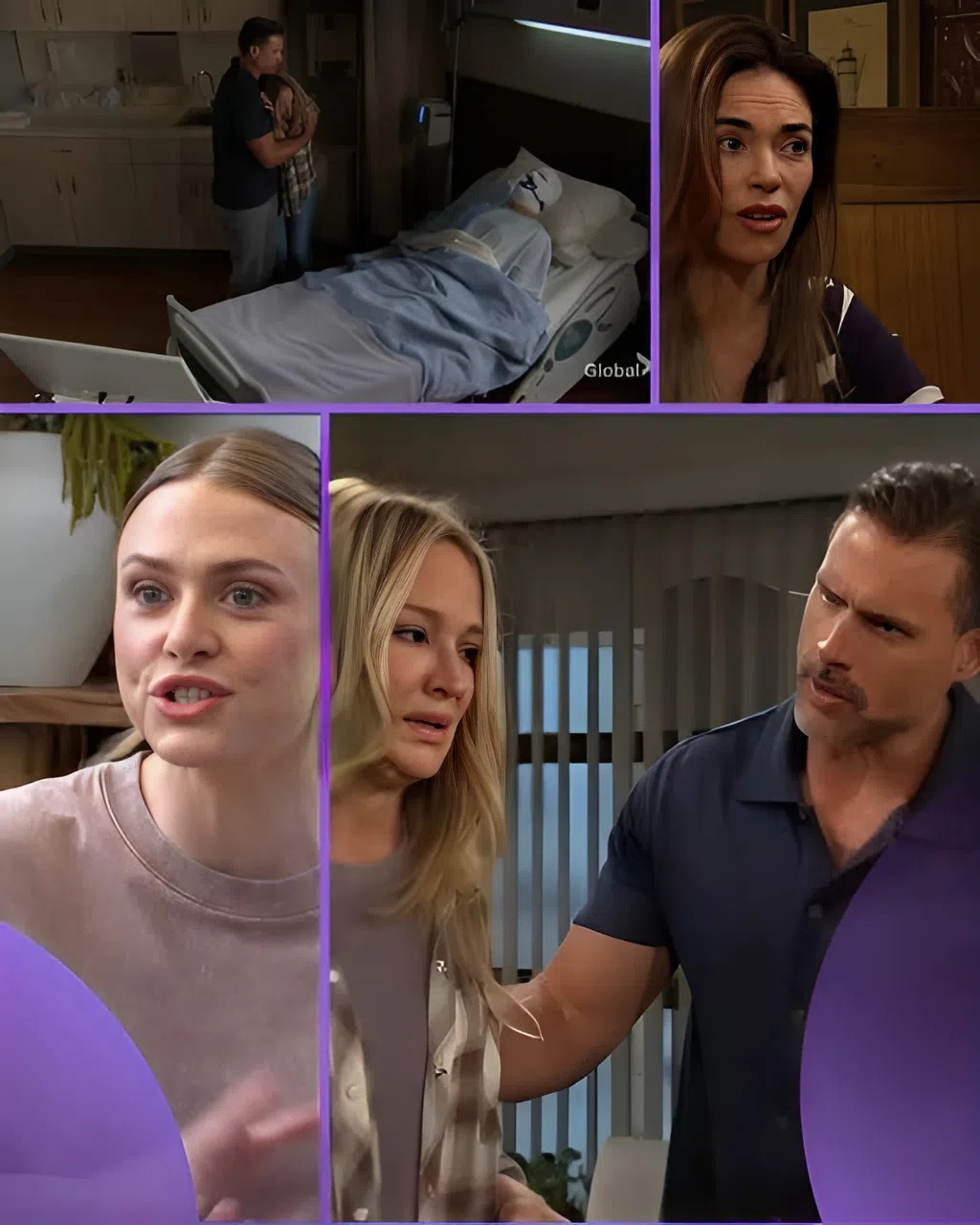

The Young and the Restless Spoilers For October 15, 2025, reveal heartbreak and danger. Sharon and Nick receive shocking news about Noah’s accident. Meanwhile, Claire’s peaceful getaway with Holden turns risky when unexpected trouble strikes. Across town, Victoria’s growing concerns push her to take action.

Sharon and Nick Face Heartbreak Over Noah’s Condition

At the hospital, Sharon Newman and Nick Newman will struggle to process the terrifying update about Noah. Their son’s accident leaves him in critical condition, forcing them to brace for the worst. Despite doctors’ efforts, uncertainty looms over Noah’s recovery and what truly caused the crash.

As Sharon breaks down, Nick steps in to comfort her, though his mind races with questions. The strange details surrounding Noah’s accident raise suspicions. Sharon clings to hope, but both parents sense this isn’t a simple mishap. Something darker may have put Noah in danger.

The Young and the Restless Spoilers: Claire’s LA Adventure Takes a Dangerous Turn

In Los Angeles, Claire Newman finally tastes freedom after weeks of emotional chaos. Her bond with Holden Novak seems fun and spontaneous, offering a much-needed escape from Kyle Abbott’s heartbreak. However, her happiness is short-lived when her plans start to unravel dramatically.

Unbeknownst to Claire, Kyle has flown to LA hoping to win her back. His sudden arrival could spark confrontation, but Holden’s mysterious nature poses a greater threat. Harrison’s chilling dream might not be random after all—Holden could be hiding a dangerous secret that puts Claire in harm’s way.

Victoria Seeks Nate’s Support

Back in Genoa City, Victoria Newman opens up to Nate Hastings about her mounting worries. Between Claire’s risky choices, Holden’s shady charm, and Kyle’s impulsive actions, she fears another family disaster. Nate becomes her emotional anchor, urging patience and reminding her that control isn’t always possible.

Still, Victoria can’t stay idle for long. Determined to protect her daughter, she prepares to head to Los Angeles. Her arrival could complicate everything for Claire, especially if Victoria starts digging into Holden’s past. Once again, the Newman family drama is on the verge of boiling over.

The Young and the Restless Spoilers For October 15, 2025, promise heartbreak, tension, and shocking discoveries. As Sharon and Nick confront Noah’s mysterious crash, Claire’s LA adventure spirals into danger. Stay tuned to Soap Opera Daily for more updates on Genoa City’s most gripping twists!

Navigating the 2025 Multifamily Landscape: Top U.S. Cities for Savvy Investors

After a period of readjustment, the multifamily real estate market in 2025 is poised for a compelling resurgence, presenting astute investors with prime opportunities for portfolio diversification and substantial wealth accumulation. Having navigated the intricacies of this dynamic sector for over a decade, I’ve witnessed cycles of expansion, recalibration, and robust recovery. This year, the confluence of stabilizing interest rates, evolving demographic shifts, and strategic urban development is creating an exceptionally fertile ground for those looking to capitalize on rental housing demand.

The narrative of real estate investment in 2025 is less about speculative frenzy and more about strategic, data-driven plays in resilient markets. While recent years saw a delicate dance between supply and demand, with some markets experiencing oversupply, expert projections for 2025 indicate a much healthier realignment. This balance is critical, driving positive rent growth and underpinning the long-term viability of multifamily assets as a cornerstone of any robust investment portfolio. For those seeking durable returns and an effective hedge against inflation, multifamily real estate investing remains an unparalleled avenue.

Our rigorous analysis, drawing on extensive market data, economic forecasts, and ground-level insights, pinpoints the best cities for real estate investment in 2025. We delve beyond surface-level statistics, examining critical factors like population migration patterns, job market vitality, cost of living, infrastructure development, and local investment climate. The goal is to identify locations where high occupancy rates are sustainable, cap rates offer attractive yields, and price-to-rent ratios signal healthy market fundamentals. As an expert in real estate asset management, my focus is always on uncovering markets that offer not just immediate gains but also long-term appreciation and consistent rental property ROI.

The decision to invest in multifamily properties is more than just buying bricks and mortar; it’s an investment in communities, economies, and the future housing needs of a growing nation. In 2025, certain U.S. cities stand out as beacons for high-yield real estate investments, offering a blend of strong economic foundations, burgeoning populations, and favorable landlord-tenant dynamics. Here are the top 10 cities where I believe investment property strategy will thrive this year.

1. Las Vegas, Nevada: Beyond the Strip, a Multifamily Powerhouse

Las Vegas continues its remarkable transformation into a diversified economic hub, making it a perennial favorite among real estate investors. From my vantage point, having observed this market for over a decade, Las Vegas has moved far beyond its resort-centric image. The arrival of major professional sports teams, burgeoning tech industries, and significant infrastructure investments have created a robust, year-round economy. This diversification fuels consistent population growth, as people are drawn to job opportunities and a relatively affordable cost of living compared to coastal metros. The city’s no-state-income-tax benefit is a powerful magnet for both residents and businesses.

The multifamily market here is characterized by high absorption rates, indicative of strong demand for quality rental housing. While development has been active, the underlying demand, particularly in submarkets catering to the burgeoning tech and logistics sectors, keeps vacancy rates tight. For apartment complex investment, Las Vegas offers compelling returns. We’re seeing:

Median Property Price (Q1 2025 Projection): $435,000 – $445,000

Occupancy Rate (Projected 2025): 91.5% – 92%

Cap Rate (Projected 2025): 5.6% – 6.1%

Price-to-Rent Ratio (Projected 2025): 19.5 – 20

Average Rent (Projected 2025): $1,850 – $1,900

These metrics, combined with the city’s forward-thinking economic development initiatives, underscore why Las Vegas remains a top-tier choice for multifamily real estate investing in 2025. Its resilience and adaptability make it a smart play for long-term holders.

2. Atlanta, Georgia: The Southern Megalopolis’s Enduring Appeal

Atlanta has cemented its status as an economic powerhouse in the Southeast, and in 2025, it continues to attract an influx of residents and corporate relocations, making it an undeniable leader for investment properties. My experience shows Atlanta consistently demonstrates robust fundamentals driven by a highly diversified economy spanning logistics, tech, film production, and healthcare. Its extensive transportation network, including Hartsfield-Jackson Atlanta International Airport, provides unparalleled connectivity, attracting major businesses and their employees. This sustained growth translates directly into powerful demand for rental housing.

What makes Atlanta particularly appealing for passive income real estate is its relative affordability compared to other major employment centers, which keeps the price-to-rent ratio attractive. Even with new units coming online, the sheer volume of population growth ensures strong absorption. We’re observing:

Median Property Price (Q1 2025 Projection): $415,000 – $425,000

Occupancy Rate (Projected 2025): 89.5% – 90%

Cap Rate (Projected 2025): 5.7% – 5.9%

Price-to-Rent Ratio (Projected 2025): 16.5 – 17

Average Rent (Projected 2025): $1,650 – $1,700

Atlanta’s dynamic job market and ongoing urban revitalization projects reinforce its position as a strategic location for real estate investment strategy. Investors seeking reliable cash flow and appreciation should keep Atlanta firmly on their radar.

3. Charlotte, North Carolina: The Queen City’s Reign in Rental Demand

Charlotte’s meteoric rise as a financial and technological hub in the Carolinas shows no signs of abating in 2025. This city is a prime example of a market fueled by strong internal migration and corporate expansion, making it a standout for investment property strategy. Its burgeoning financial services sector, complemented by a growing tech industry, creates a high-wage job market that attracts a skilled workforce. These new residents, often initially renters, drive substantial demand for rental units.

The charm of Charlotte lies in its appealing lifestyle, quality infrastructure, and continued economic development. Investors will find a healthy environment for multifamily properties characterized by consistent demand and a proactive approach to urban planning that supports sustainable growth. Key metrics include:

Median Property Price (Q1 2025 Projection): $390,000 – $410,000

Occupancy Rate (Projected 2025): 92.5% – 93%

Cap Rate (Projected 2025): 5.6% – 5.8%

Price-to-Rent Ratio (Projected 2025): 17.5 – 18.5

Average Rent (Projected 2025): $1,850 – $1,900

Charlotte offers a compelling blend of strong economic indicators and a growing renter base, making it an excellent candidate for wealth building through real estate. The city’s upward trajectory makes it a consistent performer for high-yield real estate investments.

4. Tampa, Florida: Sunshine State’s Multifamily Magnet

Tampa continues to shine brightly in the 2025 real estate market trends. The broader appeal of Florida, with its lack of state income tax and favorable business climate, remains a powerful draw. Tampa, specifically, offers a diverse and expanding economy that spans healthcare, finance, tech, and tourism. This robust economic foundation, coupled with its appealing coastal lifestyle, ensures a steady influx of new residents and, critically, strong demand for rental housing.

Having observed Florida markets evolve, Tampa stands out for its balanced growth and proactive urban development. Its long-term outlook for multifamily real estate investing remains exceedingly positive, supported by ongoing population growth and strategic infrastructure improvements. For investors targeting cash flow real estate, Tampa provides an attractive proposition.

Median Property Price (Q1 2025 Projection): $380,000 – $395,000

Occupancy Rate (Projected 2025): 91% – 91.5%

Cap Rate (Projected 2025): 5.6% – 5.8%

Price-to-Rent Ratio (Projected 2025): 14.5 – 15

Average Rent (Projected 2025): $1,850 – $1,900

Tampa’s strong fundamentals, combined with Florida’s investor-friendly environment, make it a perennial top choice for investment portfolio diversification and stable returns.

5. Denver, Colorado: High-Altitude Returns in the Rocky Mountains

Denver’s economy and population continue to climb to new heights in 2025, solidifying its position as a vibrant hub for commercial real estate investment. The city’s allure stems from its robust tech industry, strong aerospace presence, and unparalleled access to outdoor recreation, attracting a highly educated and affluent workforce. This demographic drives significant demand for housing, particularly multifamily units, leading to high absorption rates even with new supply entering the market.

From an investment perspective, Denver represents a market with high barriers to entry, which can lead to higher appreciation over time for existing assets. While property prices are higher than some other cities on this list, the strong wage growth and consistent demand underpin healthy rental income and long-term value. This is a market where value-add multifamily strategies can yield impressive results.

Median Property Price (Q1 2025 Projection): $600,000 – $620,000

Occupancy Rate (Projected 2025): 90% – 90.5%

Cap Rate (Projected 2025): 5.3% – 5.5%

Price-to-Rent Ratio (Projected 2025): 23.5 – 24.5

Average Rent (Projected 2025): $1,900 – $2,000

Denver remains a magnet for young professionals and businesses alike, making it a compelling market for investors prioritizing capital appreciation and strong rental property ROI in a dynamic urban environment.

6. Nashville, Tennessee: Music City’s Resilient Investment Rhythm

Nashville, the “Music City,” continues to hit all the right notes for real estate investors in 2025. It has been a consistent performer for several years, a trend I fully expect to continue. Beyond its iconic music industry, Nashville boasts a thriving healthcare sector, a growing tech presence, and a vibrant cultural scene that attracts a diverse population. This economic diversification creates a resilient job market, a cornerstone for sustained rental demand.

The city’s strategic location, relatively low cost of living compared to other major metros, and business-friendly environment continue to fuel strong migration. For multifamily real estate investing, Nashville offers an attractive balance of growth and stability. Investors can expect robust demand for apartment complex investment, particularly as new residents seek convenient, well-located housing.

Median Property Price (Q1 2025 Projection): $470,000 – $485,000

Occupancy Rate (Projected 2025): 89.5% – 90%

Cap Rate (Projected 2025): 5.6% – 5.8%

Price-to-Rent Ratio (Projected 2025): 19.5 – 20.5

Average Rent (Projected 2025): $1,950 – $2,000

Nashville’s consistent job growth and cultural appeal make it a reliable choice for those looking for high-yield real estate investments and a strong investment property strategy.

7. San Diego, California: Coastal Constraints, Premium Returns

San Diego, with its stunning coastline and innovation economy, presents a unique proposition for multifamily real estate investing in 2025. While property prices are significantly higher due to limited supply and stringent zoning regulations, the demand for housing remains exceptionally strong. This creates a market dynamic where existing multifamily properties command premium rents and exhibit high stability. The city’s economy is powered by robust biotech, military, tourism, and tech sectors, attracting a highly skilled and well-compensated workforce.

The high barriers to entry for new development mean that the existing housing stock is highly valued, translating into some of the highest occupancy rates in the nation. For seasoned investors with a long-term horizon and capital to deploy, San Diego offers significant appreciation potential and strong real estate asset management opportunities. It’s a market where scarcity drives value, making it an excellent candidate for investment portfolio diversification with a focus on high-quality assets.

Median Property Price (Q1 2025 Projection): $900,000 – $930,000

Occupancy Rate (Projected 2025): 95.5% – 96%

Cap Rate (Projected 2025): 4.7% – 4.9%

Price-to-Rent Ratio (Projected 2025): 24.5 – 25.5

Average Rent (Projected 2025): $2,600 – $3,100

Despite the higher entry cost, San Diego’s resilient economy and perpetually undersupplied housing market make it a compelling, albeit exclusive, destination for real estate investment strategy.

8. Salt Lake City, Utah: Silicon Slopes and Soaring Demand

Salt Lake City continues its remarkable growth trajectory in 2025, solidifying its reputation as “Silicon Slopes” and a burgeoning hub for multifamily real estate investing. The region’s economy is booming, driven by a thriving tech sector, strong outdoor recreation industry, and a business-friendly environment. This has led to consistent job growth and a significant influx of young professionals and families, all requiring quality housing.

My experience indicates Salt Lake City offers an appealing combination of strong economic fundamentals and a relatively high quality of life. The city’s proactive approach to urban development, coupled with its access to natural beauty, makes it an attractive destination for new residents. For investors, this translates into high demand for apartment complex investment and favorable market conditions. Salt Lake City is still an emerging market with significant runway for growth.

Median Property Price (Q1 2025 Projection): $540,000 – $560,000

Occupancy Rate (Projected 2025): 94.5% – 95%

Cap Rate (Projected 2025): 5.6% – 5.8%

Price-to-Rent Ratio (Projected 2025): 25.5 – 26.5

Average Rent (Projected 2025): $1,750 – $1,800

Salt Lake City offers strong potential for both capital appreciation and stable rental property ROI, making it an attractive option for sophisticated investors seeking growth in a dynamic, tech-driven market.

9. Columbus, Ohio: Midwest’s Rising Star for Affordability and Growth

Columbus, Ohio, stands out in 2025 as a prime example of an emerging market in the Midwest that offers an exceptional balance of solid growth and affordability for multifamily real estate investing. The city benefits from a diverse economy, anchored by Ohio State University, a strong healthcare sector, logistics, and increasingly, tech manufacturing. Its strategic location within a day’s drive of 50% of the U.S. population makes it a logistics powerhouse.

What truly distinguishes Columbus for investment properties is its appealing price-to-rent ratio and robust cap rates, indicating excellent value. The city’s consistent population growth, driven by job creation and a lower cost of living, ensures healthy demand for multifamily units. This is a market where investors can acquire assets at more accessible price points while still benefiting from consistent rental income and appreciating values.

Median Property Price (Q1 2025 Projection): $290,000 – $305,000

Occupancy Rate (Projected 2025): 92.5% – 93%

Cap Rate (Projected 2025): 6.9% – 7.1%

Price-to-Rent Ratio (Projected 2025): 15.5 – 16

Average Rent (Projected 2025): $1,580 – $1,630

Columbus offers a compelling case for cash flow real estate and high-yield real estate investments in a market that continues to defy traditional Midwest stereotypes with its dynamic growth.

10. Dallas, Texas: The Metroplex of Multifamily Opportunity

Rounding out our list of top investment property locations for 2025 is Dallas, Texas—a city that consistently ranks as one of the nation’s largest and most dynamic apartment markets. The DFW Metroplex is an economic juggernaut, attracting an astounding number of corporate relocations and generating massive job growth across virtually every sector imaginable, from finance and tech to healthcare and manufacturing. This broad-based economic vitality, combined with no state income tax, fuels a relentless demand for housing.

From my long-term perspective, Dallas’s infrastructure and strategic planning support its explosive growth, ensuring that new residents have access to robust employment opportunities and a high quality of life. For multifamily real estate investing, Dallas offers a deep and liquid market with a wide range of multifamily properties catering to diverse income levels. The sheer scale and dynamism of this market make it a compelling choice for both seasoned and new real estate investors.

Median Property Price (Q1 2025 Projection): $405,000 – $420,000

Occupancy Rate (Projected 2025): 90% – 90.5%

Cap Rate (Projected 2025): 5.1% – 5.6%

Price-to-Rent Ratio (Projected 2025): 18.5 – 19

Average Rent (Projected 2025): $1,850 – $1,900

Dallas embodies the quintessential American growth story, offering unparalleled opportunities for wealth building through real estate and proving itself as a consistent leader in real estate asset management.

Seize Your Opportunity in the 2025 Multifamily Market

The multifamily real estate market in 2025 presents a nuanced yet undeniably attractive landscape for strategic investment. The cities outlined above represent the pinnacle of opportunity, each offering unique strengths rooted in robust economic growth, favorable demographic trends, and a proven track record of rental demand. As an expert who has spent years analyzing these patterns and navigating market shifts, I can confidently say that these are the markets poised to deliver significant rental property ROI and long-term value.

Understanding these real estate market trends 2025 is the first step; acting on them intelligently is what separates successful investors from the rest. Whether you’re looking for passive income real estate, aiming for investment portfolio diversification, or seeking high-yield real estate investments, the time to position your capital strategically is now.

Don’t let these prime multifamily real estate investing opportunities pass you by. Connect with experienced professionals who can guide you through the intricacies of these dynamic markets and help you identify the perfect investment properties to align with your financial goals. Let’s collaborate to build your formidable real estate portfolio in 2025 and beyond.