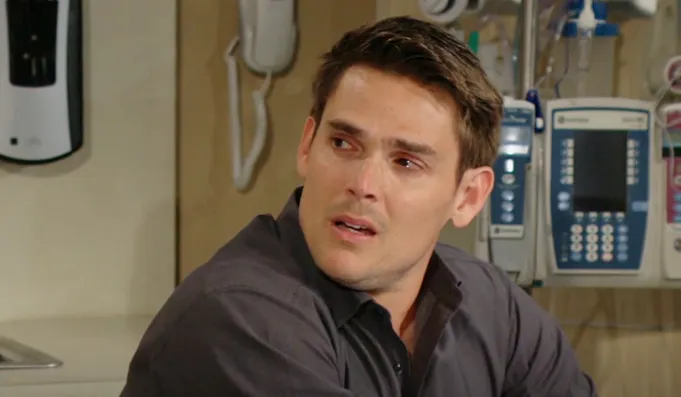

Get ready, Young and the Restless fans—this next chapter will leave you heartbroken. In an episode packed with raw emotion, shattered trust, and painful choices, Adam Newman’s world collapses in a way that will change him—and everyone around him—forever.

The story opens with a haunting silence inside Newman Tower. Adam, usually so composed and calculating, sits alone in his office, staring at a file he can’t bring himself to open. His hands shake, his eyes are hollow. Something inside him has broken. In just a few short days, he’s lost nearly everything that kept him grounded—his love, his family’s trust, and now, possibly, his future at Newman Enterprises.

The story opens with a haunting silence inside Newman Tower. Adam, usually so composed and calculating, sits alone in his office, staring at a file he can’t bring himself to open. His hands shake, his eyes are hollow. Something inside him has broken. In just a few short days, he’s lost nearly everything that kept him grounded—his love, his family’s trust, and now, possibly, his future at Newman Enterprises.

It all began with a mistake that Adam never intended to make, a choice born out of desperation and pride. His fragile truce with Sally Spectra has been crumbling for weeks. What was once a passionate, defiant love affair has turned into a battlefield of blame and regret. Sally, tired of living in Adam’s shadow and haunted by the loss of their child, finally tells him she’s done. “You can’t save me,” she whispers, tears running down her face. “You can’t even save yourself.”

Those words cut deeper than anything Adam has ever heard. For a moment, he doesn’t fight back—he just lets her go. And that’s when everything starts to unravel.

Meanwhile, the Newman family is once again divided. Victor, ever the patriarch, grows tired of Adam’s defiance and impulsive decisions. He calls a family meeting, and for once, even Nick and Victoria agree—Adam has gone too far. The company can’t survive another scandal, not with the press circling after Adam’s latest business gamble. In a shocking move, Victor announces that Adam will be stepping down from his position at Newman Media, effective immediately.

Adam’s reaction is explosive. “You’re firing your own son?” he yells, but Victor’s expression doesn’t waver. “I’m saving this family,” he replies coldly. The confrontation ends with Adam storming out, his pride shattered.

Later that evening, Adam returns to his penthouse—dark, empty, and silent. His reflection in the window stares back at him, a reminder of every wrong turn he’s ever taken. The memories flood in—his constant need for validation, his battles for power, his endless attempts to win his father’s approval. Each one feels meaningless now.

The heartbreak deepens when he discovers that Sally has already packed her things and left Genoa City. She doesn’t answer his calls, doesn’t leave a note—just silence. It’s the final blow to a man who’s already on the edge. Alone in his apartment, Adam finally collapses, whispering to himself, “I’ve lost everything.”

The next scenes move between Adam’s quiet breakdown and the reactions of those who once loved him. Chelsea, hearing the news, can’t hide her concern. “He’s not okay,” she tells Billy, fearing that Adam might spiral back into the darkness he once fought so hard to escape. Nick tries to convince himself that this is what Adam deserves—but even he looks troubled. Deep down, he knows his brother’s pain all too well.

Meanwhile, Victor struggles with guilt. For all his strength and authority, the look in his eyes betrays regret. He didn’t just remove Adam from the company; he might have pushed him out of the family for good. “He’ll come back stronger,” Victor insists to Nikki, but his tone lacks conviction. Nikki, ever the voice of empathy, warns him, “You may have just broken your son’s heart for the last time.”

Days pass, and the tension across Genoa City grows. Rumors spread that Adam has disappeared, that he’s left town without a word. Sally is seen crying at Society, whispering to Chloe that she wishes she could have stopped him. “He looked lost,” she says, “like he didn’t know where he belonged anymore.”

When Adam finally reappears, he’s not the same man. His usual sharp confidence is gone, replaced by quiet exhaustion. He visits the Newman Ranch, not to beg, but to say goodbye. “You don’t have to worry about me anymore,” he tells Victor softly. “You got what you wanted. I’m done fighting.”

Victor’s stoic mask falters for just a second, but he doesn’t stop Adam from leaving. Watching his son walk away for what might be the last time, he feels something unfamiliar—fear. Fear that this time, Adam won’t come back.

The episode ends with Adam standing at the edge of Genoa City, the skyline behind him. He looks out over the water, reflecting on everything he’s lost—the love, the power, the family name. His voice breaks as he whispers, “Maybe it’s time I stop being a Newman.”

The screen fades to black as a soft piano theme plays, leaving viewers stunned. Has Adam truly given up, or is this the calm before a darker storm?

Whatever comes next, one thing is certain: this heartbreaking episode of The Young and the Restless will shake fans to their core. Adam Newman’s fall from grace isn’t just bad—it’s tragic. And for the first time, it’s not about revenge or redemption. It’s about a man realizing that even in a world built on power and pride, love lost can destroy everything.

Mastering Multifamily: The 10 Most Strategic U.S. Cities for Real Estate Investment in 2025

As an investor who has navigated the multifaceted world of real estate for over a decade, I’ve witnessed market cycles shift, sentiments ebb and flow, and opportunities emerge from unexpected corners. The multifamily sector, in particular, has always been a cornerstone of stability and growth for a well-diversified portfolio, offering a crucial hedge against inflation and a consistent stream of passive income. While the past few years certainly presented their share of turbulence – a dizzying dance of supply-demand imbalances, rising interest rates, and evolving tenant preferences – 2025 is poised to herald a significant realignment, setting the stage for some of the most compelling multifamily investment opportunities we’ve seen in years.

This isn’t merely a prediction; it’s an informed perspective rooted in granular data and a deep understanding of macroeconomic trends. Experts across the industry are signaling a return to positive rent growth, driven by a normalization of construction pipelines and sustained demographic tailwinds. For those looking to capitalize on this impending resurgence and build substantial long-term real estate wealth, the time to act is now. But the critical question, as always, isn’t just if to invest, but where. Identifying the best cities for real estate investment requires a sophisticated blend of data analysis, forward-looking insights, and an appreciation for the unique economic fabric of each metropolitan area.

Our deep dive into the 2025 landscape unveils a meticulously curated list of markets poised for exceptional performance in high-yield multifamily properties. We’ve sifted through countless metrics, scrutinizing occupancy rates, dissecting price-to-rent ratios, analyzing cap rate trends, and forecasting rental income projections to pinpoint where your capital can achieve optimal returns and contribute to your real estate portfolio diversification. Forget the noise; this is about strategic precision.

The Realigning Landscape of 2025: Why Multifamily is Primed for Growth

The narrative for multifamily real estate in 2025 is one of cautious optimism, underpinned by several key drivers. Firstly, the interest rate environment, while still subject to Federal Reserve actions, is anticipated to stabilize, making debt financing for acquisitions more predictable and potentially more attractive. This clarity on capital costs is a significant boon for investors. Secondly, persistent housing affordability challenges continue to push a growing segment of the population towards renting, ensuring robust rental demand forecasts. Rising home prices and elevated mortgage rates mean that for many, homeownership remains an elusive dream, cementing the renter-by-choice and renter-by-necessity pools.

Furthermore, demographic shifts are providing a powerful tailwind. Millennials, now in their prime earning and household-forming years, along with an increasingly independent Gen Z, are driving significant demand for modern, amenity-rich rental units, particularly in urban and suburban cores that offer a blend of lifestyle and connectivity. The “return to office” trend, while not universal, is also revitalizing downtown areas and increasing demand in central business districts, influencing both urban and suburban multifamily dynamics.

Finally, supply-side adjustments are occurring. While some markets experienced an oversupply of new units in recent years, particularly in certain Sun Belt metros, construction starts are moderating, allowing demand to catch up. This rebalancing is crucial for sustained rent growth and healthy property appreciation trends. In essence, 2025 offers a window where the foundational elements for strong cash flow real estate opportunities are converging.

Our Methodology: Identifying 2025’s Multifamily Powerhouses

My selection criteria go beyond mere statistics; they encompass a holistic view of a market’s health and future trajectory. We prioritize cities demonstrating:

Robust Job Growth & Economic Diversification: Markets with expanding employment opportunities across multiple sectors attract and retain residents, translating into stable tenant pools.

Positive Population Migration: Cities experiencing net inward migration are inherently attractive, driving demand for housing.

Favorable Supply-Demand Dynamics: A healthy balance, or even slight undersupply, ensures pricing power for landlords.

Affordability & Quality of Life: A good mix of reasonable cost of living and desirable lifestyle factors makes a city sticky for residents.

Infrastructure Investment: Ongoing investments in transportation, education, and public amenities signal long-term commitment and growth potential.

Investor-Friendly Environment: Local policies and tax structures that support real estate investment are always a plus.

Here are the 10 cities that stand out as prime targets for commercial real estate opportunities in 2025:

The 10 Best Cities for Multifamily Investing in 2025

Las Vegas, Nevada

Often seen through the lens of entertainment, Las Vegas has quietly matured into a dynamic economic hub, attracting significant investment in technology, logistics, and professional services. This diversification, coupled with Nevada’s attractive tax environment and relatively affordable cost of living compared to coastal California, continues to fuel an influx of residents. For 2025, Las Vegas remains a formidable market, demonstrating resilience and sustained tenant demand. Its robust occupancy rates reflect this underlying strength, making it a reliable bet for high-yield rental properties.

Median Property Price (2025 est.): $425,000

Occupancy Rate (Q1 2025 est.): 91.5%

Cap Rate (2025 est.): 5.7-6.2%

Price-to-Rent Ratio (2025 est.): 19.0

Average Rent (2025 est.): $1,850

Atlanta, Georgia

Atlanta continues its meteoric rise as a powerhouse in the Southeast, boasting a booming economy driven by tech, film, logistics, and corporate relocations. The city’s expansive metropolitan area offers diverse submarket opportunities, from urban core development to sprawling suburban communities. With a steady stream of new residents relocating for job opportunities and a lower cost of living relative to other major metros, Atlanta consistently absorbs thousands of new units each quarter. Its cap rate analysis remains compelling, making it a magnet for multifamily investment strategies.

Median Property Price (2025 est.): $415,000

Occupancy Rate (Q1 2025 est.): 89.0%

Cap Rate (2025 est.): 5.8%

Price-to-Rent Ratio (2025 est.): 16.5

Average Rent (2025 est.): $1,680

Charlotte, North Carolina

Charlotte embodies the quintessential high-growth Southern city, propelled by its status as a major financial hub and rapidly expanding tech sector. The city’s strong population growth translates directly into sustained demand for rental housing. Investing in Charlotte’s multifamily market in 2025 offers access to a vibrant economic ecosystem, excellent quality of life, and ongoing infrastructure development. The consistent demand coupled with a healthy price-to-rent ratio insights solidifies its position as a top-tier market for passive income through real estate.

Median Property Price (2025 est.): $390,000

Occupancy Rate (Q1 2025 est.): 92.5%

Cap Rate (2025 est.): 5.6%

Price-to-Rent Ratio (2025 est.): 17.5

Average Rent (2025 est.): $1,850

Tampa, Florida

Florida’s attractiveness to both residents and investors, buoyed by no state income tax and favorable property tax structures, positions Tampa as a long-term winner. The city’s diversified economy, spanning healthcare, finance, tourism, and growing tech industries, provides a robust foundation. Tampa continues to experience rapid population growth, driven by retirees, remote workers, and young professionals seeking a coastal lifestyle without exorbitant costs. The market cycle analysis suggests Tampa remains on an upward trajectory for urban development investments and suburban expansions.

Median Property Price (2025 est.): $375,000

Occupancy Rate (Q1 2025 est.): 90.5%

Cap Rate (2025 est.): 5.7%

Price-to-Rent Ratio (2025 est.): 14.5

Average Rent (2025 est.): $1,820

Denver, Colorado

Despite its higher entry price point, Denver’s allure remains potent for multifamily investors. The city’s economy, anchored by tech, aerospace, and a strong outdoor recreation industry, continues to draw a highly educated workforce. While new supply has been a factor, Denver’s intrinsic desirability, coupled with geographic and zoning constraints, limits long-term oversupply risk. High absorption rates underscore a consistent demand for quality rental units. The metrics here reflect a premium market where steady economic growth cities dynamics support solid returns.

Median Property Price (2025 est.): $595,000

Occupancy Rate (Q1 2025 est.): 89.8%

Cap Rate (2025 est.): 5.3%

Price-to-Rent Ratio (2025 est.): 23.5

Average Rent (2025 est.): $1,880

Nashville, Tennessee

Music City is more than just a cultural hotspot; it’s an economic juggernaut. Nashville has consistently ranked among the nation’s top markets for job growth and population influx, fueled by healthcare, automotive, and tech sectors complementing its legendary entertainment industry. This dynamic growth has created enduring demand for multifamily housing. The city’s strategic location and appealing lifestyle continue to attract residents, making it a compelling choice for multifamily investment strategies that prioritize sustained growth and strong cash flow real estate.

Median Property Price (2025 est.): $465,000

Occupancy Rate (Q1 2025 est.): 88.5%

Cap Rate (2025 est.): 5.6%

Price-to-Rent Ratio (2025 est.): 19.5

Average Rent (2025 est.): $1,950

San Diego, California

San Diego’s position as a gateway city with exceptional quality of life and a robust, diversified economy (biotech, defense, tourism, tech) ensures persistent demand for housing. What truly sets San Diego apart for multifamily investors is its inherent supply constraints. Strict zoning laws and geographic barriers (ocean to the west, mountains to the east) severely limit new development, creating an enduring supply-demand imbalance. This scarcity drives high occupancy rates and supports premium rents, despite a lower cap rate analysis compared to other cities. It’s a market where long-term appreciation is a key driver for real estate portfolio diversification.

Median Property Price (2025 est.): $895,000

Occupancy Rate (Q1 2025 est.): 95.5%

Cap Rate (2025 est.): 4.7%

Price-to-Rent Ratio (2025 est.): 24.5

Average Rent (2025 est.): $2,600 – $3,100

Salt Lake City, Utah

Often dubbed “Silicon Slopes,” Salt Lake City has transformed into a booming tech hub, attracting major companies and a young, educated workforce. The city offers an exceptional quality of life, stunning natural beauty, and a cost of living that, while rising, remains more accessible than coastal tech centers. This potent combination drives significant population growth and robust demand for multifamily units. The relatively high price-to-rent ratio insights reflect the strong demand, but also the potential for continued rental growth, making it an attractive destination for value-add real estate projects and long-term holds.

Median Property Price (2025 est.): $535,000

Occupancy Rate (Q1 2025 est.): 94.5%

Cap Rate (2025 est.): 5.6%

Price-to-Rent Ratio (2025 est.): 25.5

Average Rent (2025 est.): $1,750

Columbus, Ohio

Columbus represents an emerging market gem in the Midwest, blending solid growth prospects with remarkable affordability. Its diverse economy is anchored by a massive state university, robust healthcare systems, financial services, and a growing tech sector. The city benefits from continuous institutional investment and a thriving innovation ecosystem. For investors seeking a balance of strong cash flow real estate and appealing entry points, Columbus offers a unique opportunity. Its impressive cap rate analysis signals strong potential returns for savvy investors.

Median Property Price (2025 est.): $285,000

Occupancy Rate (Q1 2025 est.): 92.5%

Cap Rate (2025 est.): 6.9%

Price-to-Rent Ratio (2025 est.): 15.5

Average Rent (2025 est.): $1,580

Dallas, Texas

As one of the nation’s largest and most dynamic apartment markets, Dallas continues to be a magnet for corporate relocations and job seekers. The sprawling DFW metroplex offers an incredibly diverse economy spanning logistics, finance, tech, and energy, bolstered by no state income tax. This continuous influx of residents, coupled with a proactive approach to urban development investments and infrastructure, ensures sustained demand for multifamily housing across its numerous submarkets. Dallas offers ample opportunities for multifamily investment strategies ranging from core-plus to value-add.

Median Property Price (2025 est.): $400,000

Occupancy Rate (Q1 2025 est.): 89.5%

Cap Rate (2025 est.): 5.2-5.7%

Price-to-Rent Ratio (2025 est.): 18.5

Average Rent (2025 est.): $1,850

Navigating 2025: Key Investment Considerations

Identifying the right market is just the first step. As a seasoned investor, I advocate for a meticulous approach to due diligence in 2025. Focus on:

Submarket Nuances: Even within a strong city, some neighborhoods outperform others. Understand local development pipelines, demographic shifts at a micro-level, and specific amenity demands.

Debt Strategy: With interest rates stabilizing, securing favorable financing terms will be crucial. Explore various loan products and understand their implications for your cash flow real estate projections.

Value-Add Potential: Look for properties that can benefit from strategic renovations, improved management, or repositioning to command higher rents and boost property appreciation trends. This is a classic strategy for enhancing long-term real estate wealth.

Operational Efficiency: Post-acquisition, strong property management is paramount. Focus on tenant retention, efficient maintenance, and leveraging technology to optimize operations.

Risk Mitigation: Diversify your holdings, understand local regulations, and build contingencies into your financial models. Even in strong markets, unforeseen challenges can arise.

The 2025 multifamily landscape promises a return to more predictable growth and attractive returns for those who approach it with diligence and strategic foresight. The markets identified above offer compelling narratives of economic strength, population dynamism, and robust rental demand, making them ideal candidates for your next real estate portfolio diversification move.

Don’t let opportunity pass you by. Connect with experienced professionals today to explore how these strategic markets can supercharge your multifamily investment strategies and propel you towards your financial goals in 2025 and beyond.

![After Phyllis Crashes the Bachelor and Bachelorette Parties, [Spoiler]](https://usnews.themtraicay.com/wp-content/uploads/2025/10/4-20.jpg)