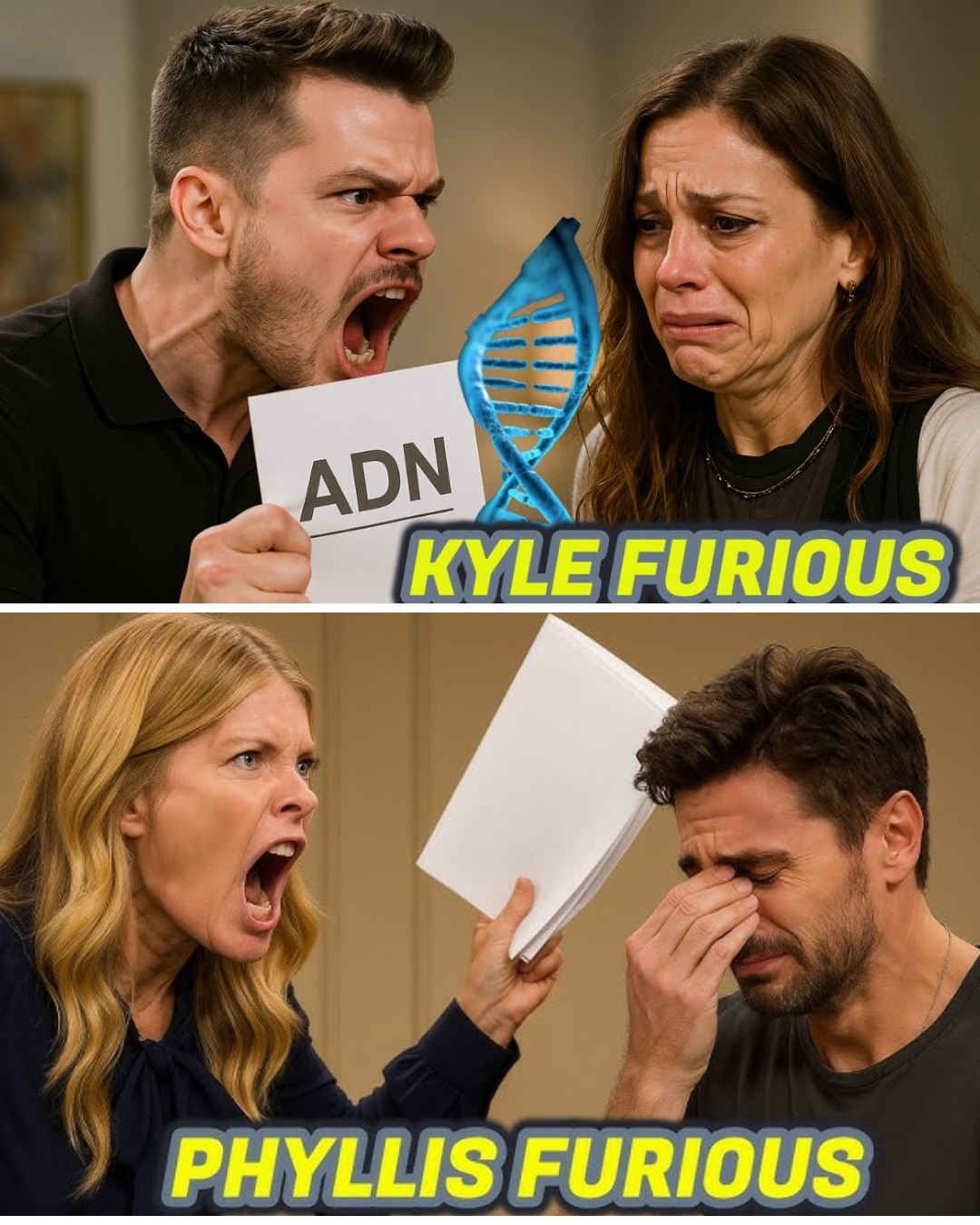

Secrets Unravel in Genoa City: The Young and the Restless Teases a Week of Turmoil and Temptation

The latest episode of The Young and the Restless promises to be nothing short of explosive as Genoa City finds itself engulfed in a storm of secrets, temptation, and psychological drama. As the clock ticks toward October 22, the stakes have never been higher for our favorite characters, each grappling with their own demons while the past refuses to stay buried.

At the center of this whirlwind is Daniel Romelotti, whose loyalty and emotional fortitude are about to be put to the ultimate test. After weeks of working closely with Tessa Porter on her music career relaunch, their friendship takes a perilous turn when Tessa, overwhelmed and intoxicated, leans in for a kiss that ignites a fire of suppressed feelings. The moment is charged with tension as Daniel, caught between right and wrong, must navigate the treacherous waters of desire and responsibility. Will he give in to temptation, or will he choose the path of restraint? The answer could change everything for him and Tessa.

Meanwhile, Mariah Copeland’s world spirals into darkness as she encounters a ghost from her past—Ian Ward, the cult leader who once tormented her. While visiting a Boston clinic, Mariah is haunted by memories and the chilling possibility that Ian may not be as dead as everyone believes. Her mind begins to blur the lines between reality and paranoia, as she finds unsettling signs that suggest she is being watched. As her anxiety deepens, Tessa notices the changes in Mariah, setting the stage for a psychological showdown that could shatter their fragile peace.

Adding to the tension, Nick Newman embarks on a mission to uncover the truth behind Sienna Beall, a mysterious woman linked to his son, Noah. As Nick delves deeper, he uncovers connections that could unravel the very fabric of their family. With each revelation, the stakes rise, leaving viewers on the edge of their seats, questioning how far Nick will go to protect his loved ones.

As these storylines intertwine, the emotional stakes escalate, revealing how past decisions haunt the present. Daniel’s struggle with his feelings for Tessa, Mariah’s paranoia regarding Ian, and Nick’s relentless pursuit of the truth create a tapestry of drama that is both compelling and relatable. Each character must confront their own choices, and as the week unfolds, the consequences of their actions threaten to upend everything they hold dear.

In a parallel narrative, the return of Cain Ashby to the business scene promises to shake things up further. His unexpected alliance with Phyllis Summers raises eyebrows and questions about their true motives. Are they partners in ambition, or is there a deeper agenda at play? As their history of manipulation and rivalry looms over them, viewers are left to wonder what fallout awaits.

Meanwhile, Sharon Newman struggles to keep her family together as she worries about Noah’s fragile mental state. The emotional toll of his selective amnesia weighs heavily on her, and the fear of what may happen when the truth comes crashing down is palpable. As tensions rise, the interconnectedness of these storylines becomes clear, illustrating the theme that in Genoa City, the past is never truly behind you.

As the week progresses, the threads of betrayal, loyalty, and redemption weave a complex narrative that promises to deliver heart-stopping moments and emotional revelations. With each character standing on unstable ground, the question remains: who will survive the storm, and at what cost?

In this gripping installment of The Young and the Restless, viewers can expect a blend of emotional turmoil and thrilling twists that will keep them glued to their screens. Secrets will be unveiled, alliances will be tested, and the consequences of past actions will reverberate throughout Genoa City, proving once again that in this world, nothing is ever as it seems. Buckle up for a week of high-stakes drama that will leave you breathless and craving more.

Mastering Multifamily: The Top 10 U.S. Cities for Savvy Real Estate Investors in 2025

As a seasoned professional with a decade navigating the intricate currents of commercial real estate, I’ve witnessed firsthand the transformative power and enduring stability that multifamily assets can inject into a diversified investment portfolio. The last few years presented a unique cocktail of supply chain disruptions, fluctuating interest rates, and evolving work-live dynamics, creating turbulence across all property sectors. However, as we look ahead to 2025, the multifamily market isn’t just steadying; it’s poised for a strategic resurgence, presenting unparalleled opportunities for discerning investors.

The prevailing expert consensus signals a significant realignment of supply and demand dynamics, setting the stage for robust rent growth and attractive returns. This isn’t merely a hopeful forecast; it’s a data-driven projection supported by stabilizing construction pipelines, continued household formation, and sustained demographic shifts across key regions. For those seeking durable wealth creation and a resilient inflation hedge, now is a critical juncture to strategically position capital within prime multifamily markets. This article delves deep into the economic bedrock, demographic tailwinds, and specific market indicators of the ten U.S. cities I believe offer the most compelling value-add and core investment opportunities for the upcoming year.

Understanding the Multifamily Advantage in 2025

Why multifamily, and why now? The asset class historically demonstrates resilience, offering consistent cash flow properties and a tangible hedge against economic volatility. In 2025, several factors amplify this inherent appeal:

Demographic Imperatives: The sheer volume of millennials entering prime household formation years, coupled with Gen Z gradually forming independent households, ensures a steady demand for rental units. Urban cores and rapidly expanding suburban hubs are primary beneficiaries of these generational shifts.

Economic Diversification: Cities with robust and varied job markets—spanning tech, healthcare, logistics, manufacturing, and finance—are less susceptible to single-industry downturns, translating into stable employment and reliable tenant bases.

Affordability Challenges in Homeownership: Elevated home prices and mortgage rates continue to price many out of the purchase market, maintaining strong demand for high-quality rental housing. This fundamental imbalance supports ongoing rent growth.

Inflationary Pressures: Real estate, particularly income-generating assets like multifamily, acts as a powerful inflation hedge. Rental income typically adjusts upwards with inflation, preserving and enhancing an investor’s purchasing power.

Strategic Capital Deployment: With interest rates stabilizing, access to financing for well-underwritten projects becomes more predictable, enabling strategic acquisitions and value-add multifamily renovations that generate superior returns.

My methodology for identifying these top-tier markets is rigorous, extending beyond superficial metrics to encompass a holistic view of economic health, demographic trends, and localized real estate dynamics. We analyze projected population growth, job creation across diverse sectors, supply pipelines (new construction permits vs. absorption rates), median income versus average rent, local regulatory environments, and, crucially, capitalization rates (Cap Rates) and projected rent growth. These factors collectively illuminate the cities best positioned for sustained appreciation and robust passive income real estate generation in 2025.

The 10 Best Cities for Multifamily Investing in 2025: A Deep Dive

Here are the cities that stand out as prime investment property opportunities for 2025, offering a blend of strong fundamentals, growth potential, and attractive returns.

Las Vegas, Nevada: The Diversification Dynamo

Las Vegas is far more than its glittering reputation suggests; it’s a rapidly diversifying economic hub that has matured significantly over the past decade. Beyond hospitality and entertainment, the city has strategically attracted major players in tech, logistics, manufacturing, and healthcare, creating a resilient job market that continues to draw new residents. The absence of state income tax further bolsters its appeal, driving strong in-migration. For multifamily investors, Las Vegas offers a vibrant blend of sustained population growth and a steady influx of skilled labor seeking accessible housing. The market continues to absorb units at a healthy pace, driven by this economic expansion.

Projected Median Property Price (2025): $435,000

Projected Occupancy Rate (2025): 92.5%

Projected Cap Rate (2025): 5.7%

Projected Price-to-Rent Ratio (2025): 18.5

Projected Average Rent (2025): $1,880

Investment Thesis: Sustained population influx, economic diversification beyond tourism, favorable tax environment, and ongoing demand for affordable quality housing. Ideal for investors targeting strong cash flow properties with solid appreciation potential.

Atlanta, Georgia: The Southern Economic Juggernaut

Atlanta firmly holds its position as a powerhouse of the Southeast, characterized by an exploding population and a remarkably diverse, thriving economy. It’s a magnet for corporate headquarters, a burgeoning tech scene, a major film production hub, and a critical logistics nexus with the world’s busiest airport. This formidable economic engine translates directly into consistent job growth, attracting thousands of new residents quarterly who fuel the demand for rental housing. The cost of living remains comparatively attractive, ensuring that Atlanta’s multifamily market sustains robust absorption rates even with new supply. Investors keen on high-growth urban centers with substantial long-term economic momentum will find Atlanta irresistible.

Projected Median Property Price (2025): $415,000

Projected Occupancy Rate (2025): 89.5%

Projected Cap Rate (2025): 5.8%

Projected Price-to-Rent Ratio (2025): 16.5

Projected Average Rent (2025): $1,680

Investment Thesis: Deep and diversified job market, exceptional population growth, strategic logistical importance, and strong corporate relocations driving sustained demand for quality rental housing. Excellent for core-plus and value-add strategies.

Charlotte, North Carolina: The Carolina’s Crown Jewel

Charlotte continues its ascent as one of the nation’s most dynamic multifamily markets. Fueled by explosive population growth and a robust, diversified economy, the Queen City is a prime destination for real estate investing. As a prominent banking and finance hub, Charlotte boasts a high concentration of professional jobs, attracting a skilled workforce. Beyond finance, sectors like healthcare, energy, and technology are rapidly expanding, underpinning a strong, stable renter base. The city offers an appealing quality of life at a relatively moderate cost compared to other major metros, making it highly attractive to new residents. The consistent demand, coupled with thoughtful urban planning, supports healthy occupancy and rent appreciation.

Projected Median Property Price (2025): $390,000

Projected Occupancy Rate (2025): 93.0%

Projected Cap Rate (2025): 5.6%

Projected Price-to-Rent Ratio (2025): 17.5

Projected Average Rent (2025): $1,860

Investment Thesis: Dominant financial sector, strong job creation across multiple industries, compelling in-migration, and a high quality of life underpinning consistent rental demand. A solid choice for long-term wealth creation real estate.

Tampa, Florida: The Sunshine State’s Growth Engine

Tampa’s multifamily market is riding a wave of unprecedented growth, making it a standout in 2025. Florida’s well-known advantages—no state income tax and favorable business policies—continue to attract both corporations and individuals seeking a vibrant lifestyle and economic opportunity. Tampa’s economy is exceptionally diversified, with significant strength in healthcare, finance, tech, and logistics. The city’s strategic location on the Gulf Coast and ongoing infrastructure improvements further enhance its appeal. This potent combination drives relentless population growth, ensuring a deep pool of renters. The long-term outlook for Tampa remains overwhelmingly positive, making it a reliable destination for multifamily investment.

Projected Median Property Price (2025): $380,000

Projected Occupancy Rate (2025): 91.0%

Projected Cap Rate (2025): 5.6%

Projected Price-to-Rent Ratio (2025): 14.5

Projected Average Rent (2025): $1,875

Investment Thesis: Robust population migration, diversified and expanding job market, no state income tax, and strong tenant demand for coastal living. Excellent for investors seeking high-yield real estate in a growth market.

Denver, Colorado: The Mile-High Magnet

Denver maintains its position as a compelling market for multifamily investors, driven by a resilient economy and an enduring appeal to a young, educated workforce. The city’s economic foundation is robust, with significant sectors in tech, aerospace, healthcare, and energy. This diversification ensures steady job growth and attracts a continuous stream of new residents drawn by career opportunities and the famed outdoor lifestyle. While property values are higher, Denver consistently demonstrates strong absorption rates, indicating that demand continues to outpace new supply. Strategic property management strategies are key here, focusing on appealing amenities and efficient operations to capture and retain the desirable renter demographic.

Projected Median Property Price (2025): $600,000

Projected Occupancy Rate (2025): 90.5%

Projected Cap Rate (2025): 5.3%

Projected Price-to-Rent Ratio (2025): 22.5

Projected Average Rent (2025): $1,890

Investment Thesis: High-wage job growth, strong quality of life attracting skilled labor, and consistent demand for urban and suburban multifamily growth. Offers stable long-term appreciation for well-located assets.

Nashville, Tennessee: The Dynamic Music City

Nashville continues its impressive multi-year run as a top-tier market for multifamily investment. The city’s dynamic economy extends far beyond its iconic music industry, encompassing a rapidly expanding healthcare sector, a burgeoning tech scene, and significant automotive manufacturing presence. This economic vitality translates into exceptional job growth, drawing a continuous stream of new residents to the region. Tennessee’s lack of state income tax is a significant draw, contributing to favorable migration patterns. Nashville’s cultural vibrancy and strong community appeal make it a highly desirable place to live, supporting consistent demand for rental housing across all submarkets. Investors here can capitalize on both appreciation and strong rental income.

Projected Median Property Price (2025): $470,000

Projected Occupancy Rate (2025): 89.5%

Projected Cap Rate (2025): 5.7%

Projected Price-to-Rent Ratio (2025): 19.5

Projected Average Rent (2025): $1,975

Investment Thesis: Rapidly diversifying economy (healthcare, tech, automotive), strong cultural appeal, no state income tax, and sustained population influx driving rental demand. Ideal for strategic multifamily acquisition targeting growth.

San Diego, California: The Coastal Opportunity

San Diego’s multifamily market thrives on a powerful combination of constrained supply and insatiable demand. Strict zoning regulations and high development costs create significant barriers to entry, limiting new construction and ensuring existing properties hold substantial value. Meanwhile, the region’s population continues its steady growth, fueled by robust industries like biotechnology, defense, tourism, and innovation. The high quality of life, favorable climate, and abundant amenities attract a consistently affluent renter base willing to pay premium rents. While initial entry costs are higher, San Diego offers a unique market where supply-side limitations provide a strong floor for property values and support robust rent growth. This market is a testament to the power of scarcity.

Projected Median Property Price (2025): $900,000

Projected Occupancy Rate (2025): 96.0%

Projected Cap Rate (2025): 4.7%

Projected Price-to-Rent Ratio (2025): 23.5

Projected Average Rent (2025): $2,600 – $3,100

Investment Thesis: High barriers to entry creating limited supply, strong economic drivers, affluent renter demographic, and consistent demand supporting premium rental rates and capital appreciation. A prime target for sophisticated commercial real estate investment.

Salt Lake City, Utah: “Silicon Slopes” Ascendant

Salt Lake City has emerged as a significant player on the national economic stage, often dubbed “Silicon Slopes” due to its burgeoning tech sector. This vibrant metropolitan area benefits from a young, educated, and growing workforce, alongside a highly diversified economy that includes healthcare, finance, and manufacturing. The city offers an attractive blend of urban amenities and unparalleled access to outdoor recreation, drawing talent and businesses alike. The multifamily market here benefits from steady in-migration and strong household formation, creating consistent demand for quality rental housing. With a balanced regulatory environment and ongoing infrastructure improvements, Salt Lake City presents a compelling case for investors seeking long-term growth and stability.

Projected Median Property Price (2025): $540,000

Projected Occupancy Rate (2025): 95.0%

Projected Cap Rate (2025): 5.6%

Projected Price-to-Rent Ratio (2025): 25.0

Projected Average Rent (2025): $1,750

Investment Thesis: Rapidly growing tech industry, young and educated demographic, high quality of life, and balanced economic growth fueling robust rental demand. Excellent for diversified real estate portfolio strategies.

Columbus, Ohio: The Midwest’s Emerging Powerhouse

Columbus is carving out a reputation as one of the most exciting emerging real estate markets in the Midwest. This vibrant capital city strikes an attractive balance between solid economic growth and compelling affordability, a combination that is increasingly rare in major U.S. metros. Anchored by Ohio State University, a major research institution, Columbus benefits from a constant infusion of talent and innovation. Its economy is well-diversified, spanning education, healthcare, logistics, and a burgeoning tech sector. The city’s progressive urban planning and investment in infrastructure further enhance its appeal to both residents and businesses. For multifamily investors, Columbus offers an accessible entry point with strong upside potential, driven by consistent job creation and a growing population.

Projected Median Property Price (2025): $290,000

Projected Occupancy Rate (2025): 93.0%

Projected Cap Rate (2025): 6.9%

Projected Price-to-Rent Ratio (2025): 15.5

Projected Average Rent (2025): $1,580

Investment Thesis: Strong affordability, major university presence, diversified economy, and consistent population growth, offering high-yield real estate opportunities and a promising outlook for capital appreciation.

Dallas, Texas: The Megacity of Opportunity

Dallas stands as one of the nation’s largest and most consistently robust apartment markets. Its sheer scale and relentless economic expansion make it a perennial favorite for multifamily investors. The Dallas-Fort Worth metroplex is a magnet for corporate relocations, consistently ranking among the top U.S. cities for job growth. Key industries include finance, technology, logistics, and energy, ensuring a deep and diversified employment base. Coupled with Texas’s advantageous lack of state income tax, Dallas continues to attract a significant influx of residents from other states, fueling a powerful and sustained demand for rental housing. The market offers ample opportunities across various asset classes, from urban core development to rapidly expanding suburban multifamily growth corridors.

Projected Median Property Price (2025): $405,000

Projected Occupancy Rate (2025): 90.0%

Projected Cap Rate (2025): 5.3%

Projected Price-to-Rent Ratio (2025): 18.5

Projected Average Rent (2025): $1,870

Investment Thesis: Massive scale, unparalleled job growth, continuous corporate relocations, no state income tax, and deep liquidity across all multifamily submarkets. An anchor for any serious real estate investment portfolio.

Seizing the 2025 Multifamily Moment

The outlook for multifamily real estate investing in 2025 is unequivocally positive, marking a strategic inflection point for those ready to capitalize on a rebalancing market. The cities highlighted above represent the pinnacle of opportunity, each offering unique strengths rooted in robust economic fundamentals, favorable demographic trends, and attractive return profiles.

Investing in multifamily is more than just acquiring property; it’s about making informed decisions that contribute to long-term financial security and portfolio diversification. While these markets present immense potential, success hinges on meticulous due diligence, understanding local nuances, and executing a well-defined investment strategy. As an experienced guide in this landscape, I emphasize the importance of partnering with professionals who possess deep market intelligence and a proven track record. The trajectory of your investment journey in 2025 will be defined by the quality of your insights and the strength of your partnerships.

Ready to unlock these lucrative opportunities and strategically enhance your real estate portfolio? Connect with seasoned professionals who can provide tailored market analysis, identify prime multifamily investment opportunities, and guide your next strategic acquisition to build lasting wealth. Your informed journey into profitable real estate begins now.

![CBS FULL [10/22/2025] — Y&R Spoilers EXPLODE! Daniel’s Temptation… Tessa’s Kiss… and a Secret That Could Burn Genoa City Down!](https://usnews.themtraicay.com/wp-content/uploads/2025/10/30-6.jpg)