The Young and the Restless explodes with courtroom chaos, betrayal, and long-simmering emotions as Bryton and Jahaira’s tense legal battle turns into a dramatic showdown no one saw coming. In an episode packed with shocking revelations, hidden alliances, and emotional outbursts, fans are left stunned when the true identity of the traitor manipulating events from the shadows is finally exposed.

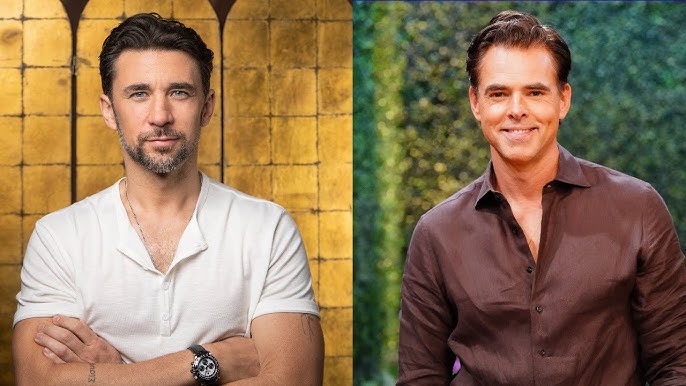

The episode opens in the bustling Genoa City courthouse, where anticipation hangs thick in the air. Reporters fill the gallery, cameras flash, and whispers echo through the hallways. Bryton, dressed sharply in a charcoal suit, walks into the courtroom with determination written all over his face. His jaw is tight, his eyes cold — this isn’t just about business anymore. For him, it’s personal. On the other side of the room sits Jahaira, composed but visibly nervous, clutching her notes and glancing occasionally toward her attorney. The tension between them is palpable, a mix of hurt, pride, and unresolved emotion.

Judge Carmichael calls the court to order, and what begins as a professional dispute quickly spirals into a heated personal confrontation. Jahaira’s lawyer presents documents suggesting Bryton violated the terms of their previous agreement, allegedly diverting company funds without authorization. Bryton’s side fires back, accusing Jahaira of breaching confidentiality and leaking sensitive information to a rival firm. The audience gasps as accusations fly, each one sharper than the last.

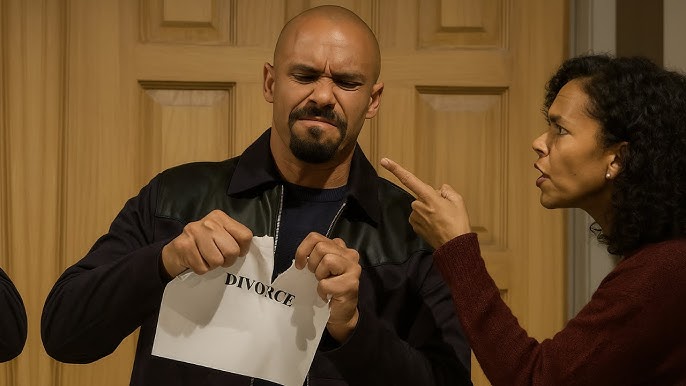

As the testimony unfolds, the undercurrent of emotion becomes impossible to ignore. When Jahaira takes the stand, she locks eyes with Bryton — her voice steady, but her pain obvious. “You promised we were building something together,” she says, her tone trembling. “But the minute things got difficult, you turned on me.” Bryton, visibly agitated, stands up despite his attorney’s warning. “You’re the one who betrayed me,” he fires back. “You went behind my back and sold us out!” The judge slams her gavel, warning them both to control themselves, but the damage is already done.

The courtroom becomes a battlefield of truth and lies, with each side trying to outmaneuver the other. Devon and Lily, seated in the back, exchange uneasy glances as the evidence becomes increasingly contradictory. It’s clear that someone has been manipulating both Bryton and Jahaira — playing them against each other for personal gain. But who?

Midway through the hearing, a surprise witness is called — someone neither side expected: Nate Hastings. The room falls silent as Nate takes the stand, his expression unreadable. Under oath, he reveals a shocking detail: an anonymous investor had been feeding false information to both parties, fabricating documents to create division and weaken their business partnership. “You were both set up,” Nate says gravely. “Someone wanted this fight to happen.”

Jahaira’s eyes widen in disbelief. Bryton looks stunned. “Who would do something like that?” he demands. Nate hesitates before answering. “The same person who stood to gain the most if you both went down.” The room buzzes with murmurs as the judge demands order. Then, in a dramatic twist, Nate drops the name — Amanda Sinclair.

Gasps fill the courtroom. Amanda, who has been quietly sitting in the back, stands up, her face pale. “That’s not true!” she cries, but the evidence Nate presents is damning. Emails, offshore transfers, and confidential reports all point back to her. The shocking revelation stuns everyone — Amanda, once a trusted ally and friend, had been secretly manipulating both sides to seize control of the company once their partnership collapsed.

Bryton’s anger boils over as he turns to face her. “You used me,” he says bitterly. “You pretended to help, but you were just waiting for us to destroy each other.” Amanda tries to explain, claiming she was coerced, but Jahaira cuts her off, her voice breaking. “You watched us tear each other apart — and you let it happen.”

The courtroom erupts into chaos as reporters rush to capture the moment. The judge calls for recess, but the emotional fallout is impossible to contain. Bryton storms out, slamming the door behind him, while Jahaira collapses into a chair, fighting back tears. Devon follows Bryton into the hallway, urging him to calm down. “Don’t let her win by losing your head,” Devon warns. Bryton clenches his fists, his voice trembling. “She already took everything.”

In a quieter moment outside, Jahaira looks out the courthouse window, tears glistening in her eyes. “We could’ve had it all,” she whispers. Inside, Amanda is led away by security as Nate hands over the final piece of evidence — a recorded phone call proving she’d planned the entire scheme.

The episode ends on a haunting note. Bryton returns to the empty courtroom, picking up the photo that once sat on their shared company desk — a picture of him and Jahaira in better times. He stares at it for a long moment before saying softly, “They broke us… but I’m not finished yet.”

As the screen fades to black, viewers are left with a sense of heartbreak, justice, and anticipation — because in Genoa City, the truth may finally be out, but revenge is just getting started.

The Ultimate Guide to Multifamily Real Estate Investing: Top 10 U.S. Cities for 2025 Success

As an expert who has navigated the multifaceted world of real estate investing for over a decade, I’ve witnessed market cycles ebb and flow, transforming challenges into unparalleled opportunities for those with foresight. In 2025, the multifamily real estate sector stands at a pivotal juncture. After a period of recalibration marked by interest rate shifts and supply-demand adjustments, we are now entering a phase poised for robust growth. Smart investors understand that while volatility creates headwinds, it also clears the path for significant real estate portfolio diversification and exceptional high yield investment properties.

The narrative of 2025 for multifamily assets is one of re-stabilization and renewed confidence. Demographic shifts, including a persistent demand for flexible living arrangements and continued migration patterns, are underpinning a resurgence in rental markets across the nation. Moreover, with the Federal Reserve’s monetary policy expected to normalize further, the capital markets are anticipated to provide a more predictable landscape for commercial real estate investment. This is not merely an optimistic forecast; it’s a data-driven projection for an asset class renowned for its resilience and potential to generate substantial passive income real estate.

However, success in this environment hinges on strategic market selection. Not all cities are created equal, and identifying areas with strong fundamentals – robust job growth, increasing population, and a favorable supply-demand balance – is paramount. My experience has taught me that the difference between an average return and a transformative one often lies in the precise location and timing of your property investment strategies. This deep dive into the top 10 cities for multifamily real estate investing in 2025 is designed to equip you with the insights needed to make informed decisions and capitalize on the coming market upswing. We’ll explore key metrics like cap rates, occupancy, rent growth, and economic drivers to paint a clear picture of where your next significant income-generating real estate opportunity lies.

Understanding the Multifamily Investment Landscape in 2025

Before we unveil the prime locations, it’s crucial to understand the macro trends shaping the multifamily market in 2025. The preceding years saw an aggressive construction pipeline in many markets, leading to temporary oversupply in some submarkets and putting pressure on occupancy and rent growth. However, this dynamic is now shifting. Construction starts have cooled, allowing demand to catch up with existing supply. This rebalancing is a critical factor driving projected positive rent growth and stable occupancy rates for well-located assets.

Furthermore, economic resilience plays a vital role. Cities with diversified economies, strong corporate relocation trends, and burgeoning tech or healthcare sectors tend to attract a consistent influx of residents, ensuring sustained tenant demand. For long-term real estate strategy, these fundamental economic indicators are far more impactful than short-term market fluctuations. Investors are increasingly prioritizing markets that offer both immediate cash flow potential and long-term appreciation prospects, creating a robust demand for apartment building investing in economically vibrant urban centers.

Key metrics we’ll analyze for each city include:

Median Property Price: A baseline for entry costs into the market.

Occupancy Rate: A critical indicator of tenant demand and potential for consistent cash flow. High occupancy translates directly to stable rental income properties.

Cap Rate (Capitalization Rate): A measure of the expected rate of return on a real estate investment property, providing a quick assessment of its income-generating ability relative to its price. Higher cap rates generally suggest better value relative to earnings.

Price-to-Rent Ratio: This ratio helps determine if a market is more favorable for renting or buying, offering insight into the relative value of rental income against acquisition costs.

Average Rent: Reflects the market’s strength and potential for ROI real estate through rental income.

Armed with this framework, let’s explore the cities that represent the vanguard of multifamily investment opportunities for 2025.

The Top 10 Multifamily Investment Hotspots for 2025

From burgeoning tech hubs to revitalized urban cores, these markets are exhibiting the robust fundamentals necessary for successful real estate asset management and superior investor returns.

Las Vegas, Nevada – The Resilient Oasis of Opportunity

Las Vegas, often stereotyped for its entertainment, has matured into a remarkably resilient economic hub. For years, I’ve observed its transformation beyond tourism, with significant investments in logistics, tech, and medical sectors. In 2025, Las Vegas continues to be a magnet for corporate relocations and Californians seeking a lower cost of living and no state income tax. This continuous influx fuels consistent demand for multifamily housing. Properties here often benefit from strong rental growth and a relatively lower entry point compared to coastal counterparts. The market’s ability to absorb new units, coupled with ongoing job creation, solidifies its position as a top-tier destination for multifamily real estate investing.

Median Property Price: $425,000 (projected for 2025, reflecting slight appreciation)

Occupancy Rate: 92% (strong tenant demand maintaining stability)

Cap Rate: 5.7-6.2% (attractive returns for investors)

Price-to-Rent Ratio: 18.5 (favorable for rental income generation)

Average Rent: $1,850 (steady growth trajectory)

Atlanta, Georgia – The Southern Economic Powerhouse

Atlanta’s relentless economic expansion positions it as a premier market for multifamily investors. As the commercial and cultural capital of the Southeast, it draws major corporations, diverse industries, and a highly educated workforce. The city’s sprawling metropolitan area continues to experience phenomenal population growth, translating directly into an insatiable demand for quality rental housing. Investing in Atlanta isn’t just about current returns; it’s about tapping into a region with long-term upward trajectory driven by robust infrastructure development and a dynamic job market. This makes it ideal for those seeking wealth creation real estate opportunities.

Median Property Price: $415,000 (reflecting sustained demand)

Occupancy Rate: 89.5% (healthy absorption of new supply)

Cap Rate: 5.8% (solid returns in a growth market)

Price-to-Rent Ratio: 15.5 (highly favorable for rental investors)

Average Rent: $1,675 (consistent rent appreciation)

Charlotte, North Carolina – The New South’s Financial Anchor

Charlotte has firmly established itself as a leading financial center, drawing comparisons to larger East Coast cities but with a more accessible cost of living. Its strong population growth, fueled by corporate expansions and a burgeoning tech scene, underpins a vibrant multifamily market. The city consistently ranks high for job growth and quality of life, making it highly attractive to renters. For investors, Charlotte offers a compelling blend of stability and growth potential, particularly in its well-located submarkets. It’s an exemplary market for real estate portfolio diversification in the booming Carolinas.

Median Property Price: $390,000 (continued appreciation)

Occupancy Rate: 93% (indicating very strong tenant demand)

Cap Rate: 5.7% (attractive for income-focused investors)

Price-to-Rent Ratio: 17 (balanced market for renters and buyers)

Average Rent: $1,875 (consistent growth fueled by demand)

Tampa, Florida – The Sunshine State’s Investment Gem

Tampa’s multifamily market is riding a powerful wave of economic expansion and population influx. Florida’s favorable tax environment, including no state income tax, continues to be a massive draw for both businesses and residents. Tampa itself boasts a diversified economy with growing sectors in healthcare, finance, and technology. Its beautiful coastal lifestyle, coupled with relative affordability, positions it as a prime target for high yield investment properties. The long-term outlook for Tampa’s real estate market remains exceptionally positive, making it a standout for income-generating real estate.

Median Property Price: $380,000 (still relatively affordable with strong growth)

Occupancy Rate: 91.5% (robust demand across asset classes)

Cap Rate: 5.6% (solid returns given the growth trajectory)

Price-to-Rent Ratio: 13.5 (highly attractive for rental income)

Average Rent: $1,850 (strong and consistent rent growth)

Denver, Colorado – High-Altitude Returns and Robust Demand

Denver’s dynamic economy and unparalleled quality of life continue to attract a skilled workforce, especially in tech and outdoor recreation industries. While entry prices are higher than some other cities on this list, Denver’s high absorption rates and persistent demand for multifamily units signify a market that can justify the premium. Investors here are betting on continued appreciation driven by limited developable land and a population that values access to nature and urban amenities. For those seeking real estate asset management in a vibrant, high-growth environment, Denver remains a strategic choice.

Median Property Price: $600,000 (premium market with strong long-term appreciation)

Occupancy Rate: 90% (healthy demand absorption)

Cap Rate: 5.3% (reflects higher property values, stable income)

Price-to-Rent Ratio: 22 (reflects a competitive buying market)

Average Rent: $1,875 (strong rent ceiling)

Nashville, Tennessee – Music City’s Multifamily Melody

Nashville’s transformation into a major economic hub extends far beyond its musical roots. Healthcare, corporate relocations, and a thriving tourism sector contribute to a vibrant job market and sustained population growth. For years, I’ve tracked Nashville’s consistent performance as one of the best cities for real estate investment, and 2025 is no exception. The city’s dynamic culture, combined with its business-friendly environment and no state income tax, makes it incredibly appealing to new residents, ensuring continuous demand for rental properties.

Median Property Price: $470,000 (reflecting sustained desirability)

Occupancy Rate: 89% (consistent with a rapidly growing market)

Cap Rate: 5.6% (attractive for discerning investors)

Price-to-Rent Ratio: 18.5 (favorable for rental operations)

Average Rent: $1,950 (demonstrating upward rental pressure)

San Diego, California – Coastal Scarcity, Premium Returns

San Diego presents a unique investment profile: a market characterized by inherently limited supply due to strict zoning and geographical constraints, coupled with consistently strong demand. Its diverse economy, spanning biotech, military, tourism, and innovation, attracts a high-income demographic. While entry costs are significantly higher, the premium paid for multifamily real estate investing in San Diego is often justified by its exceptional stability, low vacancy rates, and consistent appreciation potential. Investors seeking long-term real estate strategy in a supply-constrained, high-demand market will find San Diego compelling.

Median Property Price: $895,000 (a premium market with strong fundamentals)

Occupancy Rate: 96% (exceptionally high, signaling intense demand)

Cap Rate: 4.8% (reflects high property values relative to income, but strong appreciation)

Price-to-Rent Ratio: 23 (indicative of a strong seller’s market for properties)

Average Rent: $2,800 – $3,200 (among the highest in the nation)

Salt Lake City, Utah – The Silicon Slopes Investment Ascent

Salt Lake City has emerged as a formidable economic force, often dubbed “Silicon Slopes” for its burgeoning tech industry. This, combined with a young, educated population and a high quality of life, drives robust demand for multifamily housing. The city offers a compelling mix of strong economic growth and relatively better affordability compared to major coastal tech hubs. This unique blend makes Salt Lake City an excellent option for real estate portfolio diversification, appealing to investors looking for steady growth in an increasingly dynamic Western market.

Median Property Price: $540,000 (appreciating steadily)

Occupancy Rate: 95% (exceptionally strong, reflecting high demand)

Cap Rate: 5.6% (attractive returns in a growing tech hub)

Price-to-Rent Ratio: 24 (strong rental market)

Average Rent: $1,750 (solid rent growth)

Columbus, Ohio – The Midwest’s Emerging Powerhouse

Columbus is a quietly powerful market that often flies under the radar but delivers consistent results. Its diversified economy, anchored by a strong university presence (Ohio State), a burgeoning tech scene, logistics, and healthcare, provides a stable foundation for multifamily investment. What makes Columbus particularly attractive in 2025 is its compelling combination of affordability and solid growth potential. It’s an excellent market for investors seeking accessible entry points into income-generating real estate with robust demographic tailwinds. Columbus represents a strategic real estate market analysis choice for those looking beyond traditional coastal hubs.

Median Property Price: $285,000 (excellent affordability with growth potential)

Occupancy Rate: 93% (healthy and consistent demand)

Cap Rate: 6.9% (among the highest, indicating strong cash flow relative to price)

Price-to-Rent Ratio: 14.5 (very favorable for rental investors)

Average Rent: $1,575 (steady growth at an attractive price point)

Dallas, Texas – The Dynamic Megacity of Multifamily

Dallas Fort-Worth stands as one of the nation’s largest and most dynamic apartment markets. Its relentless job growth, fueled by corporate relocations, diverse industries (tech, finance, logistics, energy), and no state income tax, creates an almost unparalleled demand for housing. The sheer scale and continuous expansion of the DFW metroplex provide a vast landscape of opportunities for multifamily real estate investing. While new construction has been significant, the underlying economic strength and population influx ensure that demand largely keeps pace, offering resilient opportunities for passive income real estate.

Median Property Price: $405,000 (reflecting ongoing appreciation)

Occupancy Rate: 90% (robust despite significant new supply)

Cap Rate: 5.2-5.7% (solid returns in a highly competitive market)

Price-to-Rent Ratio: 17.5 (favorable balance for rental operations)

Average Rent: $1,850 (consistent and strong rent growth)

Maximizing Your Multifamily Investment in 2025: Beyond the City Limits

While selecting the right city is foundational, successful commercial real estate investment in 2025 demands more than just location awareness. As a seasoned expert, I emphasize the importance of rigorous due diligence, understanding local submarket nuances, and forming strategic partnerships. The nuances of property management, financing structures, and the potential tax benefits real estate offers are all critical components of a well-executed long-term real estate strategy.

Each of these cities presents unique advantages and challenges. For instance, in higher-priced markets like San Diego or Denver, value-add strategies – acquiring underperforming assets and improving them – can unlock significant equity. In rapidly expanding markets like Atlanta or Dallas, focusing on new construction or properties near major job centers can yield superior ROI real estate. Regardless of the market, a strong grasp of local economic indicators, zoning laws, and demographic shifts is indispensable. Partnering with a firm that has a proven track record and deep local expertise can be the distinguishing factor in realizing exceptional returns and achieving your wealth creation real estate goals.

Ready to Seize the 2025 Multifamily Opportunity?

The year 2025 heralds a promising era for multifamily real estate investors. The markets highlighted above are not merely trending; they possess the fundamental economic strength, demographic appeal, and rental market dynamics that signify enduring value and robust income-generating real estate potential. Whether you’re an experienced investor looking to expand your real estate portfolio diversification or a newcomer eager to enter a resilient asset class, these cities offer compelling avenues for growth.

Don’t let opportunity pass you by. The time to strategically position your capital in these high-potential markets is now. Connect with a trusted real estate investment partner today to explore prime multifamily opportunities and begin building your legacy of financial success.