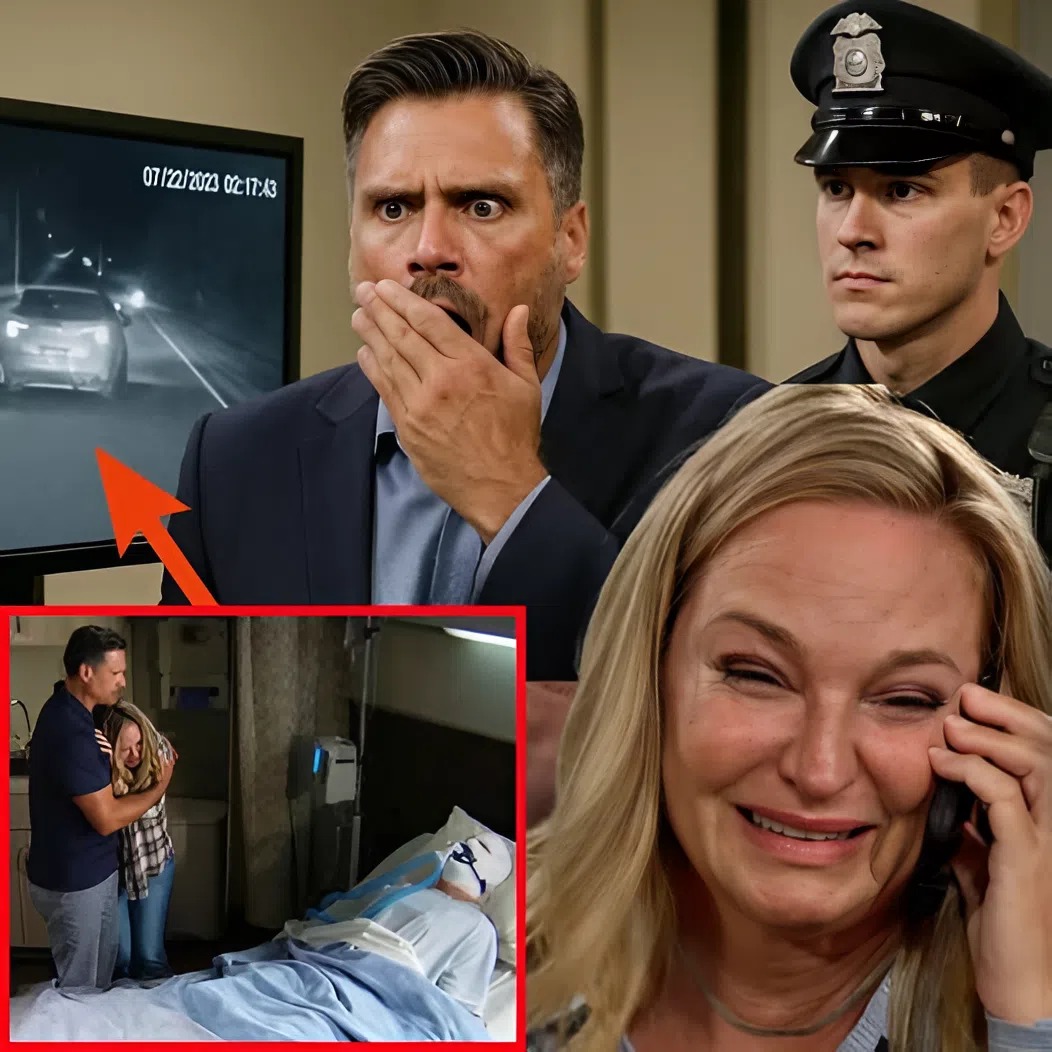

Tragedy strikes in Genoa City as Noah Newman lies in a coma following a mysterious accident that has left his family reeling. In an emotional hospital scene, his mother, Sharon Newman, is devastated, praying for her son’s survival as he battles for life. With Noah’s prognosis grim, his father, Nick Newman, is not convinced that this was merely an accident.

As tensions rise, Nick is determined to uncover the truth behind the events that led to Noah’s critical condition. He has urged local police to extract surveillance footage from nearby homes, suspecting foul play. The investigation has revealed alarming evidence: an unfamiliar car was seen in the vicinity just before the incident, and the driver fled the scene. Nick’s instincts scream that this was no accident, but a calculated attack on his son.

Sharon, grappling with her own heartbreak, fears that Noah’s recent troubles at the nightclub may be linked to this shocking turn of events. She recalls his recent struggles and stress, sensing that something darker loomed over her son. Could Noah have been involved in something more sinister? With every passing hour, the uncertainty grows, and the stakes become higher.

As the family waits anxiously for updates from doctors, the emotional weight is palpable. Nick and Sharon, despite their complicated past, find themselves united in their fight for Noah’s life. The hospital room is filled with despair, but also a flicker of hope. They cling to the belief that if Noah wakes up, they can confront whatever challenges lie ahead together.

In a poignant moment, Sharon breaks down, overwhelmed by the reality of the situation. Nick, feeling the weight of their shared grief, reassures her that they must remain strong for Noah. But as they face the possibility of losing their son, questions loom large: Was Noah’s accident truly an accident? Who would want to harm him?

With the police investigation underway, the urgency intensifies. Time is of the essence as Nick seeks answers, desperate to protect his son from any further danger. Meanwhile, Sharon’s heart aches as she watches her son, bandaged and vulnerable, lying in the hospital bed.

The community holds its breath, waiting for news. Will Noah survive this harrowing ordeal? As the family navigates the storm of emotions and uncertainty, one thing is clear: the fight for Noah’s life is just beginning, and the quest for truth may reveal shocking secrets that could change everything.

Stay tuned as this developing story unfolds. The fate of Noah Newman hangs in the balance, and the search for justice is only just beginning.

Navigating the 2025 Multifamily Real Estate Landscape: Top Cities for Strategic Investment

After a decade immersed in the intricacies of the commercial real estate market, particularly the multifamily sector, I can confidently say that 2025 presents a unique and compelling opportunity for discerning investors. The multifamily asset class, often lauded for its resilience and ability to provide a consistent income stream, has certainly weathered its share of market fluctuations. However, as we look ahead to 2025, the stars are aligning for a significant resurgence, driven by rebalancing supply-demand dynamics and persistent demographic shifts. This isn’t just about finding properties; it’s about identifying strategic urban ecosystems poised for exponential growth.

The past few years saw an influx of new construction in certain metros, creating temporary imbalances, while interest rate hikes tempered some of the feverish activity. Yet, the fundamental drivers of rental demand remain robust. Population growth continues, household formation rates are strong, and the dream of homeownership remains a distant reality for many, cementing the rental market’s enduring strength. My analysis for 2025 suggests a landscape where rental growth will stabilize and accelerate in key markets, offering attractive yields and long-term capital appreciation for those who invest wisely.

Successful multifamily real estate investment hinges on far more than just attractive cap rates or immediate cash flow. It demands a holistic understanding of local economic resilience, demographic shifts, regulatory environments, and the overall quality of life a city offers its residents. Investors looking to diversify their real estate portfolio and secure passive income streams must delve deep into market fundamentals, identifying areas with sustainable job growth, expanding infrastructure, and a palpable sense of community and opportunity. This comprehensive approach is what separates transient gains from generational wealth creation.

For those ready to capitalize on the unfolding opportunities in 2025, strategic market selection is paramount. My research, drawing on extensive data analysis and on-the-ground observations from my years in the field, points to ten specific metropolitan areas that are not just trending but possess the underlying economic fortitude and demographic momentum to deliver superior risk-adjusted returns in the multifamily space. These cities represent diverse regional strengths, but all share common threads: robust job markets, burgeoning populations, and a continued appeal to a wide spectrum of renters. Here’s a detailed look at the prime locations for your multifamily investment strategy in the coming year.

The Top 10 High-Growth Cities for Multifamily Investment in 2025

Identifying the best cities for real estate investment means understanding your investing goals and taking a deep dive into the multifamily real estate market. The following cities stand out as prime candidates for acquiring investment property in 2025, each presenting unique advantages and a compelling investment thesis.

Las Vegas, Nevada: Beyond the Glitz, a Robust Economic Engine

Las Vegas has transcended its reputation as merely a gambling mecca, evolving into a diversified economic powerhouse with substantial growth potential for multifamily investors. Over the past decade, I’ve witnessed firsthand its transformation. The city is experiencing significant inward migration, particularly from California, driven by its relatively lower cost of living, business-friendly environment, and no state income tax. The diversification of its economy into tech, healthcare, and advanced manufacturing sectors has created a stable job market, attracting a diverse tenant base. Infrastructure projects and ongoing urban development initiatives are further enhancing its appeal.

Key 2025 Multifamily Projections:

Median Property Price: $417,000

Occupancy Rate: 91%

Cap Rate: 5.5-6.0%

Price-to-Rent Ratio: 19.2

Average Rent: $1,800

These metrics highlight a market with strong demand and healthy rental income potential, supporting consistent cash flow properties. The favorable cap rate signals attractive yields compared to many coastal markets.

Atlanta, Georgia: The Southern Juggernaut of Growth

Atlanta continues its reign as one of the nation’s most dynamic urban centers, offering an incredibly fertile ground for multifamily real estate investment. Its booming economy is propelled by a diverse array of industries, including logistics (Hartsfield-Jackson Atlanta International Airport), technology, film production, and corporate headquarters. The city’s extensive transportation network and status as a major regional hub draw continuous population inflow, leading to sustained demand for rental housing across all asset classes. Atlanta’s relative affordability compared to other major metropolitan areas, coupled with a vibrant cultural scene and a highly educated workforce, makes it incredibly attractive to both businesses and residents.

Key 2025 Multifamily Projections:

Median Property Price: $400,000

Occupancy Rate: 88%

Cap Rate: 5.6%

Price-to-Rent Ratio: 16.0

Average Rent: $1,600

Atlanta’s robust absorption rates and healthy price-to-rent ratio suggest a market poised for strong rental income stability and potential for future appreciation in property values.

Charlotte, North Carolina: Banking on Expansion

Charlotte has firmly established itself as a premier destination for multifamily investors, driven by exceptional population growth and a robust, diversified economy. As a major financial hub, second only to New York City, it boasts a powerful job market attracting young professionals and families. Beyond finance, Charlotte is seeing significant expansion in healthcare, energy, and technology sectors. The city’s proactive approach to urban planning and infrastructure development, coupled with its appealing quality of life, fuels sustained demand for high-quality rental units. This market exhibits all the hallmarks of a sustainable high-growth environment for apartment complex investments.

Key 2025 Multifamily Projections:

Median Property Price: $375,000 – $400,000

Occupancy Rate: 92%

Cap Rate: 5.5%

Price-to-Rent Ratio: 17.0 – 18.0

Average Rent: $1,800

Charlotte’s high occupancy rate and competitive cap rate underscore its stability and strong appeal for both value-add opportunities and core investment strategies.

Tampa, Florida: Sunshine, Growth, and Investor Appeal

Tampa’s multifamily market is experiencing an extraordinary surge, making it a compelling choice for investors in 2025. Florida’s attractive tax environment (no state income tax) and moderate property taxes are powerful magnets for both businesses and individuals seeking relocation. Tampa’s economy is highly diversified, with strong sectors in healthcare, finance, logistics, and tourism, creating a broad base of employment opportunities. The city consistently ranks among the fastest-growing metros in the U.S., translating directly into sustained demand for rental housing. Its coastal appeal, coupled with ongoing revitalization efforts, ensures a positive long-term outlook for real estate portfolio diversification.

Key 2025 Multifamily Projections:

Median Property Price: $367,000

Occupancy Rate: 90%

Cap Rate: 5.5%

Price-to-Rent Ratio: 14.0

Average Rent: $1,800

The particularly attractive price-to-rent ratio in Tampa signals strong affordability relative to rental income, making it a lucrative market for cash flow-focused investors.

Denver, Colorado: High-Altitude Opportunities

Denver’s economy and population continue to climb, showcasing remarkable resilience and growth potential. This vibrant city has become a major magnet for tech companies and startups, earning its moniker “Silicon Mountain.” Its highly educated workforce, combined with an unparalleled outdoor lifestyle, attracts significant numbers of young professionals. While property prices are higher than some other markets on this list, the robust job growth and high absorption rates for multifamily units demonstrate strong, consistent demand. For investors seeking appreciation and exposure to a dynamic, forward-thinking economy, Denver offers compelling commercial property analysis opportunities.

Key 2025 Multifamily Projections:

Median Property Price: $586,000

Occupancy Rate: 89.5%

Cap Rate: 5.2%

Price-to-Rent Ratio: 23.0

Average Rent: $1,800

Despite a slightly lower cap rate compared to other growing markets, Denver’s strong demand fundamentals and consistent tenant base indicate robust investment stability and long-term appreciation potential.

Nashville, Tennessee: The Resonant Growth Story

Nashville, often celebrated as Music City, has consistently proven its mettle as one of the best cities for real estate investment for several consecutive years. Its appeal extends far beyond its legendary music scene, with significant growth in healthcare (it’s a national healthcare hub), technology, and automotive manufacturing. The city benefits from a low cost of doing business, no state income tax, and a vibrant cultural identity that attracts new residents at an impressive rate. This combination fuels robust tenant demand, leading to high occupancy rates and consistent rental revenue streams for apartment complex investors.

Key 2025 Multifamily Projections:

Median Property Price: $455,000

Occupancy Rate: 88%

Cap Rate: 5.5%

Price-to-Rent Ratio: 19.0

Average Rent: $1,900

Nashville’s strong rental market trends and healthy cap rate make it a perennial favorite for those seeking high-yield real estate investments with strong growth prospects.

San Diego, California: A Coastal Gem with Enduring Demand

San Diego’s multifamily market operates under a unique set of conditions that make it an attractive, albeit premium, investment locale. The region benefits from intrinsically limited supply due to strict zoning laws and geographical constraints, while demand remains exceptionally strong. Its diverse economy is anchored by booming biotech and life sciences sectors, a significant military presence, robust tourism, and an expanding tech scene. Despite higher property valuations, the consistent influx of high-wage earners and a highly desirable quality of life ensure sustained tenant demand and low vacancy rates. This market is ideal for investors prioritizing long-term capital appreciation and stability in a supply-constrained environment.

Key 2025 Multifamily Projections:

Median Property Price: $876,000

Occupancy Rate: 95%

Cap Rate: 4.6%

Price-to-Rent Ratio: 24.0

Average Rent: $2,500 – $3,000

San Diego’s remarkably high occupancy rate, despite a lower cap rate, speaks to its premium status and the enduring, inelastic demand for rental properties in this desirable market.

Salt Lake City, Utah: Silicon Slopes’ Ascendancy

Salt Lake City has emerged as a formidable player in the technology sector, often dubbed “Silicon Slopes,” drawing a young, educated workforce and considerable corporate investment. Its robust economy, coupled with a strong job market across various industries, fuels consistent population growth. The city offers an exceptional quality of life, with access to world-class outdoor recreation, while maintaining a more affordable cost of living compared to traditional tech hubs. This unique blend creates a dynamic multifamily market with high absorption rates and a strong appeal for both residents and investors seeking sustainable growth in rental income stability.

Key 2025 Multifamily Projections:

Median Property Price: $526,000

Occupancy Rate: 94%

Cap Rate: 5.5%

Price-to-Rent Ratio: 25.0 – 26.0

Average Rent: $1,700

Salt Lake City’s high occupancy and healthy cap rate highlight its strong investment potential, driven by a burgeoning tech scene and a young, growing population base.

Columbus, Ohio: The Midwest’s Rising Star

Columbus stands out as an increasingly attractive emerging market in the Midwest for multifamily investors. It masterfully balances solid economic growth with remarkable affordability, a combination that is becoming increasingly rare. The city boasts a diverse economy with strengths in education (home to Ohio State University), healthcare, technology, and logistics. This diversity creates a stable job market and attracts a consistent stream of new residents. Columbus’s pro-business environment and ongoing urban revitalization projects further enhance its appeal, positioning it as an excellent option for long-term passive income real estate investments with significant upside potential.

Key 2025 Multifamily Projections:

Median Property Price: $277,000

Occupancy Rate: 92%

Cap Rate: 6.8%

Price-to-Rent Ratio: 15.0

Average Rent: $1,530

Columbus offers one of the most compelling value propositions on this list, with an exceptionally high cap rate and low price-to-rent ratio, signaling strong cash flow opportunities and attractive entry points for investors.

Dallas, Texas: The Colossus of Opportunity

Dallas continues to be one of the nation’s largest and most dynamic apartment markets, anchoring a sprawling metropolitan area that consistently attracts businesses and residents. Its diversified job growth spans finance, technology, professional services, healthcare, and logistics, creating an exceptionally broad and resilient economic base. Like other Texas metros, Dallas benefits from no state income tax, making it a magnet for corporate relocations and individual migration. The sheer scale of its market, combined with ongoing population expansion and a business-friendly regulatory environment, ensures sustained demand for multifamily housing. For investors seeking robust growth and the opportunity for significant scale, Dallas remains a top-tier choice for multifamily investment strategies.

Key 2025 Multifamily Projections:

Median Property Price: $390,000

Occupancy Rate: 89%

Cap Rate: 5.0 – 5.5%

Price-to-Rent Ratio: 18.0

Average Rent: $1,800

Dallas’s consistent performance, large market size, and diversified economic base provide a strong foundation for both immediate rental income and long-term capital appreciation in a real estate portfolio.

The multifamily sector in 2025 is primed for strategic investment, offering both stability and significant growth potential. The cities outlined above represent the pinnacle of opportunity, each supported by robust economic fundamentals, favorable demographic trends, and a resilient rental market. As an expert who has navigated these waters for a decade, my advice remains clear: thorough due diligence, a keen understanding of local market nuances, and a long-term perspective are your most valuable assets. These markets are not just places to buy property; they are thriving ecosystems where astute multifamily investment strategies can yield substantial and enduring returns.

The journey into profitable multifamily real estate in 2025 begins with informed choices and decisive action. Equip yourself with knowledge, conduct thorough due diligence, and position your portfolio for unparalleled growth in these dynamic markets. Your next significant investment opportunity awaits.