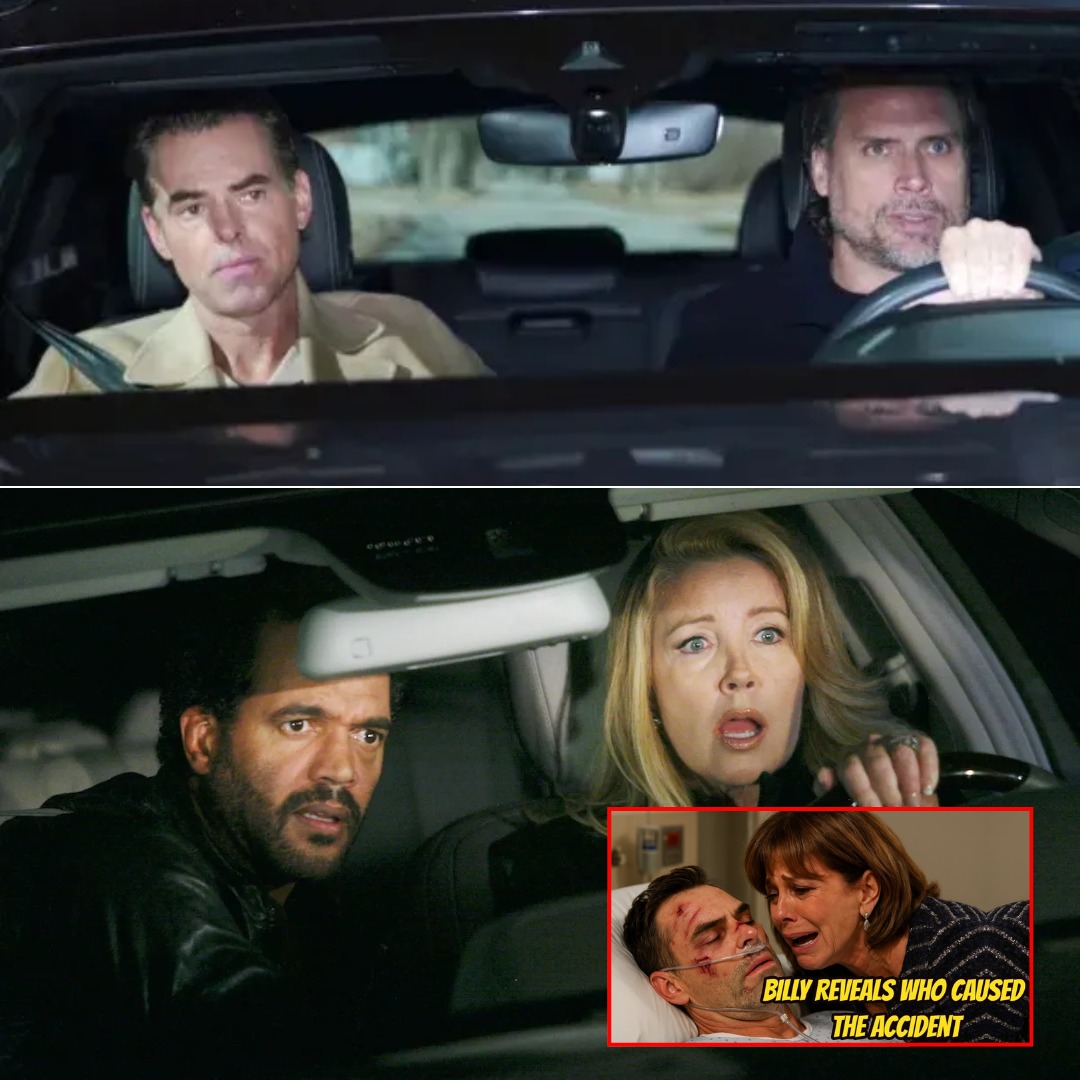

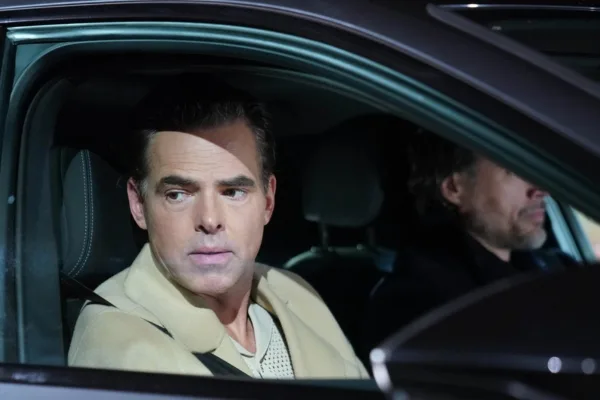

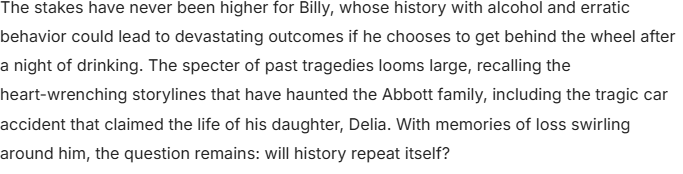

Billy Abbott’s Shocking Downward Spiral: Will a Car Crash Seal His Fate on Young and the Restless?

The Definitive Guide to America’s Top Housing Markets: Unlocking Opportunities in 2025

The U.S. housing market has been a rollercoaster, to say the least. After years of unprecedented shifts, characterized by fluctuating mortgage rates, lingering inflation concerns, and persistent affordability challenges, the landscape of real estate in 2025 is anything but uniform. While headlines often paint a broad picture, my decade-plus navigating these dynamic waters has taught me that the true story of opportunity lies in the micro-markets – those specific locales demonstrating exceptional resilience, growth potential, and undeniable appeal. Forget the gloom-and-doom narratives; I’m here to guide you through the exciting prospects emerging in the nation’s hottest housing markets, where strategic investment and informed buying can yield significant rewards.

As we step into 2025, the market is maturing, not collapsing. We’re moving away from the frenetic, pandemic-fueled bidding wars to a more measured, yet still highly competitive, environment in specific regions. For savvy investors and prospective homeowners, understanding where these pockets of robust activity exist is paramount. This isn’t just about fast sales; it’s about discerning markets poised for sustainable growth, driven by fundamental economic shifts, demographic tailwinds, and lifestyle preferences that are reshaping America’s urban and suburban fabric. The markets I’m highlighting aren’t just selling quickly; they’re building long-term value.

The Anatomy of a “Hot” Market in 2025: An Expert’s Perspective

What truly defines a “hot” housing market today, from an expert’s vantage point? It’s far more nuanced than just rising prices. My analysis, built on years of observing trends and projecting futures, focuses on several critical indicators that point to genuine market strength and investment viability:

Economic Resilience & Diversification: Beyond simple “job growth,” I look for robust, diversified economies that aren’t reliant on a single industry. Markets with burgeoning tech sectors, advanced manufacturing, healthcare innovation, logistics hubs, or resilient government/education employment bases tend to withstand broader economic pressures better. This drives consistent demand for housing. For investors, this translates into reliable rental markets and strong property appreciation rates.

Demographic Magnetism: Are people actually moving to these areas? This includes young professionals seeking career opportunities, families forming and growing, and even retirees looking for a better quality of life or lower cost of living. Population influx, particularly from younger generations like Millennials and Gen Z, creates an inherent demand for housing, boosting owner-occupied households and investment opportunities.

Affordability Arbitrage: In an era where housing costs in traditional gateway cities have become astronomical, many buyers are seeking regions where their purchasing power stretches further. These “affordable real estate markets” often become magnets for those migrating from high-cost coastal areas, bringing their equity and higher incomes, which in turn fuels local market growth without pricing out existing residents immediately.

Supply-Demand Imbalance, with a Nuance: While low inventory typically drives prices up, a healthy hot market has new construction attempting to keep pace. The “hottest” markets are those where demand still outstrips supply, leading to rapid sales, but where future supply is anticipated, preventing runaway bubble formation. This creates competitive environments where homes go pending quickly, signaling robust buyer confidence.

Quality of Life & Infrastructure Investment: Modern buyers prioritize lifestyle. Markets that offer cultural amenities, accessible outdoor recreation, improving public transit, and significant infrastructure projects (think new hospitals, universities, or business parks) tend to attract and retain residents, fortifying their housing markets against downturns. These factors underpin long-term property value growth.

Macro Trends Shaping 2025’s Housing Landscape

The broader narrative for 2025 sees a continuation of several pivotal trends. The great migration driven by remote work has solidified, with secondary and tertiary cities in the Midwest and Northeast experiencing significant gains. While interest rates have stabilized, they remain a key factor influencing affordability, pushing buyers towards markets where property taxes and initial home prices are more manageable. This shift means that the “hot” markets are often those that were overlooked in previous booms, now offering compelling blends of value, opportunity, and lifestyle. Understanding these U.S. real estate trends is crucial for making informed decisions and capitalizing on housing market predictions for 2025.

Deep Dive: America’s 10 Hottest Housing Markets for 2025

Let’s unpack the markets poised to make significant waves this year, based on my extensive analysis and projections:

Buffalo, NY: The Reign Continues

For the second year running, Buffalo holds its top spot, defying old stereotypes. This isn’t just about the scenic Niagara Falls proximity; it’s a story of profound urban revitalization. The city has strategically invested in its medical corridor, fostering a thriving biotech and healthcare sector that’s attracting talent and driving economic diversification. Its historic architecture, vibrant arts scene, and genuinely affordable living have made it a magnet for those seeking a high quality of life without the exorbitant costs of larger East Coast metros. With expected home value growth of 2.8% and homes going pending in just 12 days, Buffalo investment properties continue to offer exceptional value. The Canadian border proximity adds a unique cross-cultural appeal, further stabilizing its Western New York real estate market.

Indianapolis, IN: The Hoosier State’s Heartbeat

Indianapolis is far more than an auto-racing mecca. It’s a dynamic logistics and distribution hub, strategically positioned at the crossroads of America. Anchored by pharmaceutical giant Eli Lilly and a growing tech sector, the city boasts a robust and diversified economy. Significant downtown revitalization projects, a burgeoning culinary scene, and a strong sense of community make it highly attractive. The affordability factor here is a huge draw, particularly for first-time home buyers and investors seeking strong rental yields. With typical home values projected to rise to $285,086 and homes selling within two weeks, the Indianapolis real estate forecast remains exceptionally bright, solidifying its status as a key Midwest housing market analysis standout.

Providence, RI: New England’s Hidden Gem

Often overshadowed by its larger New England neighbors, Providence is emerging as a sophisticated yet quaint urban center. Home to prestigious institutions like Brown University and RISD, it boasts a vibrant academic and creative economy. Its stunning waterfront, historic charm, and access to coastal amenities, all at a fraction of Boston’s prices, make it incredibly appealing. The city is experiencing a brain drain reversal, attracting young professionals who appreciate its blend of history and innovation. While home value growth is projected at a solid 3.7%, a slowdown from 2024, demand remains robust with homes going pending in 12 days. This signals a healthy, competitive Rhode Island property market.

Hartford, CT: The Insurance Capital’s Renaissance

Hartford, the traditional insurance capital, is undergoing a remarkable renaissance. Strategic urban renewal projects, a growing healthcare sector, and its advantageous position between New York City and Boston are propelling its housing market. Buyers are discovering excellent value and a quality of life that offers a compelling alternative to the sky-high prices of neighboring metropolises. The forecast of a 4.2% increase in home values – the largest projected bump in our top 10 – to $378,693, highlights its upward trajectory. With homes selling in about 7 days, the Hartford real estate investment landscape demands decisiveness, underscoring the fierce competition within the Connecticut housing market.

Philadelphia, PA: The City of Brotherly Love’s Enduring Appeal

Philadelphia, a city steeped in history, continues to captivate. Its dense network of world-class universities, major healthcare systems, and growing tech sector provides a deep well of economic stability. The city’s walkable neighborhoods, diverse cultural institutions, and distinct character make it a highly desirable place to live. While its 2024 market was exceptionally hot, 2025 predicts a more sustainable 2.6% growth in home values, offering a slightly calmer but still competitive environment. New listings typically go pending in an average of 11 days, indicating strong demand for Philadelphia property values, a consistent trend in the Pennsylvania real estate market.

St. Louis, MO: Midwest Affordability Meets Innovation

St. Louis offers an exceptional combination of affordability and opportunity, making it a standout for first-time home buyers and shrewd investors alike. The city is cultivating a burgeoning startup scene and innovation districts, diversifying beyond its traditional industrial roots. Its low cost of living, significant urban redevelopment, and rich cultural heritage provide a high quality of life at an accessible price point. With home values expected to grow by 1.9% to a typical value of $254,847 – the lowest on this list – and homes flying off the market in about eight days, St. Louis real estate opportunities are ripe for the taking. This market is a prime example of a burgeoning Missouri housing market analysis.

Charlotte, NC: The Queen City’s Southern Charm and Economic Might

Charlotte has consistently been a Southern growth story, powered by its status as a major banking and financial hub. Its robust job market, diverse economy encompassing healthcare, tech, and logistics, along with an appealing climate and abundant outdoor spaces, draws residents from across the country. The “Queen City” offers a vibrant urban experience complemented by approachable suburban living. Typical home values are projected to appreciate about 3.2% in 2025 to $389,383, reflecting sustained demand. The market remains competitive, with homes going pending in about 20 days, solidifying Charlotte investment real estate as a wise choice within North Carolina housing trends.

Kansas City, MO: From Jazz to Tech Hub

Kansas City, known for its distinctive barbecue and rich musical heritage, is rapidly gaining recognition as a thriving tech and startup hub. Its central location makes it a strategic logistical center, and significant public and private investments are fueling urban revitalization. The city offers a vibrant arts scene, impressive culinary landscape, and a strong sense of community. Home values are expected to increase 2.7% in 2025, bringing the typical home value to $307,334. The speed of sales is particularly notable here, with homes going from listing to pending in just 9 days, making the Kansas City real estate forecast an exciting prospect for Missouri property investment.

Richmond, VA: Historic Roots, Modern Growth

Richmond, Virginia’s capital, masterfully blends colonial history with a dynamic contemporary scene. Its diverse economy includes government, education, and a rapidly expanding tech and creative sector. The city’s thriving social, dining, and arts scene, coupled with its proximity to Washington D.C., makes it an increasingly attractive option for those seeking urban amenities without the capital’s price tag. While things are predicted to be calmer than previous years, with forecasted growth in home values a modest 2.9%, buyers must be prepared; homes here sell in an average of 9 days in the active Richmond VA real estate market, signaling continued demand in the Virginia housing outlook.

Salt Lake City, UT: Silicon Slopes and Scenic Wonders

Salt Lake City, nestled amidst stunning mountains, has transformed into a major tech hub affectionately dubbed “Silicon Slopes.” Its burgeoning tech industry, combined with world-class outdoor recreation opportunities (10 ski resorts within an hour!), attracts a young, diverse, and affluent demographic. This unique combination drives intense demand for housing. Home values are expected to grow by 2.3% in 2025, pushing the typical home value to $555,858. Homes sell relatively fast, in about 19 days, reflecting the strong pull of Salt Lake City tech jobs real estate, making Utah property appreciation a compelling narrative for investors and homeowners alike.

Navigating the Competitive Landscape: An Expert’s Playbook for 2025

Entering any of these hot markets requires more than just enthusiasm; it demands a strategic, informed approach. Based on my decade of experience, here’s how to position yourself for success, whether you’re buying your first home or adding to your investment portfolio:

For Buyers: Master the Art of the Offer

Financial Fortification is Non-Negotiable: Get your finances in impeccable order. This means not just getting pre-approved for a mortgage, but truly understanding your debt-to-income ratio (DTI) and having a clear picture of your down payment strategies. In highly competitive markets, a fully underwritten pre-approval letter can make your offer stand out. Research “best mortgage lenders 2025” and explore “down payment assistance programs” if eligible.

The Power of an Expert Local Agent: This cannot be overstated. A seasoned real estate agent with deep local market knowledge is your most valuable asset. They understand hyper-local conditions – which neighborhoods are truly booming, typical offer strategies, and can even uncover off-market opportunities. Their negotiation skills are crucial when every offer counts.

Strategic Offer Crafting: Beyond price, consider other levers. A flexible closing date, a willingness to waive certain contingencies (after thorough due diligence, of course), or an escalation clause can make your bid more attractive. However, never waive inspections completely; prioritize a swift inspection period instead.

Be Prepared to Act Decisively: In markets where homes go pending in a week or less, hesitation is costly. Have your decision-making framework ready, so when the right property emerges, you can move quickly and confidently.

Patience and Persistence: Even in hot markets, the right home might not appear overnight. Maintain your search, stay engaged with your agent, and be prepared for potential multiple-offer scenarios. Your persistence will pay off.

For Sellers: Maximizing Your Return in a Seller’s Market

Even in a hot market, strategic selling is key to maximizing your return:

Strategic Pricing: Work with your agent to price your home competitively. While demand is high, overpricing can still deter buyers. A well-priced home generates more interest, potentially leading to a bidding war.

Presentation Matters: Professional staging and high-quality photography are non-negotiable. Make your home shine, appealing to the emotional and practical needs of potential buyers.

Leverage the Urgency: Use the rapid sales cycle to your advantage, but manage expectations. While your home may sell quickly, ensure you have a clear plan for your next steps.

Seize the Opportunity: Your Next Chapter Awaits

The U.S. housing market in 2025 presents a mosaic of opportunities, particularly in these vibrant, high-growth metros. These aren’t just places where homes are selling fast; they’re communities experiencing fundamental economic and demographic shifts that promise long-term value and an excellent quality of life. For those ready to navigate the competitive landscape, the rewards are substantial.

Are you ready to explore the exciting possibilities in America’s hottest housing markets? Whether you’re a first-time home buyer, looking to relocate, or seeking prime real estate investment opportunities, understanding these dynamics is your first step. Don’t leave your next move to chance. Connect with an experienced real estate professional today to craft a personalized strategy that capitalizes on these unparalleled market conditions and helps you achieve your property goals in 2025.