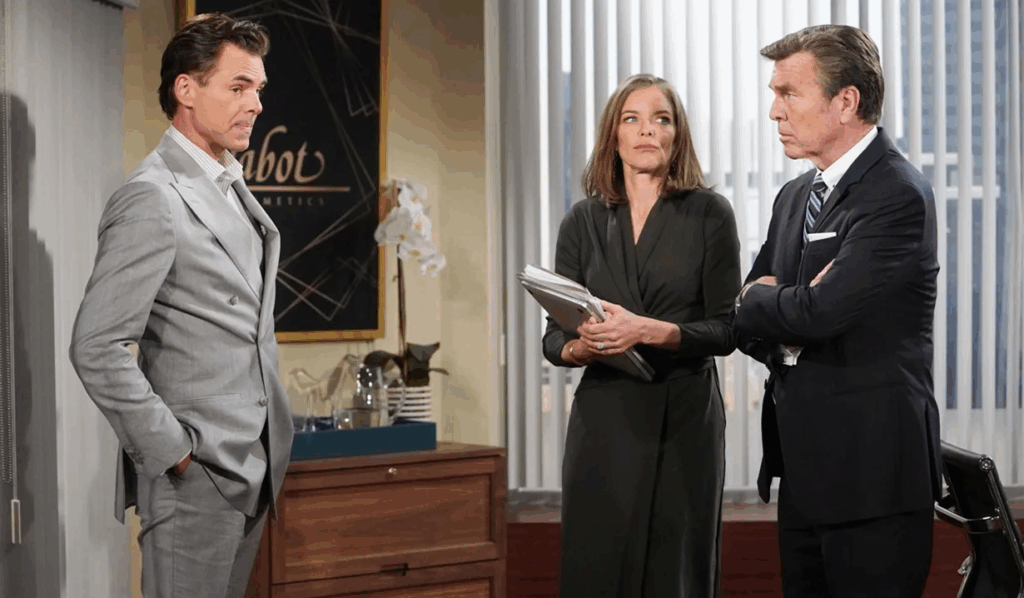

Secrets and Betrayals Ignite Drama in Young and Restless Episode

Navigating Tomorrow: The 10 Premier U.S. Housing Markets Primed for Growth in 2025

As we step firmly into 2025, the U.S. real estate landscape continues its intricate dance of opportunity and challenge. For over a decade, I’ve watched market dynamics shift, sometimes subtly, sometimes dramatically. The current environment, characterized by fluctuating mortgage rates, persistent inflationary pressures, and a relentless quest for housing affordability solutions, can feel daunting. Yet, amidst these complexities, a clear picture emerges: specific regional markets are not just weathering the storm but are poised for significant, even explosive, growth. These aren’t merely fleeting hot spots; they represent strategic advantages for both savvy homebuyers and discerning real estate investors.

The national narrative often paints a broad stroke, but my experience consistently affirms that real estate is fundamentally local. While concerns over housing inventory and interest rate volatility dominate headlines, a deeper dive into localized economic engines reveals pockets of remarkable resilience and upward trajectory. This year, my analysis points to a compelling shift towards the Northeast and Midwest, regions often overlooked in favor of traditionally booming Sunbelt states. The data, rigorously scrutinized from leading economic models and market intelligence, paints a picture of robust demand, burgeoning job markets, and a sweet spot of relative affordability that fuels rapid transactions and promising property appreciation.

Forget the static, one-size-fits-all approach to real estate. In 2025, success hinges on precision, foresight, and an understanding of the underlying forces shaping tomorrow’s top performers. My goal here is to equip you with that very insight, unveiling the markets that are not just growing, but genuinely thriving, offering unparalleled opportunities for wealth building through real estate.

Deconstructing the “Hot Market” Phenomenon: Beyond the Hype

What truly defines a “hot” housing market, especially in the nuanced climate of 2025? It’s far more intricate than just rising prices. From my decade in this industry, I’ve learned that sustainable market heat stems from a confluence of interconnected factors that create a virtuous cycle of demand, value, and economic vitality. When evaluating hundreds of metropolitan areas, I focus on several critical metrics that reveal a market’s true potential for both rapid transaction speed and long-term real estate investment value.

Sustainable Home Value Appreciation: Naturally, rising property values are a key indicator. However, my expert lens scrutinizes not just the rate of growth, but its underlying stability. Are prices being driven by speculative frenzies, or by genuine economic expansion, demographic shifts, and fundamental demand? In 2025, we’re seeking markets where appreciation is fueled by durable factors, suggesting a healthier, more predictable return on investment. This includes examining historical performance against current housing market forecast models to ensure growth isn’t an anomaly but a consistent trend.

Projected Change in Owner-Occupied Households: This metric is a powerful harbinger of future demand. An increasing number of households intending to own signifies population growth, family formation, and an influx of individuals seeking long-term roots. It reflects a growing desire for stability and equity, often correlated with stronger local economies and improved quality of life. Markets showing robust growth in this area signal sustained buyer pools, critical for both sellers and investment properties looking for consistent tenant demand.

Job Growth vs. New Construction: This is arguably the most crucial supply-demand imbalance indicator. New jobs are magnets, attracting new residents and stimulating local economies. However, if new construction cannot keep pace with this influx of opportunity-seekers, competition for existing homes intensifies, driving prices up. I look for markets where job creation is robust, particularly in high-wage sectors, but where housing supply remains constrained. This imbalance creates an inherent pressure cooker for home values and reduces housing inventory, making properties sell faster. Understanding which industries are powering this job growth – be it tech, healthcare, logistics, or manufacturing – provides deeper insight into a market’s resilience.

Market Velocity (Days on Market): How quickly homes go from “for sale” to “pending” is a direct measure of buyer urgency and market competitiveness. In the hottest housing markets 2025, homes are literally flying off the shelves, often in less than two weeks. This speed necessitates swift action from buyers, often requiring pre-approved financing and agile decision-making. For sellers, it translates to stronger negotiation power and potentially multiple offer scenarios, sometimes even leading to sales above asking price. This fierce competition, while challenging for buyers, underscores the underlying strength and desirability of these locales.

The collective impact of these factors creates the unique conditions we see in 2025’s leading markets. These are not merely places where homes are expensive; they are dynamic ecosystems where economic opportunity, demographic shifts, and a balanced, yet eager, buyer pool converge to create exceptional real estate opportunities. The shift we’re observing, particularly towards the relatively affordable housing markets in the Midwest and Northeast, indicates a maturation of the post-pandemic migration patterns and a renewed focus on fundamental economic drivers rather than solely lifestyle amenities. This shift away from some previously overheated Sunbelt areas, which are now contending with higher insurance costs and potential overvaluation, highlights a return to value-driven growth.

Spotlight: The Top 10 Premier U.S. Housing Markets for 2025

After meticulously sifting through countless data points and leveraging my decade of market experience, these are the ten U.S. metropolitan areas I predict will lead the charge in housing market trends for 2025. Each presents a unique blend of economic vigor, demographic appeal, and burgeoning property value growth.

Buffalo, NY: The Reigning Champion of Opportunity

For the second consecutive year, Buffalo tops our list, a testament to its remarkable transformation and robust underlying fundamentals. Far from its industrial past, Buffalo has emerged as a vibrant hub, capitalizing on its strategic location near the Canadian border and the natural wonder of Niagara Falls. In 2024, home values here surged by 5.8%, and while 2025 projects a more tempered 2.8% growth to a typical home value of $267,878, this steady appreciation combined with exceptional market speed (homes going pending in just 12 days) makes it an undeniable leader.

Why Buffalo? This city offers an unbeatable blend of housing affordability—the lowest entry point on our top 10 list when considering median income—and a burgeoning job market. Investments in technology, healthcare (Roswell Park Comprehensive Cancer Center, Kaleida Health), and cross-border trade are attracting new residents. Its revitalized waterfront, burgeoning food scene, and strong community ethos contribute to a high quality of life. For first-time home buyers and real estate investors seeking strong rental income potential, Buffalo presents a compelling value proposition, ensuring long-term property appreciation as the city continues its upward trajectory.

Indianapolis, IN: The Hoosier State’s Economic Powerhouse

Indianapolis, the vibrant capital of Indiana, is more than just a racing city. Centrally located and boasting a diversified economy, it’s a critical logistics hub, a burgeoning tech center, and home to pharmaceutical giants like Eli Lilly. While the market here might lean ever-so-slightly in buyers’ favor on paper, the velocity of sales tells a different story: new listings typically go pending in about two weeks. The typical home value is projected to rise to $285,086 in 2025, reflecting steady demand.

Why Indianapolis? Its robust job growth in sectors like advanced manufacturing, life sciences, and technology continues to attract talent. The city’s strategic location along the White River, combined with ongoing urban development and a lively cultural scene, makes it appealing to both young professionals and families. For investment properties, Indianapolis offers a solid combination of affordability and strong rental demand, driven by a consistent influx of new residents and a stable economic outlook. This makes it a prime candidate for wealth building through real estate with a focus on consistent returns.

Providence, RI: Quaint Charm Meets Economic Sophistication

Providence, a picturesque waterfront city, seamlessly blends historic charm with a sophisticated academic and artistic atmosphere. Home to prestigious institutions like Brown University and the Rhode Island School of Design, it attracts a diverse, educated populace. While its 7% appreciation in 2024 is projected to slow to 3.7% in 2025, homes still go pending in a brisk 12 days, indicating sustained, robust demand.

Why Providence? Its unique urban character, complete with Venice-esque bridges and a thriving downtown, enhances its desirability. The presence of major universities creates a steady demand for rental income properties. Furthermore, its strategic location, offering convenient access to Boston and New York City without the exorbitant price tags, makes it an attractive option for commuters and those seeking a more manageable pace of life. Providence represents an excellent opportunity for real estate investment that balances lifestyle appeal with solid economic fundamentals.

Hartford, CT: The Insurance Capital’s Surging Comeback

Hartford, long known as the “Insurance Capital of the World,” is experiencing a significant resurgence, defying previous perceptions. Homes here are forecast to reach $378,693 in 2025, marking an impressive 4.2% increase over 2024 – the largest projected bump in our top 10 cities. While slower than its 7.4% sprint in 2024, the market remains intensely competitive, with homes selling in just 7 days on average.

Why Hartford? Beyond its traditional industries, Hartford is seeing revitalized urban core projects and state investments aimed at economic diversification. Its relative housing affordability compared to neighboring New York and Boston makes it an appealing choice for those seeking better value while remaining within commutable distance to major economic hubs. This blend of economic stability, revitalization efforts, and strong market velocity makes Hartford a compelling opportunity for both homebuyers and investment properties aiming for significant property appreciation.

Philadelphia, PA: History Meets Modern Market Momentum

The City of Brotherly Love is a perpetually walkable testament to American history, yet its real estate market is firmly anchored in the present and future. After a heated 2024, Philadelphia is set for a calmer but still robust 2.6% growth in home values for 2025. However, buyers must be prepared for speed: new listings typically go pending in just 11 days.

Why Philadelphia? Philly boasts a diverse and resilient economy driven by healthcare (a global leader), education (numerous universities), and growing tech and biotech sectors. Its vibrant neighborhoods, rich cultural scene, and extensive public transit offer a high quality of urban life at a fraction of the cost of its East Coast megalopolis neighbors. This makes it an ideal market for first-time home buyers seeking urban living and real estate investors looking for strong rental income potential across its varied communities.

St. Louis, MO: The Gateway to Affordability and Growth

St. Louis earns its spot as a premier destination, especially noted for its exceptional affordability. With home values expected to grow by 1.9% in 2025, bringing the typical home value to $254,847—the lowest on our top 10 list—it remains a haven for value. Yet, affordability doesn’t mean slow; homes fly off the market here in about eight days.

Why St. Louis? The city is a hub for biosciences, advanced manufacturing, and a burgeoning startup scene, providing diverse job growth. Its commitment to urban revitalization, combined with iconic attractions and a strong community feel, makes it highly appealing. For first-time home buyers and real estate investors focused on value and strong cash flow from investment properties, St. Louis offers significant upside potential, particularly as its economic diversification continues to mature. It truly embodies housing affordability solutions without sacrificing growth.

Charlotte, NC: The Queen City’s Unyielding Ascent

Charlotte, often dubbed the “Queen City,” continues its impressive run as a magnet for growth. Celebrated for its temperate climate, outdoor spaces, and a fervent sports culture, it’s also a major financial hub. Home values are expected to appreciate by approximately 3.2% in 2025, pushing the typical home value to $389,383 by November. The market remains competitive, with homes going pending in about 20 days.

Why Charlotte? As a leading East Coast banking center, Charlotte offers abundant high-paying jobs, drawing a steady stream of new residents. Its expanding infrastructure, diverse economy, and high quality of life appeal to young professionals and families alike. For real estate investors, Charlotte offers a robust market with consistent demand for both owner-occupied and rental properties, making it a cornerstone for long-term property appreciation and wealth building through real estate.

Kansas City, MO: The “Silicon Prairie’s” Roaring Heart

Straddling the border of Missouri and Kansas, Kansas City is experiencing a vibrant resurgence, shedding its traditional image for one of a dynamic tech and cultural hub. Known for its rich musical heritage, legendary barbecue, and over 200 fountains, it’s also a serious economic player. Home values are expected to increase by 2.7% in 2025, bringing the typical home value to $307,334. Market speed is exceptional, with homes going pending in a rapid 9 days.

Why Kansas City? This “Silicon Prairie” city boasts strong job growth in technology, animal health, and manufacturing, attracting a skilled workforce. Its relative housing affordability compared to coastal tech hubs makes it particularly attractive to remote workers and relocating businesses. For both first-time home buyers and real estate investors, Kansas City provides an excellent blend of economic stability, cultural vibrancy, and significant potential for property appreciation. It’s a testament to the power of a diversified economy fueling sustained real estate demand.

Richmond, VA: Historic Charm, Modern Market Vigor

Richmond, Virginia’s capital, is one of the nation’s oldest cities, yet its real estate market is anything but dated. After a torrid few years, 2025 anticipates a calmer but still healthy 2.9% growth in home values. Buyers here still need to be exceptionally prepared: homes sell in an average of just 9 days.

Why Richmond? This city beautifully marries its colonial past with a thriving contemporary scene, boasting a burgeoning arts, dining, and craft beer culture. Its economy is diverse, with strong sectors in government, healthcare, education, and finance. Proximity to Washington D.C. offers additional economic spillover, while its more manageable cost of living provides a compelling alternative. For real estate investment and first-time home buyers, Richmond offers a stable, appealing market with steady demand and excellent potential for long-term property appreciation.

Salt Lake City, UT: Mountain Majesty, Economic Might

Encircled by stunning mountains, Salt Lake City is a world-class destination for outdoor enthusiasts, but its economic prowess is equally compelling. Known as “Silicon Slopes,” its tech sector is booming, driving significant job growth and attracting a young, diverse population. Home values are expected to grow by 2.3% in 2025, pushing the typical home value to $555,858. Homes here still sell relatively fast, in about 19 days.

Why Salt Lake City? Despite its higher typical home value compared to others on this list, Salt Lake City’s robust economy, strong population influx, and unparalleled quality of life continue to fuel demand. Its appeal to tech talent, coupled with continuous urban development, ensures a competitive market. For real estate investors and those seeking long-term wealth building through real estate, Salt Lake City represents a premium market with a strong track record of property appreciation and continued economic expansion. It’s an excellent choice for those looking for growth in a vibrant, amenity-rich environment.

Navigating the Dynamics: Strategic Advice for Buyers and Investors in 2025’s Hottest Markets

My decade in real estate has taught me one absolute truth: in a competitive market, preparation isn’t just an advantage—it’s a necessity. For buyers and real estate investors eyeing these red-hot locales in 2025, a strategic approach is paramount to success.

Financial Fortification is Non-Negotiable:

Pre-Approval, Not Pre-Qualification: This is your golden ticket. A full pre-approval from a reputable lender demonstrates your seriousness and capacity to close, giving you a significant edge in multiple-offer scenarios. Understand your loan options, explore down payment assistance programs if eligible, and get a clear picture of your maximum budget. In fast-moving markets, there’s no time for financial uncertainty.

Budget Beyond the Price Tag: Factor in closing costs, property taxes, insurance (which can vary significantly, especially in areas with specific environmental risks), and potential renovation costs. A comprehensive financial planning real estate strategy ensures you’re not blindsided post-purchase. High CPC keywords like “mortgage advice” and “down payment assistance” are precisely where expert guidance proves invaluable.

The Indispensable Local Expert:

A Seasoned Real Estate Agent is Your Ally: In markets where homes sell in days, a local expert isn’t a luxury; they’re essential. They possess invaluable local knowledge: specific neighborhood nuances, upcoming developments, potential off-market opportunities, and the pulse of local housing market trends. They can advise on competitive offer strategies, navigate multiple bids, and help you understand when to push and when to walk away. Look for an agent with a proven track record in your specific target market and who understands both buyer and investment property dynamics.

Negotiation Prowess: Your agent’s ability to negotiate, identify potential red flags, and manage contingencies can save you thousands and prevent future headaches. This expertise is a cornerstone of effective home buying strategy.

Speed, Decisiveness, and a Dash of Flexibility:

Be Ready to Move: With homes going pending in a week or less, you must be prepared to view properties quickly, make decisions efficiently, and submit offers without delay. This often means having your agent on speed dial and being proactive in your search.

Strategic Offers: In competitive environments, standard offers often won’t cut it. Your agent can guide you on strategies like waiving certain contingencies (with caution), offering an escalation clause, or making a larger earnest money deposit. However, never compromise on essential due diligence; a quick sale shouldn’t mean a risky one.

Long-Term Vision for Lasting Value:

Focus on Investment Potential: Whether you’re buying your dream home or an investment property, consider the long-term property appreciation prospects. Look at job growth forecasts, infrastructure development, and demographic shifts. These factors contribute to sustained demand and value.

Rental Income Considerations: If you’re eyeing investment properties, thoroughly research local rental market conditions, potential rental income, and vacancy rates. Understanding the projected cash flow is critical for wealth building through real estate.

Avoid Emotional Pitfalls: Hot markets can breed FOMO (Fear Of Missing Out). My advice? Stick to your budget, rely on your expert team, and don’t make rash decisions driven solely by emotion. The right opportunity will present itself if you’re prepared.

Leveraging Data and Tools:

Market Intelligence is Power: Utilize advanced analytical platforms and market heat indexes to understand the real-time dynamics of your chosen locale. These tools provide invaluable insights into current home values, average time on market, and the percentage of homes selling above asking price. This data, combined with expert interpretation, forms the bedrock of an informed decision, especially when addressing housing affordability solutions in competitive environments.

Your Next Move: Seize the Opportunity

The year 2025 presents a captivating chapter in the story of U.S. real estate. While challenges persist on a national scale, the localized vibrancy of these top 10 markets offers compelling pathways to property appreciation, real estate investment success, and achieving your homeownership dreams. From my vantage point of over a decade dissecting market intricacies, the message is clear: these are not just statistics; they are blueprints for your future.

The strategic insights, the economic drivers, and the sheer velocity of these markets underscore a critical truth: opportunity favors the prepared and the proactive. Whether you’re a first-time home buyer looking to establish roots, a seasoned investor seeking robust rental income and wealth building through real estate, or simply someone ready to make a smart move, these markets demand attention.

Don’t let the noise of the broader economy overshadow these exceptional, targeted opportunities. The market waits for no one, especially not in these red-hot locales. If you’re ready to transform your real estate aspirations into tangible assets, don’t delay. Reach out to a trusted real estate advisor today to craft a personalized strategy that capitalizes on these unparalleled opportunities in 2025 and positions you for success. Your future in one of America’s premier housing markets starts now.