital of the World.” This centrally located metropolis is a formidable economic engine, boasting a diverse array of industries from pharmaceuticals (Eli Lilly being a major employer) to logistics, advanced manufacturing, and a burgeoning tech sector. Its strategic location, robust infrastructure, and high quality of life at an accessible price point make it a perennial favorite for both residents and real estate investors.

The market in Indianapolis continues its steady, upward trajectory, with the typical home value expected to rise to $285,086 in 2025. While the market might slightly favor buyers on paper, properties still move swiftly, with new listings typically going pending in about two weeks. This consistent demand, coupled with ongoing investment in its urban core and a diverse employment base, ensures reliable home equity growth. Indianapolis embodies the ideal of a balanced, growing market that offers stability and long-term appreciation, making it an excellent candidate for wealth building through real estate in the heartland.

Buffalo, NY – The Resurgent Anchor of Western New York

For the second consecutive year, Buffalo, New York, claims the top spot on our list, a testament to its incredible and sustained resurgence. Once facing economic headwinds, Buffalo has transformed into a vibrant, affordable, and culturally rich city capitalizing on its magnificent waterfront, proximity to Niagara Falls, and a renewed sense of civic pride. Its growth story is genuinely remarkable, driven by strategic development, a burgeoning tech and healthcare sector, and its strategic cross-border location with Canada.

After a strong 5.8% year-over-year growth in 2024, 2025 projects a healthy 2.8% increase, bringing the typical home value to $267,878. What truly sets Buffalo apart, and cements its position as the hottest housing market 2025, is the incredible speed at which homes sell—just 12 days from listing to pending. This fierce competition, combined with an attractive affordability ratio and ongoing revitalization projects (like the Canalside development), makes Buffalo an incredibly appealing market. From an expert’s standpoint, Buffalo represents a compelling blend of value, growth potential, and quality of life that is difficult to match across the nation, offering substantial investment property strategy upside.

Navigating the Rapids: Expert Strategies for Competitive Markets in 2025

Purchasing a home in any of these competitive markets requires more than just good intentions; it demands strategic preparation, swift action, and expert guidance. Here’s how to position yourself for success:

Financial Fortitude is Paramount: Beyond a simple pre-approval, strive for full underwriting pre-approval from your lender. This signals to sellers that your financing is solid, almost as good as a cash offer, giving you a significant competitive edge in markets where homes sell in days, not weeks. Understand your mortgage rate forecast 2025 and lock in favorable terms if possible.

Forge a Partnership with a Local Expert: My decade in this industry has shown me time and again that a top-tier, locally experienced real estate agent is your most valuable asset. They possess hyper-local market intelligence, understand neighborhood nuances, and can advise on home buying strategies 2025 like crafting compelling offers, including escalation clauses or appropriate (and cautious) contingency waivers. They are your eyes and ears on the ground, helping you uncover opportunities before they hit the broader market.

Be Prepared to Move Decisively: In markets where homes go pending in less than two weeks, hesitation is a luxury you can’t afford. Have your decision-making criteria clear, your offer terms pre-discussed with your agent, and be ready to act swiftly when the right property emerges. This might mean making an offer sight unseen (after a virtual tour and agent’s detailed assessment), or being flexible on closing dates to accommodate a seller.

Embrace Data-Driven Decisions: Leverage tools and market heat indexes that provide up-to-date insights into local market conditions. Understand the “time on market” for similar properties, the average sale-to-list price ratio, and the housing affordability crisis data within your specific target neighborhoods. This empowers you to make informed, rather than emotional, decisions.

Consider the Long Game: While the immediate competition is fierce, remember the underlying economic strengths driving these markets. Buying in a fundamentally strong, growing metro positions you for long-term home equity growth and wealth accumulation, even if the initial entry is challenging.

The Investor’s Lens: Unlocking Opportunity

For investors, these top 10 markets present compelling opportunities for real estate portfolio diversification and robust returns. The consistent demand, coupled with projected appreciation and often favorable rental yield forecasts, creates an environment ripe for strategic acquisitions. Whether you’re considering single-family homes, multi-unit properties, or exploring emerging commercial real estate segments, a detailed investment property analysis for each of these cities is crucial. Look beyond the immediate sale price to the broader economic narrative and the long-term growth trajectory.

As we look towards 2025, the housing market is poised for a fascinating and dynamic year. The national narrative may hint at challenges, but specific, well-researched local markets are brimming with opportunity. Don’t let uncertainty paralyze your progress. The time to act, with knowledge and precision, is now.

Ready to explore these dynamic markets and seize your next real estate opportunity? Connect with a seasoned expert today to craft a personalized strategy that aligns with your goals and leverages the insights of America’s hottest housing markets for 2025. Your future in real estate awaits.