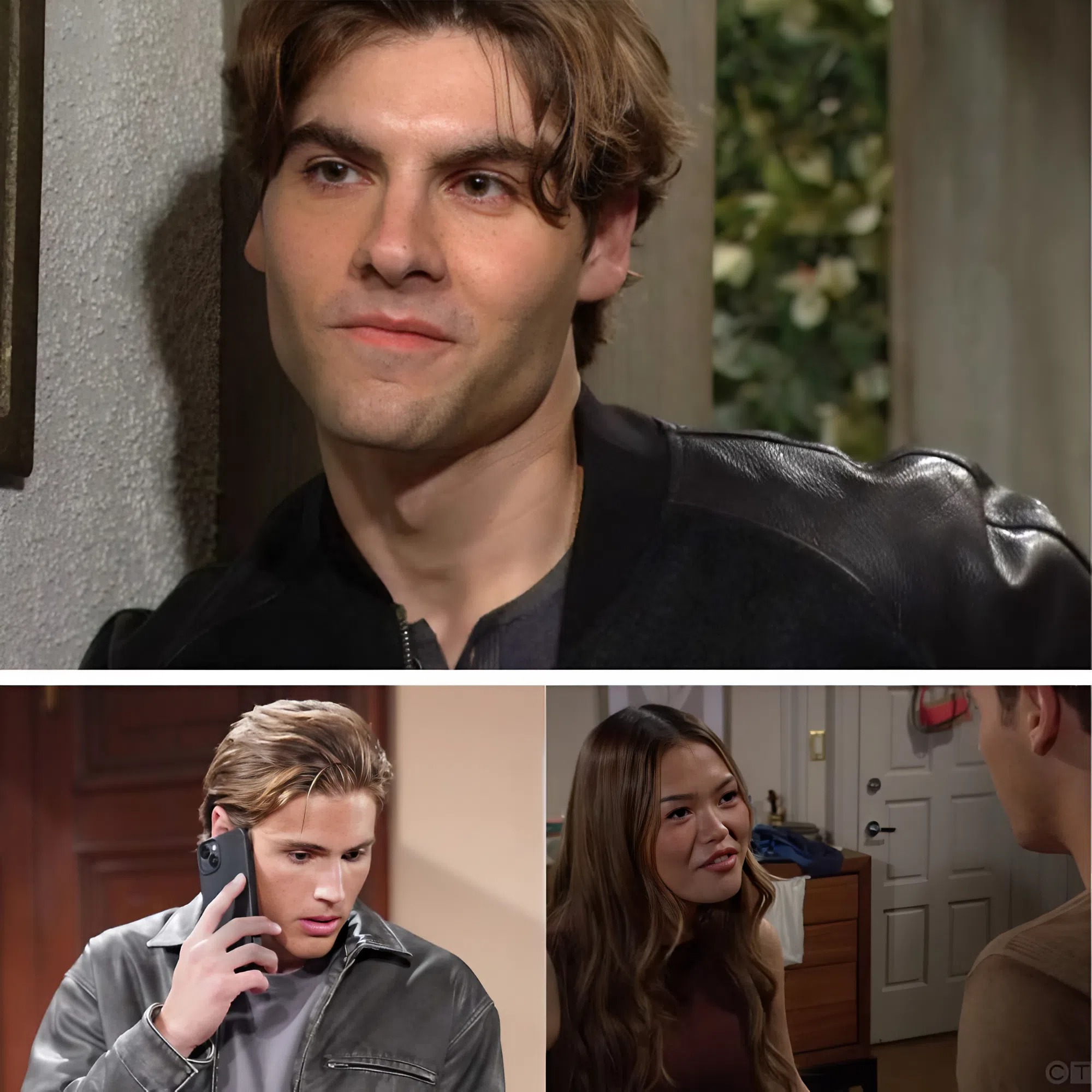

Luna’s Daring Escape

Chaos erupts in Los Angeles as Luna slips out of Will’s control in Friday’s episode of The Bold and the Beautiful. The tension peaks when Luna realizes the stakes—Will holds the power to send her to prison. In a heated confrontation at Li’s apartment, warnings are exchanged, tempers flare, and in a desperate move, Luna bolts, leaving Will stunned and furious.

Her escape sets off a chain reaction, forcing Will to scramble as he realizes that Luna is now free—and unpredictable. Every step she takes in the shadows increases his anxiety and worry for what she might do next.

Will Faces Growing Frustration

Determined to regain control, Will pursues Luna but finds her too elusive. Each failed attempt intensifies his fear and anger. The thought of Luna hiding and plotting in secret consumes him, pushing him to the brink of panic. This unforeseen freedom threatens not only his peace of mind but also the fragile relationships he has worked so hard to protect.

Katie’s Call Adds Pressure

As if Luna’s escape wasn’t enough, Will receives an unexpected call from Katie. She praises his honesty and character, encouraging him to keep his budding relationship with Electra simple and free of complications.

This advice places Will in an impossible position. He must protect Electra from the truth about Luna while grappling with guilt over his entangled past. The fear of shattering Electra’s trust haunts him, forcing Will to navigate a delicate balance between secrecy and integrity.

Luna Finds Shelter With Remy

Desperate and cunning, Luna seeks refuge at Remy’s apartment. His shock is immediate—he believed she was gone for good. Luna pleads for his help, insisting she will never return to prison. Her charm and determination sway Remy, and he reluctantly provides shelter, setting the stage for high-stakes drama.

With Luna safely hidden, the tension escalates. Will remains torn between protecting Electra and preventing Luna from causing further chaos, while Luna begins strategizing her next move.

The Stakes Rise in Los Angeles

As secrets deepen and loyalties are tested, Los Angeles becomes a tinderbox of suspense. Luna’s escape leaves the audience on edge, questioning who will emerge victorious in this dangerous game of deception and manipulation.

Will’s struggle to balance love, guilt, and the fear of exposure highlights the unpredictable twists that keep fans glued to The Bold and the Beautiful. Meanwhile, Luna’s cunning maneuvers promise that no one is truly safe—and no secret remains hidden for long.

What’s Next?

Fans can expect tension, emotional confrontations, and unexpected alliances in the coming episodes. Luna’s presence in Remy’s apartment may spark conflicts that threaten relationships, while Will’s attempts to protect Electra could unravel in surprising ways.

Stay tuned to The Bold and the Beautiful for the latest drama, where every decision carries consequences, and no escape goes unchallenged.

Navigating the 2025 Housing Market: 10 Critical Pitfalls First-Time Homebuyers Must Avoid

After a decade immersed in the dynamic world of real estate, I’ve witnessed firsthand the exhilaration and the exasperation that comes with buying a first home. As we look ahead to 2025, the housing market presents both incredible opportunities and complex challenges. For aspiring homeowners, the dream of planting roots can quickly turn into a financial nightmare if not approached with meticulous planning and informed decisions. This isn’t just about finding a house; it’s about securing your financial future and lifestyle.

Many first-time homebuyers, fueled by excitement and perhaps a touch of inexperience, often stumble into common traps that can cost them thousands—or even derail their homeownership dreams entirely. Drawing from years of observing market shifts, financing nuances, and the emotional roller coaster of property transactions, I’ve compiled the ten most critical mistakes I see emerging buyers make. My goal is to equip you with the foresight to sidestep these pitfalls, ensuring your journey to homeownership is as smooth and successful as possible in the competitive 2025 landscape. Let’s delve into these essential insights.

Mistake #1: Skipping a Thorough Mortgage Pre-Approval Process

One of the most foundational—yet frequently overlooked—steps for first-time homebuyers in 2025 is obtaining a comprehensive mortgage pre-approval. This isn’t merely a casual conversation with a lender; it’s a rigorous assessment of your financial health, determining precisely how much a lender is genuinely willing to finance for your home purchase. In a market where mortgage rates forecast for 2025 could still be volatile, and competition for desirable properties remains high, a solid pre-approval acts as your financial passport.

What Does Mortgage Pre-Approval Entail in 2025?

A lender will scrutinize several key aspects of your financial profile:

Income Verification: Expect to provide W-2s, pay stubs, and potentially tax returns from the last two years. For self-employed individuals, 24 months of bank statements and profit & loss statements are standard.

Asset Assessment: Proof of funds for your down payment and closing costs, typically through bank statements and investment accounts. Lenders want to see stability.

Debt-to-Income (DTI) Ratio: This crucial metric compares your monthly debt payments to your gross monthly income. In 2025, lenders are keenly focused on sustainable DTI ratios, often looking for figures below 43%, though this can vary by loan program.

Credit History and Score: Your FICO score and overall credit report are paramount. A robust credit history demonstrates your reliability as a borrower, directly influencing the mortgage interest rates you’ll be offered. A score of 720+ is generally considered strong for securing favorable terms.

The Undeniable Advantages of Pre-Approval:

Realistic Budgeting: A pre-approval letter gives you a precise spending limit, preventing you from “falling in love” with homes you can’t afford. This clarity helps in your search for affordable homes for sale in 2025.

Enhanced Negotiating Power: In competitive markets, sellers prioritize offers backed by pre-approval. It signals you’re a serious, qualified buyer, making your offer more attractive and potentially leading to a swifter acceptance. This is especially true when housing market forecast 2025 indicates strong seller conditions.

Expedited Closing Process: With much of the financial heavy lifting already done, your loan underwriting will proceed more efficiently, reducing stress and potential delays during closing.

Early Identification of Financial Hurdles: If credit issues, an insufficient down payment, or high DTI exist, pre-approval brings them to light early, giving you time to address them before house hunting begins.

How to Secure Your Pre-Approval:

Research and Compare Lenders: Don’t just go with your current bank. Explore different best mortgage lenders 2025, including national banks, credit unions, and local mortgage brokers. Compare rates, fees, and customer service.

Gather Your Documents: Be prepared with identification (driver’s license, Social Security card), income proofs, asset statements, and recent tax returns.

Complete the Application: This involves a credit check, which will result in a hard inquiry on your credit report. While this might slightly dip your score, multiple inquiries within a 45-day window for the same loan type are typically counted as one for scoring purposes.

Receive Your Letter: Once approved, you’ll get a conditional letter outlining the maximum loan amount and terms. This letter is typically valid for 60-90 days, so be mindful of its expiration.

Mistake #2: Underestimating the True Cost of Homeownership

Many first-time buyers focus solely on the sticker price of a home and the monthly mortgage payment. However, failing to account for the myriad of other expenses associated with owning a property in 2025 is a recipe for financial strain. The “total cost” extends far beyond the sales price.

Beyond the Mortgage: Hidden Costs to Budget For:

Closing Costs: These can range from 2-5% of the loan amount and include:

Lender Fees: Loan origination, underwriting, document preparation.

Third-Party Fees: Appraisal, credit report, title search, title insurance, attorney fees (where applicable), survey fees.

Pre-paid Expenses: Escrow deposits for property taxes and homeowners insurance rates, often covering several months in advance.

Transfer Taxes: State and local taxes on the transfer of property.

Property Taxes: These vary significantly by state, county, and even specific city. For example, some states like New Jersey or Illinois have notoriously high property tax calculator estimates, while others like Alabama or Hawaii are much lower. Always factor in the annual property tax and how it’s paid (usually monthly via escrow).

Homeowners Insurance: Essential protection against damage, theft, and liability. Premiums depend on location, home value, deductible, and coverage limits. In areas prone to natural disasters (hurricanes, wildfires), specific additional coverage may be required, significantly increasing costs.

Homeowners Association (HOA) Fees: If you’re buying a condo, townhouse, or home in a planned community, HOA fees are mandatory monthly payments covering shared amenities, common area maintenance, and sometimes specific utilities. These can range from under $100 to several hundred dollars per month.

Utility Hook-ups and Deposits: Setting up new electricity, water, gas, and internet services often involves activation fees and security deposits.

Maintenance and Repairs: This is the big one many underestimate. Experts recommend budgeting 1-4% of your home’s value annually for maintenance. For a $350,000 home, that’s $3,500 to $14,000 a year!

Annual Maintenance: HVAC servicing, gutter cleaning, landscaping, pest control.

Periodic Expenses: Repainting (every 5-10 years, $3,000-$10,000+), roof replacement (every 20-30 years, $10,000-$30,000+), major appliance repair/replacement, cost of home maintenance for plumbing or electrical issues.

Mortgage Insurance (PMI): If your down payment is less than 20% on a conventional loan, you’ll likely pay Private Mortgage Insurance (PMI). FHA loans have their own version, MIP. These add to your monthly payment until you reach sufficient equity.

2025 Market Tip: Rising material and labor costs mean that even minor repairs can be pricier. Factor this into your budget contingency. Research first time home buyer grants that might help offset some initial costs, but be realistic about ongoing expenses.

Mistake #3: Neglecting In-Depth Neighborhood Research

A house is only as good as its location. Many buyers are so fixated on the property itself that they overlook the crucial importance of the surrounding community. In 2025, understanding your chosen neighborhood safety ratings and future trajectory is paramount, especially as lifestyle priorities continue to evolve.

Key Factors for Evaluating a Locality in 2025:

Safety and Crime Rates: Utilize local police department websites, neighborhood statistics platforms (e.g., NeighborhoodScout, Niche.com), and online forums to assess crime trends.

Accessibility and Commute: Map out your typical routes to work, schools, and frequently visited places. Evaluate traffic patterns at peak times. Is public transportation accessibility a factor for you?

Schools: Even if you don’t have children, highly-rated school districts significantly impact property value appreciation and resale potential. Check GreatSchools.org or district websites for ratings and demographics.

Amenities and Services: Proximity to grocery stores, hospitals, parks, recreational facilities, restaurants, and shopping centers. Does the area offer the lifestyle you desire?

Community Demographics and Culture: Does the neighborhood align with your values? Is it family-friendly, bustling with young professionals, or quiet and retiree-focused? Attend local events or visit coffee shops to get a feel for the vibe.

Noise and Traffic: Spend time in the neighborhood at different times of day and week to assess noise levels from roads, airports, or commercial activities.

Future Development Plans: Research municipal development plans, proposed infrastructure projects (new roads, public transit lines), and zoning laws real estate changes. These can drastically impact property values, traffic, and noise levels. A new shopping center might boost values, but a major highway extension could reduce quality of life. Consider areas with real estate investment tips 2025 indicating growth potential.

The “Where to Buy a House in 2025” Question:

Look for areas with stable or growing job markets, good infrastructure, and community investment. These factors contribute significantly to long-term value and livability.

Mistake #4: Overlooking the Importance of a Professional Home Inspection

In the rush to close a deal, especially in a competitive seller’s market, some buyers might be tempted to waive the home inspection contingency. This is a colossal mistake that can lead to unforeseen and expensive repairs down the line. A thorough home inspection checklist is your protective shield.

What a Home Inspection Covers in the USA:

A certified home inspector examines the accessible areas of the property, evaluating its structural and mechanical components. This includes:

Foundation and Structure: Walls, floors, ceilings for cracks, shifts, or instability.

Roof: Shingles, flashing, gutters, and downspouts for condition and leaks.

HVAC Systems: Heating, ventilation, and air conditioning for proper function and age.

Plumbing: Visible pipes, fixtures, water heater, and drainage.

Electrical Systems: Wiring, panels, outlets, and fixtures for safety and compliance.

Attic and Basement/Crawl Space: Insulation, ventilation, moisture, and pests.

Major Appliances: Built-in appliances like ovens, dishwashers, and water heaters.

Exterior: Siding, windows, doors, grading, and drainage around the foundation.

Safety Issues: Carbon monoxide detectors, smoke detectors, railings.

Inspectors also look for signs of active water leaks, mold, insect infestations (termites), and potential environmental hazards like radon testing home (which may require a separate specialist).

Finding a Reliable, Certified Home Inspector:

The US has well-established standards for home inspectors.

Seek Referrals: Ask your real estate agent (for multiple unbiased options), friends, or colleagues for recommendations.

Verify Credentials: Look for inspectors certified by reputable organizations like the American Society of Home Inspectors (ASHI) or the International Association of Certified Home Inspectors (InterNACHI). These organizations ensure adherence to strict standards of practice and continuing education.

Check Experience and Specializations: Inquire about their experience, particularly with homes similar to the one you’re buying (e.g., older homes, specific construction types). Some may specialize in lead paint or asbestos detection.

Review Sample Reports: Ask to see a sample inspection report. A good report is detailed, easy to understand, includes photos, and clearly identifies major vs. minor issues.

Walk Through with the Inspector: Be present during the inspection. This allows you to ask questions, understand the context of issues, and learn about the home’s systems.

2025 Market Tip: With fluctuating material availability and labor shortages, some new home construction inspection processes might be rushed. Even with new builds, an independent inspection is crucial to catch builder oversights. Don’t compromise on this.

Mistake #5: Emptying All Savings for a Down Payment

While a larger down payment can lead to lower monthly mortgage payments and potentially eliminate Private Mortgage Insurance (PMI), completely depleting your savings account is a dangerous gamble. Homeownership comes with unpredictable expenses, and a healthy emergency fund is non-negotiable in 2025.

Balancing Your Down Payment with Emergency Funds:

The 3-6 Month Rule: Financial experts typically recommend having at least 3-6 months’ worth of essential living expenses saved in an easily accessible emergency fund. For homeowners, I often advise aiming for 6-9 months, or even a year, given potential cost of home maintenance and unexpected repairs.

Immediate Post-Purchase Costs: Beyond closing, you’ll likely incur expenses for moving, new furniture, window treatments, immediate repairs discovered during inspection, or renovations you planned.

Life’s Curveballs: Job loss, medical emergencies, or other unforeseen financial demands can quickly become overwhelming without a cash cushion.

Government Schemes and Assistance Programs for First-Time Buyers:

The US offers a variety of programs designed to help with low down payment mortgage options and down payment assistance programs:

FHA Loans: Backed by the Federal Housing Administration, these loans require a minimum down payment of just 3.5% and are more forgiving with credit scores. They come with Mortgage Insurance Premiums (MIP).

VA Loans: For eligible veterans, service members, and surviving spouses, VA loans offer 0% down payment and competitive rates, with no private mortgage insurance.

USDA Loans: For properties in eligible rural areas, USDA loans also offer 0% down payment options to low-to-moderate income borrowers.

State and Local Programs: Many states, counties, and cities offer grants, low-interest second mortgages, or tax credits specifically for first-time home buyer grants. These often have income limits and specific eligibility criteria.

Homeownership Education: Many assistance programs require completion of a homeownership education course, which provides invaluable knowledge.

Alternative Down Payment Sources (Use with Caution):

Gifts from Family: Often called “gift funds,” these are permissible with proper documentation (gift letter) from an approved donor.

Employer Assistance Programs: Some companies offer housing benefits or interest-free loans to help employees with home purchases.

401(k) Loans: You can borrow from your retirement account, but this carries risks. If you leave your job, the loan may become due sooner, and interest is paid back to your own account. It should be a last resort and understood thoroughly.

Home Equity Loans (for subsequent purchases): Not applicable for first-time buyers, but a future consideration for home equity loans when you have significant equity.

Mistake #6: Ignoring the Long-Term Resale Value

A common shortsighted mistake for first-time buyers is focusing purely on their immediate needs and preferences, without considering how a home will perform as an asset over time. Your first home is often your largest investment, and understanding its resale potential home is critical, especially in the evolving 2025 market.

Factors Affecting Resale Value in the US Market:

Location, Location, Location: This remains king. Proximity to good schools, job centers, major transportation routes, parks, and desirable amenities significantly boosts value.

Curb Appeal and Condition: A well-maintained exterior, attractive landscaping, and updated interiors make a home more appealing to future buyers.

Market Trends and Economic Stability: A strong local economy, job growth, and favorable real estate market trends 2025 contribute to property appreciation rates.

Functional Layout and Modern Features: Homes with practical floor plans, sufficient bedrooms/bathrooms, and desirable features (e.g., smart home technology, energy efficiency) tend to hold value better.

Infrastructure Development: Planned or ongoing infrastructure projects (new roads, public transit, commercial developments) can positively impact nearby property values.

HOA Rules and Property Taxes: Unusually high HOA fees or property taxes can deter some buyers and impact value.

Builder Reputation (for newer homes): The quality and reputation of the original builder can influence perceived value and future buyer confidence.

Smart Strategies for Future-Proofing Your Investment:

Prioritize Location: Even if it means compromising slightly on square footage or finishes initially, a prime location almost always pays off in the long run.

Consider Desirable Upgrades: Focus on renovations that offer a strong return on investment home improvements such as kitchen and bathroom remodels, adding energy-efficient windows, or boosting curb appeal. Avoid overly personalized or quirky renovations that might not appeal to a broad buyer base.

Maintain Your Home Diligently: Regular maintenance, both inside and out, prevents costly issues and preserves your home’s condition, which is paramount for increase home value.

Mistake #7: Falling in Love with a Home Beyond Your Budget

The emotional aspect of home buying is undeniable. It’s easy to get swept away by a stunning kitchen, a sprawling backyard, or a view that takes your breath away. However, allowing emotions to dictate your decision when the price tag exceeds your pre-approved limit or comfortable budget is a dangerous trap. This leads to financial strain and potential buyer’s remorse.

Tips for Staying Within Budget During Your House Hunt in 2025:

Establish a Strict Budget and Stick to It: Your pre-approval is your maximum borrowing capacity, not necessarily what you should spend. Use a home affordability calculator to determine a comfortable monthly payment that leaves room for savings and other life expenses.

Differentiate Needs vs. Wants: Make a clear list of non-negotiable “must-haves” and “nice-to-haves.” Be prepared to compromise on wants to stay within your financial comfort zone.

Avoid Overbidding Emotionally: In competitive markets, bidding wars can push prices beyond rational limits. Resist the urge to enter a bidding frenzy just because you “love” a house. There will always be other homes.

Factor in Long-Term Costs: Remember Mistake #2. A slightly more expensive house might have lower property taxes or HOA fees, making its total monthly cost comparable to a cheaper home. Always consider the full mortgage payment breakdown.

Leverage Your Agent: A good real estate agent acts as a rational guide, helping you stay grounded and focused on your financial parameters.

2025 Market Consideration: With potential market volatility, overextending your budget now could leave you vulnerable if your financial situation changes or if mortgage interest rates rise further. Prioritize long-term financial stability over immediate gratification.

Mistake #8: Not Understanding the Legal Aspects of Real Estate

The US real estate market is governed by a complex web of local, state, and federal laws. Ignorance of these legal intricacies can lead to significant delays, unexpected costs, or even legal disputes. For first-time buyers, navigating real estate legal issues can be daunting, highlighting the importance of professional guidance.

Common Legal Considerations in US Real Estate:

Title Search and Title Insurance: A title search verifies that the seller has the legal right to sell the property and uncovers any liens, encumbrances (e.g., unpaid taxes, existing mortgages), or claims against the property. Title insurance importance cannot be overstated; it protects you and your lender against future claims that might arise from issues with the title that were not discovered during the search.

Purchase Agreement and Contingencies: This legally binding contract outlines the terms of the sale. Crucial contingencies in real estate contracts protect the buyer, such as:

Inspection Contingency: Allows you to back out or renegotiate if significant issues are found.

Appraisal Contingency: Protects you if the home appraises for less than the offer price.

Financing Contingency: Allows you to cancel if you can’t secure a mortgage.

Disclosure Laws: Sellers are generally required to disclose known material defects about the property. These disclosure laws home selling vary by state but are designed to protect buyers from hidden problems.

Property Surveys: A survey verifies property lines and identifies any encroachments or easements. While not always mandatory, a property survey benefits are significant in preventing future boundary disputes.

Zoning and Building Codes: Understanding local zoning laws real estate helps determine how the property can be used and if any existing structures violate current codes.

Homeowners Association (HOA) Covenants: If applicable, HOA documents outline rules, restrictions, and fees that legally bind homeowners. Review these thoroughly before buying.

The Role of Professionals:

Depending on your state, you may work with a real estate attorney (common on the East Coast) or a title company to handle the legal aspects of the transaction. Never hesitate to ask questions and ensure you understand every document you sign.

Mistake #9: Rushing the Decision and Waiving Protections

In a hot market, the pressure to make an offer quickly can be intense. Real estate agents, sellers, and even market conditions can push buyers to make impulsive decisions or waive crucial protections like contingencies to make their offer more attractive. This is a primary source of buyer’s remorse real estate.

When to Walk Away from a Deal:

Undisclosed or Significant Property Concerns: If the home inspection reveals major structural, safety, or system issues that the seller is unwilling to address, or if the costs are prohibitive, it’s a red flag.

Seller’s Unfair Bargaining Practices: If the seller is unreasonable in negotiations, unresponsive, or trying to hide information, it suggests future complications.

Altered Personal Financial Circumstances: A job loss, unexpected expense, or a change in your mortgage interest rates pre-approval can justify reconsidering. Don’t push forward if your financial picture has changed.

Coercive Strategies: If your agent or the seller’s agent is pressuring you to waive contingencies, make an offer without viewing the property, or act before you’re comfortable, step back. A good agent protects your interests, not just closes a sale.

Appraisal Gap: If the appraisal comes in significantly lower than your offer, and you can’t or won’t cover the difference in cash, it’s often wise to walk away or renegotiate.

Feeling Uncomfortable: Trust your gut. If something feels off, investigate further or move on.

The Value of Due Diligence:

Thorough due diligence home buying takes time. Review all documents (disclosures, HOA docs, inspection reports), conduct your own neighborhood research, and ensure all your questions are answered. Patience is a virtue, especially when making such a significant financial commitment. The housing market forecast 2025 may still be competitive, but your financial health is more important than winning a single bidding war.

Mistake #10: Neglecting to Plan for the Future

Your first home is rarely your forever home, but it’s a significant long-term asset. Many first-time buyers get caught up in the immediate present, failing to consider how their home will align with their life goals and changes over the next 5-10 years and beyond. This is critical for long-term homeownership planning.

Considering Long-Term Family and Lifestyle Needs:

Family Growth or Shrinkage: Do you anticipate having children, or perhaps elderly parents moving in? Does the home offer enough bedrooms, bathrooms, and living space to accommodate these changes?

Schools and Childcare: If children are in your future, school district rankings and proximity to quality childcare become paramount considerations.

Career Changes and Commute: Will a potential career change make your commute unbearable? Is the area conducive to remote work if that’s a possibility?

Accessibility and Aging-in-Place: As you age, will the home remain accessible? Consider features like single-story living, wider doorways, or the ease of adding ramps or grab bars if needed.

Lifestyle Evolution: Do you foresee a desire for more outdoor space, a different community vibe, or proximity to specific hobbies?

Financial Planning: How will your mortgage payment fit into your broader financial planning for homeowners, including retirement savings, investment goals, and other major life events?

Flexibility and Adaptability:

Consider whether the home has the flexibility to adapt to future needs. Can a basement be finished for extra living space? Is there room for a home office if remote work becomes permanent? Is there potential to add a rental unit for investment property analysis in the future, if zoning allows?

By thinking strategically about your potential needs, you ensure your first home remains a valuable asset that supports your evolving lifestyle, rather than becoming a source of constraint or regret.

Your Path to Confident Homeownership in 2025

Navigating the US housing market in 2025 requires more than just a desire to own a home; it demands a strategic, informed, and patient approach. By understanding and actively avoiding these ten common pitfalls, you equip yourself with the knowledge and foresight to make intelligent decisions. From securing a robust pre-approval to meticulously researching neighborhoods and ensuring thorough inspections, each step is an investment in your future financial stability and peace of mind.

Don’t let the excitement of a new beginning blind you to the complexities of the process. Empower yourself with expertise, ask the right questions, and leverage the insights of seasoned professionals. Your journey to homeownership is a marathon, not a sprint.

Ready to confidently step into the 2025 housing market? Let’s connect to discuss your unique situation and craft a personalized strategy to turn your homeownership dreams into a secure reality.