When Jill Abbott stepped off the plane in Nice, her every movement was weighed down by grief—and by the knowledge that the truth she carried in her hands had the power to obliterate Cane Ashby’s life forever. Colin Atkinson’s sudden death had been whispered about in hushed tones for weeks, surrounded by rumors and uncertainty. But what Jill found waiting for her in the south of France was not closure. It was a time bomb: a letter, a storage device, and a final confession that could tear her fractured family apart.

Jill’s Burden: Grief and Betrayal Intertwined

Jill had long lived in a world where men like Colin thrived in the shadows—con artists, schemers, men who blurred the line between charm and cruelty. But she had never prepared herself for the anguish of his final words. The letter that arrived was worn and creased, as though Colin himself had clung to it desperately in his last moments. Alongside it was a small device containing a video, a digital echo of his dying voice.

When Jill pressed play, Colin’s gaunt face appeared, his eyes clouded with regret and terror. His voice, trembling and strained, spoke of betrayal deeper than any of his own crimes. And the name he uttered with anguish was the one Jill least expected: Cane Ashby.

Colin’s Final Confession

In the haunting recording, Colin revealed how Cane had manipulated him during his weakest hours. According to his testimony, Cane coerced him into signing a fraudulent will, stripping him of the fortune he had intended to leave to Billy Abbott. For all his scheming, Colin had reached a place of reluctant respect for Billy—recognizing in him a core of integrity absent in many around them. Yet in his dying days, that legacy had been stolen.

Worse still, Colin’s story turned darker. He described how his treatments—supposedly meant to prolong his life—were laced with poison. His body failed as he pleaded for mercy, his calls for help ignored. Alone in his final hours, he understood too late that the very man he once called family had orchestrated his slow, excruciating death.

His last plea was not for himself but for justice—for Jill, for Billy, and for truth in a world consumed by deception.

Jill’s Breaking Point

As the video ended, Jill wept uncontrollably, clutching the device as if it were both a curse and a lifeline. Colin had never been a saint. He had conned, lied, and betrayed countless people—including her. But in his final confession, stripped of bravado, he was simply a man broken by betrayal, begging not to be forgotten.

The revelation that Cane—someone Jill had defended and forgiven time and time again—could be responsible for Colin’s death shattered her. For years, she had argued with critics, insisting Cane had redeeming qualities. Now, the truth made her defenses crumble.

Billy’s Rage

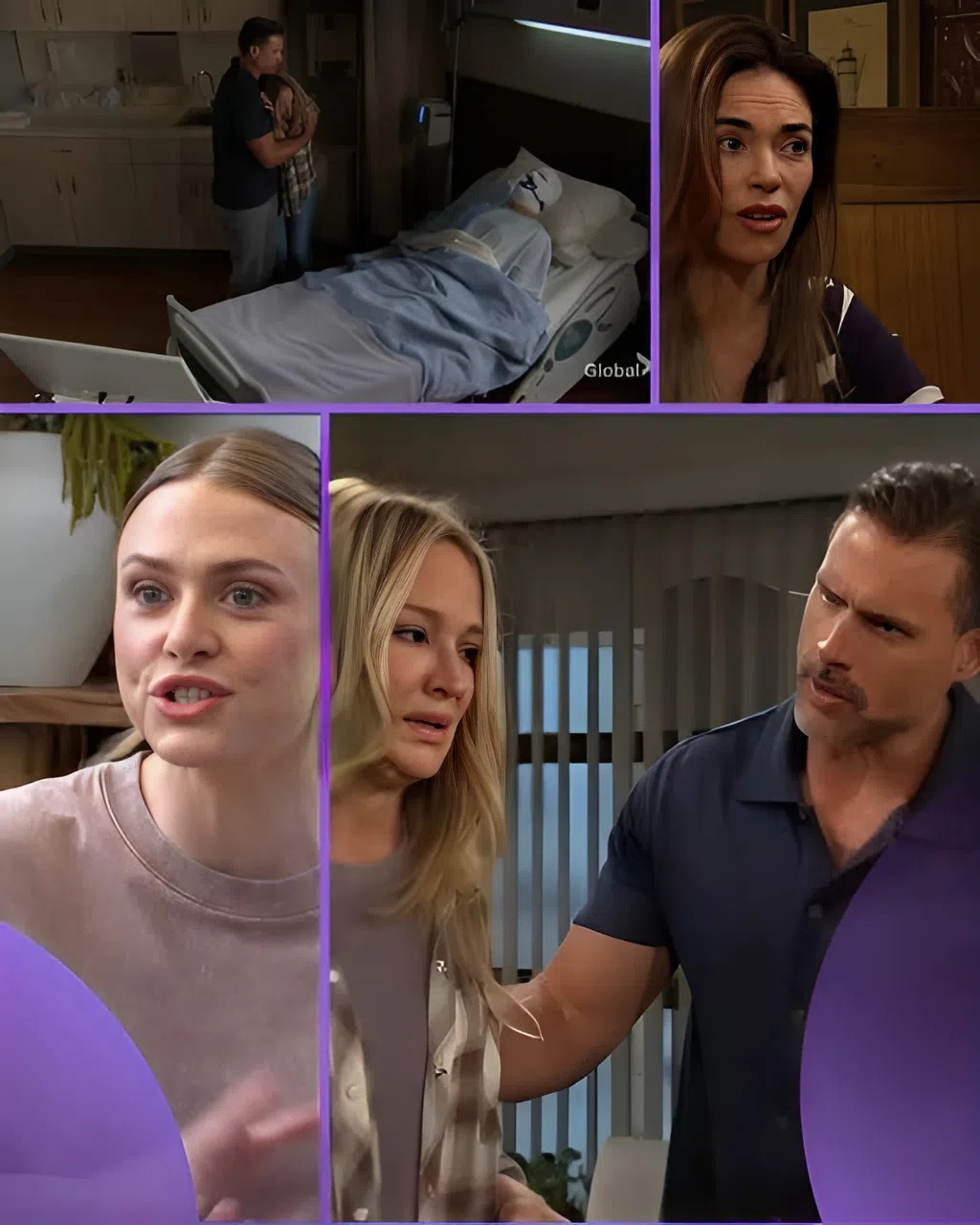

Billy Abbott found his mother moments later. Jill collapsed into his arms, her grief mingling with fury. As she handed him the evidence, Billy’s expression darkened. For him, this wasn’t just another business rivalry or personal vendetta. This was family.

The knowledge that Colin had named him as rightful heir, that his inheritance had been stolen through fraud and murder, ignited something primal in Billy. His complicated relationship with Colin had never been about money—but knowing Cane robbed his father-in-law of dignity and life filled him with both guilt and rage.

The confrontation was explosive. As Cane stood before them, Billy lunged, his fury unleashed in a way few had ever seen. To the onlookers, Billy wasn’t the reckless Abbott playboy or the scheming executive—he was a son defending his mother, a man enraged by a crime too heinous to comprehend.

It took everything Jill had to restrain him, her pleas piercing the chaos as she begged Billy not to destroy himself in his quest for vengeance.

Cane Cornered

For Cane, the walls began closing in. For years, he had relied on charm, manipulation, and denial to sidestep accusations. But the letter, the video, and Colin’s testimony left him exposed. No smooth words could erase the image of a dying man confessing from beyond the grave.

Fear set in—a fear far different from corporate rivalries or family disputes. This was the gut-wrenching terror of a man who knew prison was looming. He imagined the whispers in boardrooms, the disdain in Jack Abbott’s eyes, and the smug satisfaction on Victor Newman’s face. More terrifying still were the inevitable headlines: Cane Ashby Accused of Murder.

Jill’s Warpath

Jill’s grief transformed into resolve. She had been humiliated, deceived, and betrayed by men more times than she could count, but this—Colin’s plea, the destruction of her trust in Cane—was unforgivable. She vowed to fight, not just for herself but for the truth Colin demanded in his last breaths.

Armed with the letter and the damning video, Jill prepared for war. She knew Cane wouldn’t go down quietly. He would dig up every secret, twist every knife, and unleash every ounce of malice he had left. But Jill had spent decades surviving ruthless battles in Genoa City. She would not back down now.

Ripple Effects Across Genoa City

The fallout from this revelation is poised to ripple far beyond Jill and Billy.

- Devon Hamilton: Having once viewed Cane as both family and rival, Devon will be forced to confront just how far Cane has fallen. The betrayal could reignite old wounds tied to inheritance battles and destroy what little trust remained.

- Lily Winters: Already torn between loyalty and disillusionment, Lily will struggle to reconcile the man she once loved with the monster exposed in Colin’s confession.

- Victor Newman & Jack Abbott: Titans of Genoa City’s power struggle will seize this opportunity to dismantle Cane once and for all, further tilting the balance of corporate wars.

- Billy Abbott: Beyond rage, Billy faces a moral choice—seek legal justice, or take matters into his own hands? His decision could define not only his future but the Abbott family’s standing in the city.

A Legacy Redefined

At its core, Colin’s confession was not about wealth. It was about truth. In naming Billy as his heir, Colin had extended a final act of redemption, a chance to pass on something honest amid a lifetime of deceit. That truth, however, now comes at a price—dragging the Abbott and Atkinson families into a firestorm of scandal.

For Jill, this is not just about avenging Colin. It’s about cleansing her family’s name of the stain Cane has left behind. For Billy, it’s about proving he can shoulder the weight of both inheritance and justice. And for Cane, it’s about survival in a city that will no longer tolerate his schemes.

The Storm Ahead

The stage is set for a showdown that could redefine Genoa City’s power map. Jill and Billy, united in grief and determination, now hold the evidence that could obliterate Cane once and for all. But Cane has nothing left to lose—and a desperate man can be the most dangerous adversary of all.

As Colin’s haunting words echo across time, one truth is undeniable: secrets never stay buried in Genoa City. And this time, the storm Cane faces may be one even he cannot escape.

Unlocking Opportunity: An Expert’s Definitive Guide to the 10 Best US Cities for Multifamily Real Estate Investing in 2025

After a period of unprecedented market dynamics, 2025 is poised to herald a renaissance in multifamily real estate. As an investor with a decade deeply entrenched in market cycles and property acquisitions, I’ve witnessed firsthand the resilience and unparalleled potential this asset class offers. While recent years presented their share of headwinds, marked by shifting supply-demand equilibriums and fluctuating interest rates, the landscape is stabilizing, and discerning investors are already positioning themselves for substantial growth. We’re moving beyond the turbulence, entering a phase where strategic, data-backed decisions will define superior portfolio performance.

Multifamily real estate has always been a bedrock for savvy investors seeking both stability and robust portfolio diversification. Its inherent ability to generate consistent cash flow, offer inflation hedges, and provide significant long-term appreciation remains unmatched. For 2025, the narrative shifts from simply riding the wave to actively identifying markets primed for outperformance. Experts universally predict a healthy recalibration of supply and demand, setting the stage for positive rent growth and attractive cap rates. This isn’t merely a rebound; it’s an opportunity to optimize your real estate portfolio diversification and secure high-yield investment properties that will pay dividends for years to come.

The critical question, then, isn’t whether to invest, but where. Identifying the best cities for real estate investment in this evolving climate demands more than just a cursory glance at headlines. It requires a meticulous, data-driven approach, coupled with an understanding of underlying economic drivers, demographic shifts, and future growth trajectories. My team and I have spent countless hours poring over granular market intelligence, analyzing everything from job creation statistics to infrastructure development plans, to pinpoint the urban centers offering the most compelling multifamily investment opportunities for the coming year. This comprehensive analysis factors in key metrics like occupancy rates, price-to-rent ratios, and average rents, but goes deeper to reveal the qualitative advantages that truly distinguish a thriving market.

Navigating the 2025 Multifamily Landscape: Our Investment Criteria

Successful commercial real estate investment hinges on a robust framework for market selection. Our methodology for identifying 2025’s top multifamily markets is built upon several pillars, reflecting both macro-economic resilience and micro-market opportunities. We aren’t just looking for quick wins; we’re seeking markets that demonstrate sustainable growth, favorable landlord-tenant dynamics, and clear pathways to long-term value creation.

Robust Economic Growth & Diversification: A city’s economic engine is paramount. We prioritize regions boasting diversified job markets, strong employment growth, and the presence of innovative industries. Markets overly reliant on a single sector are inherently riskier. A healthy economy underpins strong demand for housing, translating to higher occupancy and sustained rent growth. We look for indicators like low unemployment rates, significant corporate relocations, and a pipeline of new business development. This ensures a stable tenant base and consistent cash flow properties.

Population Migration & Demographic Trends: Where people are moving, opportunities follow. Cities experiencing consistent, positive net migration, particularly among younger demographics and skilled professionals, signal a growing renter base. This includes analyzing internal migration patterns, birth rates, and the attractiveness of a region’s lifestyle amenities. Understanding these demographic shifts is crucial for predicting future housing demand and securing apartment complex acquisition targets with enduring appeal.

Affordability & Price-to-Rent Ratio: While growth is important, affordability dictates sustainability. A balanced price-to-rent ratio indicates a market where renting remains an attractive, viable option compared to homeownership, thereby supporting rental demand. Cities with runaway property values but stagnant wages present a higher risk. We seek markets where the cost of living remains appealing to a broad segment of the population, ensuring a steady stream of tenants. This metric is a key indicator for rental property ROI.

Supply-Demand Dynamics & Development Pipeline: An imbalance in supply and demand is often the primary driver of rent growth. We analyze current and projected housing unit completions, comparing them against anticipated population and job growth. Markets with constrained new supply, due to geographical limitations or stringent zoning, coupled with high demand, tend to exhibit stronger rent appreciation. Conversely, areas with an overabundance of new construction might face temporary absorption challenges.

Capitalization Rates (Cap Rates): Cap rates offer a snapshot of a property’s potential return on investment. While lower cap rates often reflect market stability and perceived lower risk, we look for markets where cap rates remain attractive relative to borrowing costs, providing healthy initial yields. Our focus is on identifying markets where cap rates are supported by strong underlying fundamentals, signaling sustainable value.

Infrastructure Investment & Urban Development: Significant public and private investment in infrastructure (transportation, utilities, public spaces) and urban revitalization projects are powerful growth catalysts. These investments enhance quality of life, attract businesses, and increase property values, making them ideal for value add multifamily strategies. We consider proposed developments that will reshape cityscapes and boost economic activity.

Landlord-Friendly Environment: The regulatory landscape plays a vital role in an investor’s profitability. We assess local and state regulations concerning property taxes, rent control, eviction processes, and zoning. Markets that offer a balanced, predictable environment for property owners tend to be more attractive for long-term investment.

By applying this rigorous framework, we’ve pinpointed the following 10 cities as the standout performers for multifamily investment opportunities in 2025. These are the urban centers where demographic tailwinds, economic resilience, and strategic development converge to create fertile ground for substantial returns.

The 10 Best Cities for Multifamily Real Estate Investing in 2025

Las Vegas, Nevada: The Resurgent Oasis

Las Vegas continues its remarkable transformation from a gambling mecca into a diversified economic powerhouse, making it one of the perennial best cities for real estate investment. In 2025, the city’s appeal as a multifamily hub is stronger than ever. Beyond its iconic Strip, Las Vegas boasts burgeoning tech, healthcare, logistics, and professional services sectors. This diversification fuels steady job growth, attracting new residents who contribute to the city’s impressive population expansion. The lack of state income tax in Nevada is a significant draw for both businesses and individuals, enhancing disposable income and stimulating consumer spending, which in turn boosts the local economy. Our decade of involvement in this market, including the successful 2015 acquisition of Lake Tonopah, a 356-unit multifamily property, has consistently demonstrated its capacity for high occupancy rates and resilient revenue streams. Looking ahead, ongoing infrastructure projects and the expansion of the UNLV Medical District further solidify its long-term potential for high cash flow real estate.

Median Property Price: $416,903

Occupancy Rate (Q3 2024): 91%

Cap Rate: 5.5-6%

Price-to-Rent Ratio: 19.2

Average Rent: $1,807

Atlanta, Georgia: The Southern Economic Juggernaut

Atlanta remains an undisputed champion among multifamily investment opportunities due to its dynamic economy and relentless population growth. Often dubbed the “Silicon Peach,” the city is a magnet for major corporations across technology, media, logistics, and finance, creating a robust and diverse employment base. The city’s strategic location, Hartsfield-Jackson Atlanta International Airport, and extensive transportation networks cement its status as a major economic hub. Crucially, Atlanta’s cost of living, while rising, still offers attractive affordability compared to coastal megacities, making it highly appealing to a broad spectrum of renters. This combination drives extraordinary absorption rates, with thousands of new units consistently being leased each quarter. The ongoing redevelopment of the BeltLine and significant public-private partnerships continue to inject vitality into various neighborhoods, ensuring strong demand for urban core investment.

Median Property Price: $400,000

Occupancy Rate: 88%

Cap Rate: 5.6%

Price-to-Rent Ratio: 16

Average Rent: $1,600

Charlotte, North Carolina: The Banking & Tech Hub

Charlotte’s ascent as a premier multifamily market is no longer a secret, but its momentum shows no signs of slowing in 2025. This Queen City of the Carolinas is experiencing exponential population growth, driven by its powerful financial sector – second only to New York City – and a rapidly expanding tech industry. Major employers and an influx of educated professionals fuel the demand for high-quality rental housing across all submarkets. Charlotte’s appeal is bolstered by its moderate cost of living, strong job prospects, and a vibrant cultural scene, drawing both young professionals and families. Infrastructure improvements, particularly in public transit and urban revitalization efforts like the South End and NoDa districts, are enhancing livability and boosting property values. This robust growth narrative makes Charlotte an excellent environment for real estate growth drivers and high-yield investment properties.

Median Property Price: $375,000-$400,000

Occupancy Rate: 92%

Cap Rate: 5.5%

Price-to-Rent Ratio: 17-18

Average Rent: $1,800

Tampa, Florida: The Sunshine State’s Rising Star

Tampa’s multifamily market continues to shine brightly in 2025, buoyed by Florida’s perennial attractiveness to residents and investors alike. The state’s lack of a state income tax and comparatively moderate property taxes are powerful incentives. Tampa’s economy is remarkably diversified, with strong sectors in healthcare, finance, logistics, and technology. This economic resilience, combined with a continuous stream of population migration, especially from colder climates, underpins a consistently positive long-term outlook. The city is investing heavily in its downtown and waterfront areas, creating new cultural attractions and fostering a dynamic live-work-play environment. These enhancements, coupled with a limited supply of developable land in prime areas, suggest continued strong rental property ROI for well-located assets. Tampa offers compelling real estate investment strategies for those seeking sustained growth.

Median Property Price: $367,000

Occupancy Rate: 90%

Cap Rate: 5.5%

Price-to-Rent Ratio: 14

Average Rent: $1,800

Denver, Colorado: High Plains, High Returns

Denver’s economy and population continue their upward trajectory, making it a compelling market for apartment building investment. The Mile-High City benefits from a highly educated workforce, a burgeoning tech scene, and significant investment in aerospace and healthcare. Its scenic beauty and active lifestyle opportunities attract a steady stream of residents, leading to high absorption rates for multifamily units. While property values are higher than some other cities on this list, the consistent demand and strong economic fundamentals justify the investment. Denver’s commitment to sustainable urban development and public transit also enhances its appeal as a long-term commercial property investment destination. Investors should focus on strategic acquisitions that offer value add multifamily potential, capitalizing on the city’s enduring allure.

Median Property Price: $586,000

Occupancy Rate: 89.5%

Cap Rate: 5.2%

Price-to-Rent Ratio: 23

Average Rent: $1,800

Nashville, Tennessee: Music City’s Harmony of Growth

Nashville has consistently proven itself as one of the nation’s best cities for real estate investment, and 2025 is no exception. Its iconic status as a global music capital is just one facet of its appeal; the city’s economy is remarkably diverse, fueled by healthcare, automotive, corporate headquarters, and a thriving tourism industry. This economic vibrancy attracts a constant flow of new residents, creating robust demand for multifamily housing. Our own strategic acquisitions in Nashville, such as the 336-unit Discovery at Mountain View in 2022, have consistently delivered high occupancy rates and reliable revenue. The city’s relatively low cost of living, combined with a burgeoning professional job market, makes it highly attractive to renters. Ongoing developments and a reputation for being an investor-friendly market solidify Nashville’s position as a prime location for passive income real estate.

Median Property Price: $455,000

Occupancy Rate: 88%

Cap Rate: 5.5%

Price-to-Rent Ratio: 19

Average Rent: $1,900

San Diego, California: Coastal Resilience

San Diego’s multifamily market benefits from a unique confluence of factors: strong demand, an unparalleled quality of life, and severely limited supply due to stringent zoning regulations and geographical constraints. The city boasts a powerful innovation economy, driven by biotechnology, defense, telecommunications, and tourism, ensuring a high-wage job base. Despite higher property prices, the persistent population growth and the attractiveness of coastal living mean that rental demand remains incredibly robust. Investors in San Diego are acquiring assets in a market with high barriers to entry for new construction, which historically translates to strong rent growth and property appreciation. This positions San Diego as a top-tier market for real estate portfolio optimization and long-term capital appreciation, particularly for those seeking prime urban development trends within a supply-constrained environment.

Median Property Price: $876,000

Occupancy Rate: 95%

Cap Rate: 4.6%

Price-to-Rent Ratio: 24

Average Rent: $2,500-$3,000

Salt Lake City, Utah: The Mountain West’s Tech Frontier

Salt Lake City has transformed into a dynamic economic hub, earning its moniker “Silicon Slopes” due to its thriving tech industry. Beyond technology, the city benefits from strong sectors in healthcare, finance, and outdoor recreation, fostering a diversified and resilient economy. A highly educated workforce, low unemployment, and a high quality of life continue to draw new residents, creating consistent demand for multifamily housing. Our past investments, like the 2016 acquisition of Parkway Commons, a 93-unit property, underscored the market’s potential. In 2025, Salt Lake City continues to offer compelling multifamily investment opportunities due to its youthful demographic, pro-business environment, and ongoing urban development projects. The relative affordability compared to coastal tech hubs makes it an attractive destination for both residents and investors, contributing to excellent yield real estate investment.

Median Property Price: $526,000

Occupancy Rate: 94%

Cap Rate: 5.5%

Price-to-Rent Ratio: 25-26

Average Rent: $1,700

Columbus, Ohio: The Midwest’s Smart Growth Story

Columbus stands out as an emerging market in the Midwest, offering a compelling blend of solid growth fundamentals and relative affordability. As Ohio’s capital and largest city, it benefits from a diverse economy anchored by education (Ohio State University), healthcare, insurance, and a rapidly expanding tech sector. The city’s proactive approach to urban planning and investment in infrastructure, including its Smart City initiatives, is attracting both businesses and talent. This creates a unique environment for multifamily real estate investing where investors can find attractive cap rates and strong potential for appreciation without the intense competition of more established coastal markets. Columbus’s steady population growth and robust job market make it an ideal location for those seeking suburban real estate opportunities with urban amenities.

Median Property Price: $277,000

Occupancy Rate: 92%

Cap Rate: 6.8%

Price-to-Rent Ratio: 15

Average Rent: $1,530

Dallas, Texas: The Lone Star State’s Economic Engine

Dallas solidifies its position as a top-tier multifamily market in 2025, cementing its status as one of the nation’s largest and most dynamic apartment markets. The city’s undeniable appeal stems from its exceptional job growth, driven by a highly diversified economy spanning corporate headquarters, logistics, finance, technology, and healthcare. Texas’s lack of a state income tax is a huge draw for both businesses and residents, fueling continuous in-migration. Dallas’s expansive metropolitan area offers a wide range of multifamily investment opportunities, from urban core luxury to suburban value-add. Ongoing infrastructure developments, a pro-business regulatory environment, and a robust pipeline of corporate relocations ensure sustained demand for rental housing. For investors seeking scale and consistent performance, Dallas offers unparalleled opportunities for apartment complex acquisition.

Median Property Price: $390,000

Occupancy Rate: 89%

Cap Rate: 5-5.5%

Price-to-Rent Ratio: 18

Average Rent: $1,800

The Path Forward: Seizing Multifamily Momentum in 2025

The multifamily market in 2025 presents a compelling opportunity for investors who are prepared to act with precision and insight. The turbulence of recent years is giving way to a more predictable and potentially highly lucrative landscape, driven by fundamental economic strengths, demographic shifts, and evolving consumer preferences. The cities highlighted above are not merely data points on a spreadsheet; they are vibrant, growing communities with robust economic foundations and a clear trajectory for sustained demand in the rental sector.

As an expert who has navigated numerous market cycles, I can confidently state that successful real estate investment strategies are built on thorough due diligence real estate and an unwavering commitment to understanding local market nuances. This deep dive into the top 10 cities for multifamily investing in 2025 provides a roadmap, but the journey requires partnership and expertise.

Are you ready to optimize your real estate portfolio optimization and capitalize on these prime multifamily investment opportunities? Whether you’re looking to acquire your first income-generating property or expand an existing portfolio, the time to strategically engage with these markets is now. Let’s explore how you can unlock the full potential of multifamily real estate in 2025 and beyond.

Connect with us today to discuss your investment goals and discover how our deep market insights and proven acquisition strategies can position you for success in these top-performing cities.