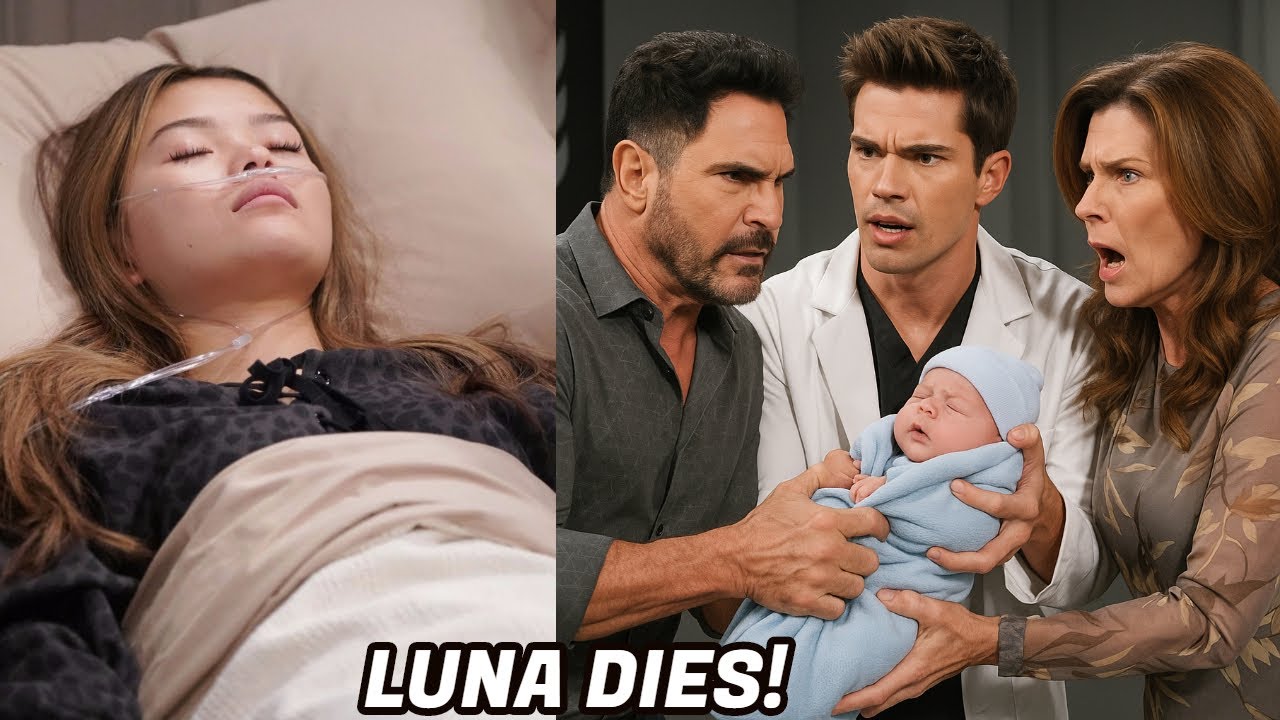

In a storyline that has rocked The Bold and the Beautiful to its very core, Luna Nozawa’s fate takes a devastating turn behind the cold steel bars of Los Angeles County Jail. What began as a scandalous arrest has spiraled into a web of betrayal, murder mystery, and a custody battle so high-stakes it could fracture three of the show’s most powerful families forever.

Luna’s Last Days: A Storm Behind Bars

When Luna Nozawa was arrested—pregnant, terrified, and begging for mercy—it felt like the end of her road. Her desperate plea to Bill Spencer to protect her fell on deaf ears, his silence cutting deeper than any sentence. Charged with the drugging and assault of Will Spencer, Luna’s incarceration was never just about punishment—it became a ticking time bomb, especially once news of her pregnancy broke.

Far from providing protection, Luna’s unborn child—fathered by Will Spencer—made her the most endangered woman in the system. And she knew it. But what Luna didn’t realize was just how many people wanted her silenced for good.

Bill Spencer: Vengeful Patriarch or Grieving Father?

Bill’s fury was immediate and volcanic when he learned Luna was carrying his grandchild. His threats, made publicly and without remorse, sent chills through everyone who heard them. The once-protective billionaire known as “Dollar Bill” made it clear: Luna and her baby were not part of his vision for the Spencer legacy.

So when Luna collapses in her cell from what appears to be pregnancy complications—her body failing and blood staining the floor—Bill becomes suspect number one. His public rage, unmatched wealth, and access to dangerous networks make him a man of interest. But is Bill really the one who orchestrated the tragedy, or is he being set up?

Katie Logan’s Dangerous Devotion

Katie Logan’s maternal instincts toward her son Will and his unborn child morph into something more chilling. She visits Luna just a day before the collapse, allegedly to discuss custody arrangements. But what really happened during that prison visit?

Investigators now question whether Katie, who has declared Luna unfit to raise a child, might have taken drastic steps to “protect” her grandchild. Did she bribe a guard? Slip something into Luna’s food? Or did she orchestrate something darker from outside the prison walls?

The Return of Steffy Forrester: A Reckoning Long Overdue

Steffy’s return to Los Angeles sends shockwaves through the storyline. She has every reason to want Luna gone. This is the woman who drugged her, locked her in a cage in a condemned building, and left her for dead. That trauma, barely beneath the surface, flares to life when Finn tells Steffy the truth: Luna survived—and she’s carrying his grandchild.

Steffy’s loathing for Luna is visceral. Her sense of justice leans toward the personal. And her cold, calm demeanor after Luna’s collapse doesn’t go unnoticed. Could Steffy, who has long taken fate into her own hands, have played a role in ensuring Luna never walks free again?

Dr. Lee Finnegan: A Medical Conspiracy?

Lee Finnegan, once a protector, now carries deep regret. She faked Luna’s death to offer her niece a second chance—an act she now sees as a tragic mistake. Luna didn’t change. She brought chaos, violence, and now, a baby into the world under a cloud of scandal.

Lee’s medical knowledge makes her the most dangerous suspect. She knows how to make a death look natural. She’s done it before—or almost did, when she watched Sheila Carter suffer a heart attack without helping. Investigators are combing through hospital records and pharmacy logs. Did Lee ensure Luna received a fatal dosage during a routine medical visit?

A Baby Becomes the Ultimate Prize

As Luna lies in a coma—or possibly dead—the fight over her child escalates into a war.

Bill and Katie move quickly, arguing they’re the only ones with the resources and stability to raise the child. Katie delivers a tearful testimony in court, painting Luna as dangerous, unfit, and manipulative. Bill, once adamant that the baby shouldn’t exist, now claims he’ll do anything to protect it.

Finn, overwhelmed with guilt and love for the grandchild he may never meet, throws his hat into the ring. He believes the baby offers a chance at redemption—a way to correct the failures that led to Luna’s downfall. He and Steffy clash over the idea, but Finn’s resolve is unshakable.

And then there’s Poppy Nozawa. Luna’s mother, once absent and unreliable, suddenly reappears. Her motives are suspect. Does she want to be a grandmother—or is she chasing the Spencer fortune? Her sudden interest in the child raises eyebrows, and her weak legal case draws scorn from the court.

Sheila Carter’s Shocking Custody Bid

In the twist no one saw coming, Sheila Carter—Luna’s former captor and the child’s great-grandmother—files for visitation rights. The courtroom erupts. Her dark history, her violent past, her unstable presence—none of it makes her a suitable guardian. The judge dismisses her bid almost instantly, but Sheila’s attempt adds fuel to an already raging fire.

Who Killed Luna Nozawa?

If Luna has died, her death isn’t just a tragedy—it’s a murder mystery with too many suspects and not enough answers.

- Bill Spencer: Public threats, immense resources, motive clear as day.

- Katie Logan: A calculated prison visit, maternal obsession, a quiet rage.

- Lee Finnegan: A doctor with means, motive, and the knowledge to kill without leaving a trace.

- Steffy Forrester: Traumatized, vengeful, and back in LA with unfinished business.

Or was it all of them?

The theory gaining traction among viewers is that Luna’s death wasn’t the work of a single person—but a conspiracy of grief, rage, and silent complicity. Each person playing their part. Each choosing not to stop what they feared might happen.

The Verdict and Fallout

The judge’s custody decision rocks the courtroom. Perhaps Finn and Steffy win, the judge believing their family—despite the trauma—offers the child the most stable home. Or Bill and Katie claim victory, their wealth and influence tipping the scales.

Either way, the ruling fractures already delicate alliances. Lifelong friendships strain. Family members turn on each other. And in the shadows of the courtroom, the question still lingers:

Did Luna die for justice—or for vengeance?

A Legacy of Pain or Redemption?

As the investigation into Luna’s collapse continues, and as the battle over her child rages on, The Bold and the Beautiful dives into a storyline unlike any before. This isn’t just about one woman’s demise. It’s about what people are capable of when they feel justice has failed. It’s about how far families will go to protect their own—and what happens when those efforts turn deadly.

Whether Luna lives or dies, her child now carries the legacy of a woman who burned every bridge and a community that may never recover from what happened behind those prison walls.

One thing is certain: the baby’s story is only just beginning. And the truth about Luna’s death—or survival—may come from the smallest voice of all.

Next on The Bold and the Beautiful: Thanksgiving brings uneasy truces, secret alliances, and romantic tension to Il Giardino, where Deacon and Sheila host a holiday feast that could either heal or shatter what’s left of their world.

Navigating the 2025 Multifamily Landscape: Top 10 Cities for Strategic Real Estate Investment

From my vantage point, having navigated the intricate currents of real estate investment for over a decade, I can tell you that the multifamily sector in 2025 presents a compelling, albeit nuanced, opportunity for astute investors. After a period marked by supply chain disruptions, fluctuating interest rates, and evolving tenant demands, the market is demonstrating clear signs of recalibration. We’re witnessing a pivotal shift where the equilibrium between supply and demand is steadily realigning, setting the stage for sustained rent growth and robust asset performance. For those poised to expand or initiate their real estate portfolio diversification, now is an opportune moment to strategically deploy capital into high-yield real estate assets.

Identifying the optimal locations for commercial real estate investment requires a granular understanding of economic fundamentals, demographic shifts, and localized market dynamics. It’s not just about chasing the highest rents or lowest property prices; it’s about discerning markets with resilient economies, enduring population influx, and a supportive environment for rental income properties. My analysis, drawing on extensive market research and a deep dive into projected economic indicators for 2025, points to a selection of cities that stand out as prime candidates for multifamily real estate investing. These aren’t merely hot spots; they are markets underpinned by sustainable growth drivers, offering attractive prospects for both appreciation and consistent cash flow properties.

Let’s explore the best cities for real estate investment in 2025, where the confluence of economic vitality, demographic expansion, and favorable market conditions promises significant returns for savvy investors.

Key Factors Driving Our 2025 City Selection

Before we delve into specific markets, it’s crucial to understand the criteria that inform these selections. My 10 years in this business have taught me that successful property investment strategies hinge on evaluating more than just superficial metrics. We’re looking for cities exhibiting:

Robust Economic Growth: Diversified job markets, a low unemployment rate, and the presence of expanding industries (tech, healthcare, logistics, manufacturing) that attract and retain a skilled workforce.

Persistent Population Influx: Strong net migration, often driven by job opportunities and a desirable quality of life, which translates directly into sustained demand for housing.

Affordability & Cost of Living: While this varies, markets where housing costs remain relatively attractive compared to average incomes tend to see healthier long-term rental demand.

Favorable Landlord Environment: State and local policies that are balanced and predictable, supporting both property owners and tenants.

Infrastructure Investment: Ongoing development in transportation, education, and public amenities enhances a city’s appeal and property values.

Supply/Demand Dynamics: A healthy balance where new construction doesn’t drastically outpace absorption, ensuring rent stability and growth.

Attractive Cap Rates and Price-to-Rent Ratios: While these are snapshots, they offer critical insights into potential returns and market health, indicating strong passive income real estate opportunities.

With these foundational principles in mind, here are my top 10 picks for buying investment property in the upcoming year:

Las Vegas, Nevada

Las Vegas, often perceived solely through its entertainment lens, has profoundly diversified its economic base over the past decade. Looking into 2025, the city continues to cement its reputation as a burgeoning hub for logistics, technology, healthcare, and professional services, drawing in a steady stream of new residents. From my experience, the Southern Nevada market possesses an incredible resilience, consistently bouncing back stronger after economic shifts. The lack of state income tax in Nevada is a significant draw for both businesses and individuals, fueling population growth and a robust workforce. The demand for quality multifamily apartments remains high, especially as new residents seek more affordable living options compared to coastal California markets. Ongoing infrastructure projects and continued corporate relocations further bolster the long-term outlook for wealth building real estate here.

Projected Median Property Price (Multifamily): $430,000 – $450,000

Anticipated Occupancy Rate (Mid-2025): 92%

Expected Cap Rate: 5.7% – 6.2%

Price-to-Rent Ratio: 19-20

Average Rent Projection: $1,850 – $1,900

Atlanta, Georgia

Atlanta’s economic engine runs at full throttle, positioning it as a dominant force in the Southeast. As we head into 2025, this metropolitan powerhouse continues to attract major corporations across sectors like FinTech, healthcare, logistics, and film production. The city’s Hartsfield-Jackson Atlanta International Airport acts as a global gateway, contributing immensely to its economic vibrancy and accessibility. What makes Atlanta particularly appealing for property investment is its strong demographic growth – it’s a magnet for young professionals and families seeking career opportunities and a vibrant lifestyle at a relatively attractive cost of living compared to other major U.S. cities. While new supply has been significant, absorption rates have largely kept pace, driven by continuous inward migration. This dynamic market offers diverse opportunities, from urban core Class A properties to more affordable, value-add propositions in expanding suburbs.

Projected Median Property Price (Multifamily): $415,000 – $435,000

Anticipated Occupancy Rate (Mid-2025): 89.5%

Expected Cap Rate: 5.8% – 6.0%

Price-to-Rent Ratio: 16-17

Average Rent Projection: $1,650 – $1,700

Charlotte, North Carolina

Charlotte epitomizes the rapid growth story of the Carolinas, solidifying its position as a major financial and banking hub, second only to New York City. In 2025, we anticipate this economic momentum to continue, fueled by corporate expansions and a burgeoning technology sector. The city’s dynamic job market, coupled with an excellent quality of life and relatively lower cost of living compared to Northeastern counterparts, makes it incredibly attractive to new residents. This consistent population growth translates directly into sustained demand for rental units. Investors keen on markets with a strong forward trajectory and a young, upwardly mobile populace will find Charlotte’s multifamily sector particularly enticing. The city has done an impressive job of balancing growth with infrastructure development, which is critical for long-term investment stability.

Projected Median Property Price (Multifamily): $390,000 – $410,000

Anticipated Occupancy Rate (Mid-2025): 92.5%

Expected Cap Rate: 5.7% – 5.9%

Price-to-Rent Ratio: 17.5-18.5

Average Rent Projection: $1,850 – $1,900

Tampa, Florida

Tampa Bay’s multifamily market continues its strong upward trajectory, a testament to Florida’s enduring appeal. The state’s lack of a personal income tax, coupled with a generally pro-business and pro-landlord regulatory environment, makes it a perennial favorite for real estate investors. Tampa, specifically, benefits from its diversified economy, spanning healthcare, technology, finance, and tourism. The city’s appeal extends to a wide demographic, from retirees to young professionals, all drawn by the lifestyle and economic opportunities. My observations confirm that Tampa’s strategic location on the Gulf Coast and ongoing civic improvements continue to attract significant investment and population migration. While the market has seen considerable development, the demand continues to absorb new units, indicating a healthy and balanced growth cycle for investing in apartments.

Projected Median Property Price (Multifamily): $380,000 – $400,000

Anticipated Occupancy Rate (Mid-2025): 91%

Expected Cap Rate: 5.6% – 5.8%

Price-to-Rent Ratio: 14.5-15.5

Average Rent Projection: $1,850 – $1,900

Denver, Colorado

Denver’s robust economy and consistent population growth show no signs of slowing down as we look to 2025. This Mile-High City has established itself as a major tech hub, a center for aerospace, and a significant player in renewable energy, attracting a highly educated and affluent workforce. The natural beauty and outdoor lifestyle also contribute significantly to its allure, drawing people from across the country. While Denver has historically boasted higher property values, the underlying strength of its economy and the persistent demand for housing, evidenced by high absorption rates, make it a compelling market for long-term appreciation potential. Investors should focus on strategic acquisitions in submarkets undergoing revitalization or those with strong connectivity to major employment centers. The premium on housing here reflects the city’s desirability and strong economic prospects.

Projected Median Property Price (Multifamily): $600,000 – $620,000

Anticipated Occupancy Rate (Mid-2025): 90.5%

Expected Cap Rate: 5.3% – 5.5%

Price-to-Rent Ratio: 23.5-24.5

Average Rent Projection: $1,850 – $1,950

Nashville, Tennessee

Nashville, affectionately known as Music City, has long been a darling of real estate market analysis, and 2025 will be no different. Its economic growth extends far beyond entertainment, encompassing healthcare, automotive manufacturing, and a rapidly expanding tech sector. Tennessee’s favorable tax environment, which includes no state income tax, acts as a powerful magnet for businesses and individuals alike, driving continuous inward migration. My decade of observing this market confirms its consistent ability to deliver strong returns, particularly in the multifamily segment. The demand for housing, especially for rental properties, continues to outpace supply in many areas, sustaining healthy rent growth. Nashville offers a vibrant cultural scene, excellent universities, and a dynamic job market, making it an enduring magnet for diverse demographics.

Projected Median Property Price (Multifamily): $470,000 – $490,000

Anticipated Occupancy Rate (Mid-2025): 89%

Expected Cap Rate: 5.6% – 5.8%

Price-to-Rent Ratio: 19.5-20.5

Average Rent Projection: $1,950 – $2,000

San Diego, California

San Diego offers a unique proposition within the California market: constrained supply and exceptionally strong demand. As an expert, I’ve seen firsthand how stringent zoning laws and a lack of available developable land severely limit new construction, creating a perpetually undersupplied housing market. Simultaneously, San Diego’s economy thrives on innovation, propelled by its robust military presence, burgeoning biotechnology industry, a significant tourism sector, and a growing tech footprint. The city’s unparalleled quality of life, mild climate, and beautiful coastline ensure a steady stream of high-income earners seeking residence. While the entry point for multifamily investment is higher here, the stability and consistent demand often translate into superior long-term returns and real estate portfolio management resilience, particularly for those focused on Class A and B assets.

Projected Median Property Price (Multifamily): $900,000 – $930,000

Anticipated Occupancy Rate (Mid-2025): 96%

Expected Cap Rate: 4.7% – 4.9%

Price-to-Rent Ratio: 24.5-25.5

Average Rent Projection: $2,600 – $3,100

Salt Lake City, Utah

Salt Lake City has emerged as one of the most dynamic and fastest-growing economies in the Mountain West. As we look to 2025, its trajectory remains upward, driven by a diversified economy that includes tech (often dubbed “Silicon Slopes”), healthcare, and outdoor recreation. The city boasts a young, educated workforce and a high quality of life that continues to attract new residents, particularly from more expensive coastal markets. This demographic tailwind directly translates into robust demand for multifamily housing. Investors can find a compelling mix of growth and stability in Salt Lake City, with strong rent growth potential and a generally pro-development environment. The ongoing investment in downtown revitalization and public transportation further enhances its appeal for long-term property investment strategies.

Projected Median Property Price (Multifamily): $540,000 – $560,000

Anticipated Occupancy Rate (Mid-2025): 94.5%

Expected Cap Rate: 5.6% – 5.8%

Price-to-Rent Ratio: 25.5-26.5

Average Rent Projection: $1,750 – $1,800

Columbus, Ohio

Columbus stands out as an increasingly attractive, yet often overlooked, market in the Midwest. For 2025, it represents a compelling blend of solid economic fundamentals, affordability, and consistent growth. Home to The Ohio State University, a major research institution, the city benefits from a continuous influx of young talent and a strong educational ecosystem that fuels its tech, healthcare, and logistics sectors. Its strategic location makes it a critical distribution hub. What makes Columbus particularly interesting for multifamily real estate investing is its relative affordability compared to coastal and Sun Belt metros, offering potentially higher cash flow yields and more accessible entry points for investors. The local government has also been proactive in supporting development and revitalization projects, creating a positive environment for growth.

Projected Median Property Price (Multifamily): $285,000 – $305,000

Anticipated Occupancy Rate (Mid-2025): 93%

Expected Cap Rate: 6.9% – 7.1%

Price-to-Rent Ratio: 15.5-16.5

Average Rent Projection: $1,580 – $1,630

Dallas, Texas

Dallas, part of the sprawling Dallas-Fort Worth metroplex, remains one of the nation’s largest and most dynamic apartment markets, and its allure for commercial property investment shows no signs of waning in 2025. Texas’s business-friendly policies and lack of state income tax continue to attract a massive influx of corporations and residents, making DFW a perennial leader in job growth and population expansion. The region’s diverse economy, spanning finance, technology, logistics, and energy, provides a broad and stable base for housing demand. As an experienced investor, I’ve consistently seen Dallas deliver strong performance across various market cycles due to its sheer scale and economic resilience. While new construction is robust, the underlying demand driven by continuous relocation ensures a healthy market for multifamily investors seeking scale and consistent performance.

Projected Median Property Price (Multifamily): $405,000 – $425,000

Anticipated Occupancy Rate (Mid-2025): 90%

Expected Cap Rate: 5.2% – 5.7%

Price-to-Rent Ratio: 18.5-19.5

Average Rent Projection: $1,850 – $1,900

Seizing the 2025 Opportunity

The multifamily real estate market in 2025 is poised for a significant upswing, offering a strategic window for investors. The cities highlighted above are not merely trending; they are fundamentally strong markets with sustainable growth drivers that align with my decade of observation in this field. Each offers a unique blend of economic vitality, demographic expansion, and favorable market conditions, ripe for wealth creation real estate.

However, successful investing is never a set-it-and-forget-it endeavor. It demands thorough due diligence, localized expertise, and a clear understanding of your investment goals, whether that’s passive income strategies, aggressive appreciation potential, or real estate syndication. Navigating this landscape effectively requires not just identifying the right cities, but also the right submarkets, property types, and management strategies.

Are you ready to transform these insights into tangible opportunities and elevate your multifamily real estate portfolio? The time to position yourself for success in 2025 is now. Connect with seasoned experts who can provide the tailored market intelligence and strategic guidance necessary to unlock prime multifamily investment opportunities that align with your financial objectives. Let’s build your future in real estate, together.