Title: Family Feuds and Corporate Chaos: The Abbott Brothers Clash in Genoa City

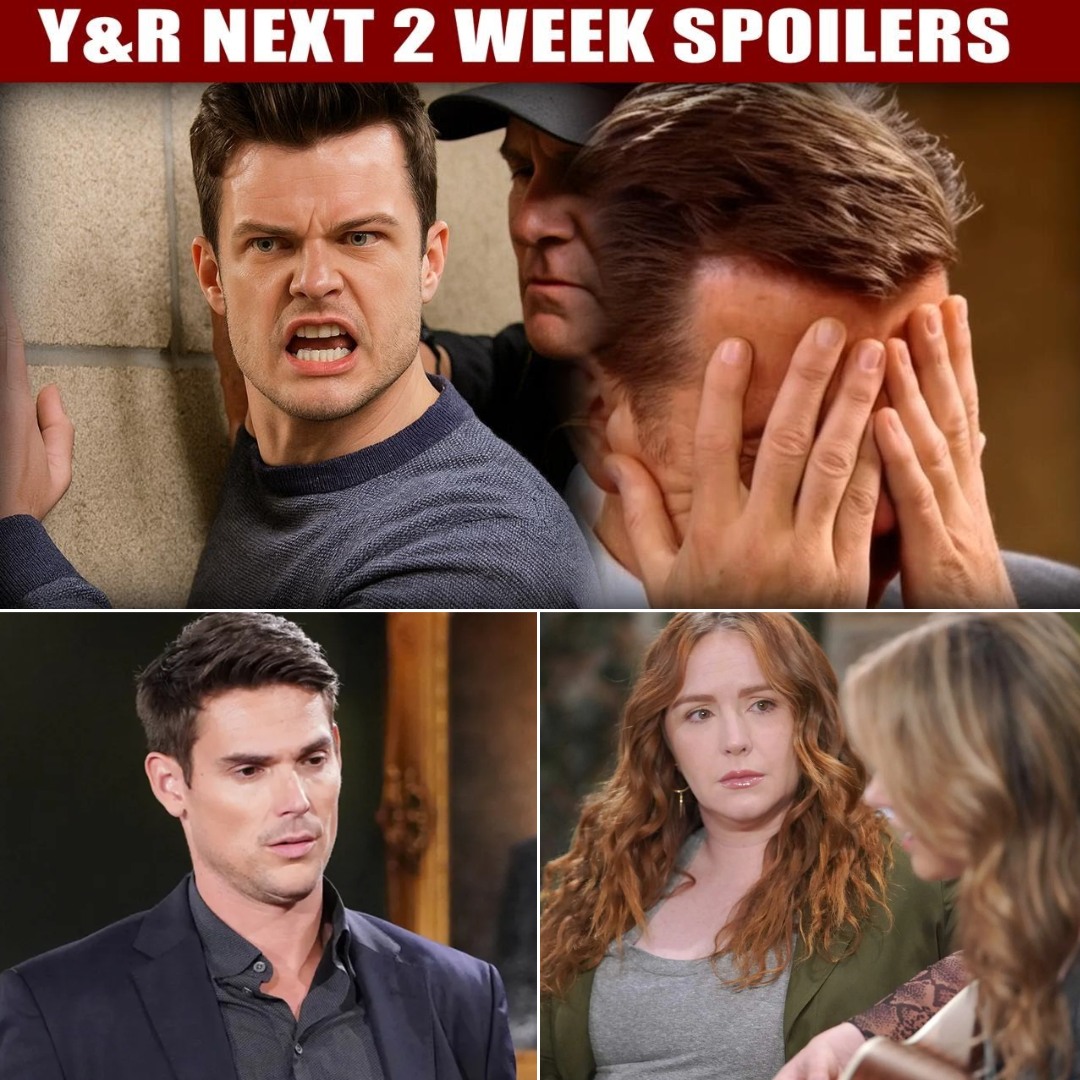

In a dramatic turn of events that has left fans of The Young and the Restless reeling, Jack Abbott’s patience has finally worn thin, leading to a fierce confrontation with his brother Billy that threatens to unravel the very fabric of the Abbott family legacy. The stakes have never been higher as Jack grapples with the future of Jabau amidst a brewing storm of ambition, betrayal, and personal turmoil.

In a dramatic turn of events that has left fans of The Young and the Restless reeling, Jack Abbott’s patience has finally worn thin, leading to a fierce confrontation with his brother Billy that threatens to unravel the very fabric of the Abbott family legacy. The stakes have never been higher as Jack grapples with the future of Jabau amidst a brewing storm of ambition, betrayal, and personal turmoil.

In a recent episode, Jack, played by Peter Bergman, made a decisive move that has sent shockwaves through Genoa City. After enduring Billy’s relentless demands for funding for yet another impulsive venture, Jack drew a line in the sand. His refusal to finance Billy’s reckless ambitions was rooted not in personal animosity, but in the cold, hard reality of business strategy. With the looming threat of an Arabesque takeover, Jack is determined to safeguard the company’s future, even if it means clashing with his own brother.

Billy, portrayed by Jason Thompson, is spiraling deeper into a pit of insecurity and resentment. Feeling sidelined and underestimated, he perceives Jack’s practical decisions as personal betrayals. The tension between the brothers has reached a boiling point, with Billy convinced that Jack’s recent alliance with their mother, Jill Abbott, is a calculated move to exclude him from the family business. This perception of betrayal is only exacerbated by Jack’s announcement that Sally Spectra will soon oversee Abbott Communications, further igniting Billy’s fury.

Meanwhile, Sally, played by Courtney Hope, finds herself caught in the crossfire of this family feud. As her relationship with Billy deteriorates, she is drawn into Jack’s orbit, where her professional ambitions begin to flourish. However, the emotional fallout from her tumultuous romance with Billy hangs heavy over her, complicating her newfound success. Her conversations with Audra Charles reveal a woman torn between ambition and affection, struggling to navigate the treacherous waters of Genoa City’s business landscape.

As Jack and Jill strategize behind closed doors, Billy’s desperation grows. He feels the walls closing in on him, convinced that his brother is orchestrating a plan to push him out of the family legacy. Jack, however, is merely trying to protect what their father built, aware that the stakes have never been higher. With Cain Ashby lurking in the shadows, ready to exploit any weakness, Jack knows he must tread carefully.

The emotional stakes are just as high as the financial ones. As Billy’s anger festers, he risks becoming the very thing he despises: an outsider in his own family. His relationship with Sally, once filled with promise, now teeters on the brink of collapse as she reaches her breaking point. The tension between ambition and loyalty becomes palpable, setting the stage for a showdown that could change everything.

With alliances forming and loyalties tested, the Abbott family is on the brink of a chaotic upheaval. Fans are left wondering: can Jack maintain his grip on Jabau while navigating the treacherous waters of family loyalty? Will Billy find a way to reclaim his place, or will he be consumed by his own demons? And what role will Sally play as the lines between love, ambition, and betrayal blur?

As the sun sets on Genoa City, viewers brace for the fallout of this explosive family drama. With every decision carrying the weight of legacy and every confrontation steeped in emotion, the Abbott brothers’ battle is far from over. Tune in to The Young and the Restless to witness the unfolding saga of ambition, betrayal, and the quest for power that defines this iconic soap opera.

Navigating the 2025 Landscape: An Expert’s Guide to Top Multifamily Real Estate Investment Markets

The multifamily real estate sector stands at a fascinating juncture as we enter 2025. After navigating the choppy waters of interest rate hikes, inflation pressures, and shifts in post-pandemic living, the market is poised for a significant re-alignment, presenting astute investors with prime opportunities for portfolio growth and diversification. Having spent over a decade immersed in this dynamic landscape, observing cycles, anticipating trends, and executing successful acquisitions across various markets, I’ve gained a firsthand understanding of what truly drives value in multifamily investment strategies. The prevailing sentiment among market analysts, and indeed my own observations, points towards a healthier balance of supply and demand emerging in 2025, laying the groundwork for sustainable rent growth and robust asset performance.

For those looking to strategically position their capital, understanding the nuanced dynamics of individual markets is paramount. While macro-economic factors like potential interest rate stabilization and a moderated inflation outlook create a more predictable environment, the real alpha in multifamily investment comes from identifying specific geographic sweet spots. This isn’t merely about chasing the highest cap rates or the cheapest properties; it’s about a holistic evaluation of economic resilience, demographic magnetism, infrastructure investment, and long-term rental demand projections. My analysis for 2025 drills down into these critical indicators, moving beyond surface-level statistics to uncover the underlying narratives that promise high-ROI real estate markets for the discerning investor. We’re talking about markets where job creation outpaces national averages, where population influx generates sustained housing needs, and where a diversified economic base can weather future uncertainties.

The goal here isn’t just to list cities; it’s to provide an expert-level perspective on why these markets are primed for growth, offering a detailed investment thesis for each. We’ll explore key metrics like evolving occupancy rates, the supply pipeline’s impact on rent trajectories, the significance of price-to-rent ratios, and the nuanced interplay of local economic drivers. This comprehensive approach is essential for anyone serious about maximizing rental income and embarking on a journey of wealth creation through real estate. For 2025, these are the ten markets I believe offer the most compelling arguments for multifamily investment, handpicked for their blend of stability, growth potential, and strategic value.

The 10 Most Compelling Cities for Multifamily Investing in 2025

Las Vegas, Nevada: The Resilient Oasis of Opportunity

Las Vegas continues its remarkable transformation from a purely entertainment-driven economy to a diversified hub attracting tech, logistics, and healthcare industries. This economic broadening, coupled with Nevada’s favorable tax environment (no state income tax), fuels a consistent influx of residents. My experience in the Las Vegas market over the past decade underscores its enduring appeal; properties we acquired as far back as 2015, like the Lake Tonopah community, consistently demonstrate high occupancy and strong revenue streams.

For 2025, Las Vegas is projected to maintain strong population growth, driven by its affordability relative to coastal California and its burgeoning employment sectors. The median property price, currently around $417,000, offers an attractive entry point compared to many high-growth markets. Occupancy rates, hovering around 91% (Q3 2024 data), indicate robust demand, while cap rates in the 5.5-6% range reflect a healthy risk-adjusted return. The price-to-rent ratio of 19.2, with average rents around $1,807, suggests a market where renting remains a financially sensible option for a significant portion of the population, thereby ensuring sustained demand for multifamily units. Investors seeking a dynamic market with proven resilience and long-term growth trajectory will find Las Vegas an indispensable component of their real estate portfolio optimization.

Atlanta, Georgia: The Southern Economic Powerhouse

Atlanta’s economic expansion is nothing short of phenomenal. As a major logistics hub, a burgeoning tech center (often dubbed “Silicon Peach”), and a nexus for corporate relocations, the city’s job market is a powerful magnet for new residents. This relentless population growth translates directly into an escalating demand for housing, making Atlanta a top-tier market for multifamily investment. The city has demonstrated an impressive absorption rate for new units, absorbing thousands each quarter, showcasing its capacity to accommodate growth without oversaturation.

With a median property price around $400,000 and an average rent of $1,600, Atlanta presents an appealing balance of affordability and robust income potential. Its 88% occupancy rate, while slightly lower than some, reflects the aggressive new construction that is quickly being absorbed by market demand. A solid cap rate of 5.6% and a healthy price-to-rent ratio of 16 underscore the market’s fundamental strength. For 2025, Atlanta’s diversified economy—ranging from film production to fintech—positions it as a resilient choice for passive income real estate investing, promising consistent cash flow and appreciation.

Charlotte, North Carolina: The Banking Capital’s Growth Spurt

Charlotte, North Carolina, continues to impress with its explosive population growth and a vibrant economy anchored by the banking and finance industries. It’s a key player in the high-growth Carolinas, attracting young professionals and families alike. The city’s investment in infrastructure and its favorable business climate further bolster its appeal. This demographic surge directly fuels the demand for rental housing, keeping the multifamily sector robust.

Market stats for 2025 remain highly compelling: median property prices in the $375,000-$400,000 range offer excellent value. An exceptional occupancy rate of 92% speaks volumes about the scarcity and high demand for quality rental units. With a cap rate around 5.5% and a price-to-rent ratio between 17-18, the market indicates a healthy environment for landlords. Average rents of $1,800 reflect the strong earning power of the local populace. Charlotte isn’t just growing; it’s maturing into a sophisticated urban center, making it an ideal candidate for long-term real estate portfolio diversification and sustained wealth creation.

Tampa, Florida: Sunshine State’s Multifamily Gem

Tampa’s multifamily market is riding a wave of sustained momentum, propelled by Florida’s attractive policy of no state income tax and moderate property taxes. These financial incentives, combined with a high quality of life, continue to draw both residents and businesses to the region. Tampa’s economy is increasingly diversified beyond tourism, with burgeoning sectors in healthcare, technology, and professional services contributing to its long-term stability and growth.

The city’s rapid population growth translates into consistent demand for rental housing. With a median property price of approximately $367,000 and average rents around $1,800, Tampa offers a highly attractive price-to-rent ratio of 14, one of the most favorable on this list. An occupancy rate of 90% and a cap rate of 5.5% confirm its strong investment fundamentals. As the state continues to invest in infrastructure and urban development, Tampa is set to deliver exceptional performance for multifamily investors in 2025 and beyond, solidifying its status as a high-yield real estate market.

Denver, Colorado: The Mile-High Magnet for Talent

Denver’s economic and population strength shows no signs of waning. Its appeal lies in a high quality of life, access to outdoor recreation, and a robust job market, particularly in tech, aerospace, and healthcare. The city consistently attracts a young, educated workforce, leading to strong household formation and continued demand for rental properties. High absorption rates for multifamily units underscore this persistent demand, despite a relatively active construction pipeline.

While Denver’s median property price is higher at $586,000, reflecting its desirability and high cost of living, its average rent of $1,800 still offers a compelling return profile. The occupancy rate of 89.5% and a cap rate of 5.2% are indicative of a mature, sought-after market. The price-to-rent ratio of 23 suggests that while homeownership is expensive, renting remains a practical necessity for many, ensuring a stable tenant pool. Investors looking for a market with strong long-term appreciation potential and a dynamic economy will find Denver an excellent addition to their commercial property investment advice.

Nashville, Tennessee: Music City’s Harmony of Growth

Nashville has consistently featured on lists of top investment cities, and 2025 is no exception. Its unique blend of a booming job market, vibrant culture, and reasonable cost of living continues to attract a diverse demographic. The city’s economic growth is fueled by healthcare, automotive manufacturing, tourism, and of course, its iconic music industry. Properties like Discovery at Mountain View, a 336-unit asset acquired in 2022, exemplify the market’s capacity for high occupancy rates and consistent revenue generation.

With a median property price of $455,000 and an average rent of $1,900, Nashville’s fundamentals are robust. The 88% occupancy rate and a cap rate of 5.5% reflect a healthy market absorbing new supply efficiently. A price-to-rent ratio of 19 further solidifies its appeal. The continued migration into Tennessee, supported by no state income tax, ensures that Nashville will remain a powerhouse for multifamily investment. It’s a market where quality assets, strategically managed, can deliver significant cash flow real estate benefits and long-term capital appreciation.

San Diego, California: Coastal Constraints, Premium Returns

San Diego’s multifamily market thrives on a fundamental imbalance: limited supply meeting strong, persistent demand. Strict zoning laws and a constrained geographical footprint mean new development often struggles to keep pace with population growth, which is consistently driven by its strong military presence, biotech industry, tourism, and quality of life. This scarcity creates a premium on existing rental stock.

This market is characterized by higher entry costs, with a median property price of $876,000 and average rents soaring between $2,500 and $3,000. However, the high occupancy rate of 95% is a testament to the immense demand, indicating virtually no vacancy. While the cap rate of 4.6% is lower than other markets, reflecting the premium pricing, the strong rent growth potential and high appreciation rates offer a different kind of investment thesis. The price-to-rent ratio of 24 underscores the significant cost of homeownership, pushing more residents into the rental market. For investors prioritizing asset appreciation in a highly desirable, supply-constrained market, San Diego represents a compelling, albeit more expensive, opportunity zone investment for those with significant capital.

Salt Lake City, Utah: The Mountain West’s Economic Engine

Salt Lake City has emerged as a dynamic economic center in the Mountain West, attracting tech companies, startups, and a young, educated workforce. Its diversified economy, growing population, and strategic location make it a regional hub. We recognized this potential early, acquiring properties like Parkway Commons in 2016, which has proven its resilience and value over the years. The city benefits from a strong pro-business environment and continued investment in its urban core.

The multifamily market in Salt Lake City presents a compelling profile for 2025. With a median property price of $526,000 and average rents around $1,700, it strikes a balance between value and return. An impressive 94% occupancy rate highlights the strong demand, while a cap rate of 5.5% suggests attractive yields. The price-to-rent ratio of 25-26 indicates that renting is a much more feasible option than buying for many residents, supporting a robust renter pool. Salt Lake City offers investors a chance to capitalize on strong demographic shifts real estate, steady economic expansion, and a quality of life that continues to draw residents to the Intermountain West.

Columbus, Ohio: The Midwest’s Ascendant Star

Columbus, Ohio, represents an increasingly attractive prospect for multifamily investors seeking a blend of solid growth and relative affordability. It’s an emerging market in the Midwest that has successfully diversified its economy beyond traditional manufacturing, embracing sectors like technology, healthcare, education (with Ohio State University as a major anchor), and logistics. This economic transformation fuels stable job creation and draws a steady stream of new residents.

One of Columbus’s most significant advantages is its affordability. With a median property price of just $277,000 and average rents around $1,530, it offers an outstanding entry point and strong cash flow potential. The occupancy rate of 92% is excellent, demonstrating strong demand for its rental stock. Most notably, a cap rate of 6.8% is among the highest on this list, indicating a very attractive yield for investors. The price-to-rent ratio of 15 further underscores the economic viability of its rental market. Columbus is a testament to the fact that high-ROI real estate markets aren’t exclusive to the coasts, offering significant potential for those seeking compelling returns without the premium price tags of more established “hot” markets.

Dallas, Texas: The Megacity of Diverse Opportunities

Dallas, Texas, consistently ranks as one of the nation’s largest and most dynamic apartment markets. Its immense size, coupled with a booming, diverse job market across sectors like finance, technology, logistics, and healthcare, ensures a continuous stream of new residents. Texas’s absence of state income tax is a powerful incentive for both businesses and individuals, contributing to its sustained growth trajectory. Dallas is not just large; it’s strategically positioned for continued expansion.

The multifamily market in Dallas remains robust for 2025. With a median property price around $390,000 and average rents of $1,800, it offers a strong value proposition in a major metropolitan area. An 89% occupancy rate, while reflecting a large and active construction market, indicates healthy absorption. Cap rates in the 5-5.5% range are competitive for a market of this scale and growth potential. The price-to-rent ratio of 18 suggests that renting remains a practical and prevalent option, ensuring a deep pool of tenants. Dallas represents a resilient and expansive market, offering a broad spectrum of opportunities for seasoned investors focused on significant scale and consistent growth.

Seizing the Moment in 2025

The 2025 multifamily real estate landscape offers a confluence of stabilizing economic factors and targeted growth opportunities for investors who are prepared to act strategically. From the diversified economies of the Sunbelt to the resilient growth of emerging Midwest hubs, the markets detailed above present compelling cases for inclusion in a robust investment portfolio. The key to unlocking their full potential lies in meticulous due diligence, a deep understanding of local market nuances, and a commitment to optimizing asset performance.

These cities aren’t just statistics on a spreadsheet; they represent vibrant communities with strong underlying economic drivers and demographic tailwinds. Investing in multifamily real estate in these markets provides not only the potential for significant financial returns through rent growth and appreciation but also the satisfaction of contributing to the housing needs of growing populations. As an expert with over a decade in this field, I firmly believe that 2025 is the year to capitalize on these carefully identified opportunities.

Ready to explore how these prime multifamily investment opportunities can align with your financial goals and enhance your real estate portfolio? Contact us today to gain personalized insights and strategic guidance on navigating these top markets.