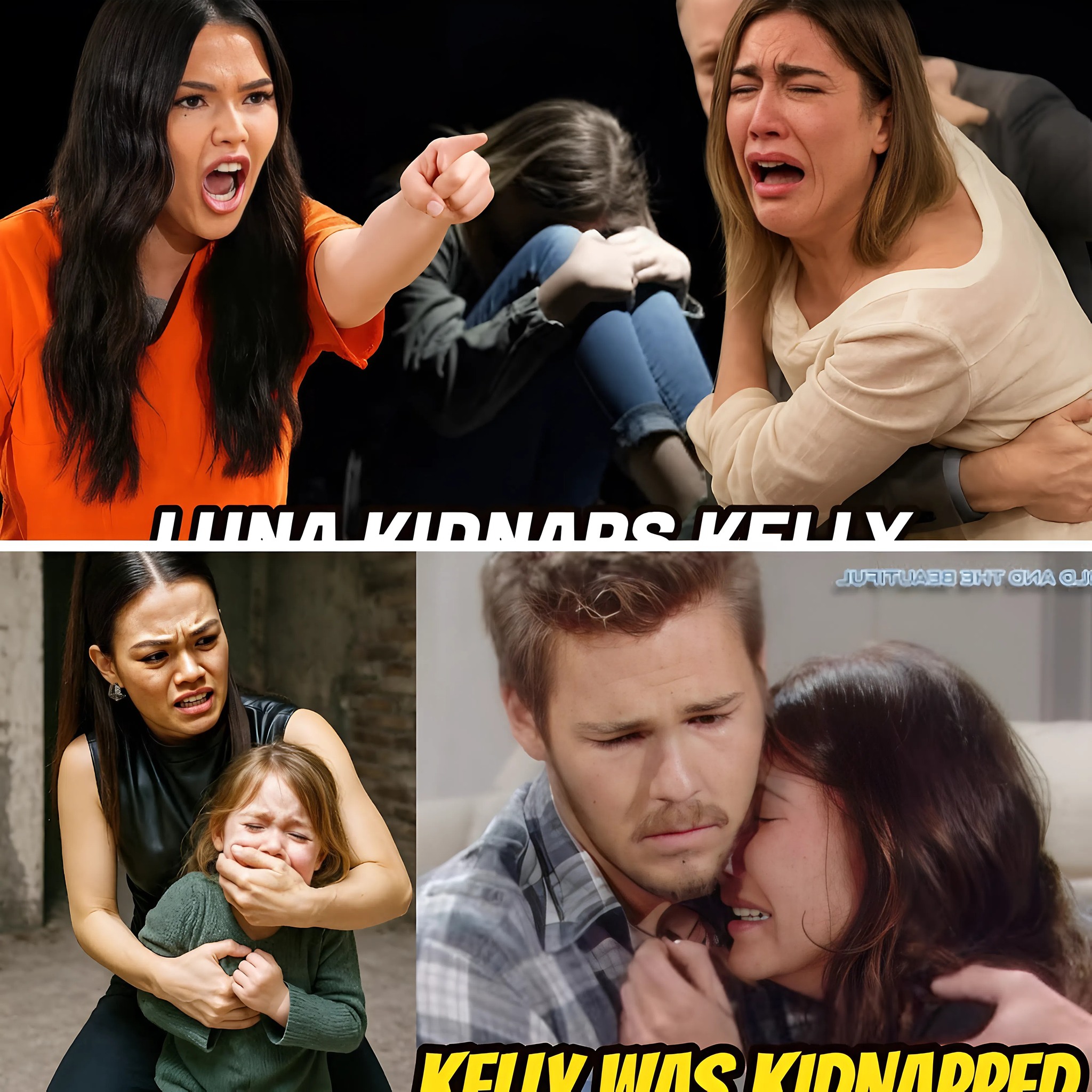

n a shocking turn that has left fans reeling, The Bold and the Beautiful has unleashed one of its darkest, most gripping storylines yet: the rise of Luna Nozawa from a fallen outcast to a vengeful fugitive with nothing to lose. Branded a murderer and abandoned by the very people she once called family, Luna’s story is now one of calculated chaos, bitter betrayal, and a harrowing thirst for revenge. Her escape from prison has thrown the entire Forrester universe into turmoil, and her next target? None other than young Kelly Spencer.

This is Luna’s Revenge—a psychological thriller unraveling in the heart of Los Angeles, where love, loyalty, and legacy are now laced with fear.

The Escape That Shook Los Angeles

It started on a moonless Thursday night. Security cameras blinked into static, guards mysteriously disappeared from their posts, and before anyone realized what was happening, Luna Nozawa had slipped through the cracks of the justice system like smoke in the dark. Her prison bunk was empty, and the only trace she left behind was a chilling message scrawled across the concrete wall: “They’ll all pay.”

But this was no impulsive act. Luna’s breakout was months in the making. Inside prison walls, she’d forged a secret alliance with a disgruntled former Forrester Creations employee—someone with an axe to grind and the resources to help Luna vanish. Corrupted guards, fake IDs, access to safe houses and vehicles across Los Angeles—it was a meticulous operation born of desperation, resentment, and rage.

Now free, Luna wasn’t just on the run. She was on a mission.

The List of Vengeance

Her enemies were carefully chosen—five names etched into her mind like scars:

- Electra Forrester: The woman who called the police on her.

- Will Spencer: The father of her unborn child who had rejected her.

- Bill and Katie Spencer: The power couple who plotted to steal her baby.

- Steffy Forrester: The woman who, in Luna’s eyes, destroyed everything.

Steffy wasn’t just a name on Luna’s list. She was the centerpiece of Luna’s destruction. The perceived architect of her downfall. The woman who had “turned Finn against his own daughter,” and Luna’s ultimate target.

But revenge, for Luna, wasn’t a bullet to the head. It was slow, suffocating chaos.

Phase One: The Psychological Assault

Luna’s war began not with violence, but with manipulation. She knew Electra’s vulnerabilities—her trust issues, her lingering trauma, her fear that Will would never truly be hers. Anonymous messages began flooding Electra’s phone: photos of Will and Luna together, fabricated receipts, deepfakes of hotel visits. Lies that felt like truth.

The result was devastating. Electra’s relationship with Will collapsed under the weight of suspicion. Within days, she had moved out of the Forrester guest house, her world in tatters. Luna’s revenge had struck its first blow, and she hadn’t even lifted a finger.

Bill and Katie were next. With help from her insider, Luna leaked doctored financial documents suggesting Bill had embezzled funds to cover Luna’s house arrest. The media pounced. The scandal rocked Spencer Publications, and Katie’s professional integrity was publicly questioned.

Phase Two: Real Danger Arrives

With trust shattered, Luna escalated her attacks to terrifying new heights.

Will Spencer’s car veered off Mulholland Drive after his brake lines were cut. Electra suffered a severe allergic reaction after someone tampered with her food in the Forrester Creations cafeteria. Threatening packages began arriving at Bill’s office, each one containing relics from Luna’s time in prison—personal items, blood-stained notes, photographs scorched around the edges.

She wasn’t just targeting her enemies anymore. She was haunting them.

Detectives were stumped. Luna left no trace. No fingerprints. No digital trail. She moved like a ghost, her plan unfolding with surgical precision.

Phase Three: The Final Target

All roads led to Steffy.

Luna knew that to truly destroy her, she needed to go after what Steffy held most dear—her children. Kelly and Hayes were her heart, and Luna planned to rip that heart out.

She began surveillance of the Forrester estate, studying routines and security lapses. She observed Kelly’s school pickup times, even briefly approaching Hayes at a park, pretending to be a friendly stranger—planting seeds of familiarity.

Then came the message. A chilling video sent directly to Steffy’s phone:

“You kept me from my father. Now you’ll know how it feels to be kept from your child. Kelly and Hayes will disappear, and you’ll never find them. This is just the beginning.”

Steffy’s world imploded. Security was tightened. Police were alerted. Finn wouldn’t let the children out of his sight. But Luna had all the time in the world. She had already waited months. She could wait a little longer.

The Confrontation in the Shadows

The moment came during a high-profile charity event at Forrester Creations. Security was distracted. The building was crowded. Luna, disguised with staff credentials, moved through the halls like a shadow.

When Steffy stepped into the parking garage that evening, Luna was waiting.

“Hello, Steffy,” she said, stepping from the darkness with a gun in hand.

“Surprised to see me?”

What followed was a standoff drenched in emotion. Luna accused Steffy of ruining her life, stealing her family, and destroying her identity. Steffy, ever defiant, tried to reason with her, pleading for the safety of the children. But Luna was unmoved.

And then—Finn arrived.

“Luna, stop.”

His voice cracked through the tension like lightning. The man Luna had wanted to know, had longed to call “Dad,” stood between her and Steffy. His words were soft, filled with sorrow.

“I never stopped caring about you. Let us help you.”

For a second, Luna hesitated. A flicker of the girl she used to be shone through the rage.

And then it vanished.

She pulled the trigger.

The Sacrifice Heard Around the World

Finn lunged in front of Steffy and took the bullet.

As he crumpled to the ground, Steffy screamed, blood staining her hands as she clutched her husband. Sirens wailed in the distance. Luna stood frozen, the gun slipping from her fingers. She hadn’t meant to kill him. She only wanted justice. But now…

Now she had become the monster everyone said she was.

As police swarmed the garage, Luna surrendered—empty, broken, her revenge complete, but her soul shattered. She had destroyed everything. Even the one person who had still seen good in her.

The Fallout

Finn’s fate remains uncertain. Steffy’s world lies in ruins. Kelly and Hayes may grow up without their father. And Luna? She faces life behind bars—or worse.

But in this tragic tale of vengeance and despair, one thing is certain:

The Bold and the Beautiful will never be the same again.

Stay tuned. The storm has only just begun.

Strategic Urban Frontiers: The Top 10 U.S. Cities for Multifamily Real Estate Investment in 2025

As a seasoned veteran navigating the complexities of commercial real estate for over a decade, I’ve witnessed cycles of boom and bust, innovation and stagnation. Heading into 2025, the multifamily sector stands at a pivotal juncture, poised for a robust resurgence after a period of recalibration. For astute investors seeking both stability and significant growth potential, understanding where to allocate capital is paramount. This isn’t just about chasing the latest trend; it’s about identifying fundamental economic shifts, demographic tailwinds, and sustainable demand drivers that will define the next wave of wealth generation in real estate.

The narrative of the multifamily market in 2025 is one of strategic recovery and renewed opportunity. Following the supply-side surges and demand fluctuations of recent years, we’re seeing a healthy rebalancing act. Construction starts are moderating, and the absorption of existing and newly delivered units is accelerating, setting the stage for positive rent growth trajectories and compressed vacancy rates. Interest rate uncertainty is largely behind us, paving the way for more predictable financing environments. This confluence of factors makes the upcoming year an exceptionally opportune moment to expand or initiate a multifamily real estate portfolio.

My analysis, backed by extensive market intelligence and on-the-ground experience, points to specific urban cores that are not merely recovering but are actively cementing their positions as prime destinations for multifamily investment. These aren’t just cities with attractive current metrics; they are regions underpinned by resilient economies, burgeoning populations, and a palpable energy that attracts both residents and businesses. My selection criteria for these top ten markets delve deep into factors beyond surface-level statistics, examining long-term economic diversification, infrastructure development, quality of life, and, crucially, the underlying supply-demand dynamics projected for 2025 and beyond. When we talk about high-yield rental properties and sustainable real estate wealth building, these are the markets leading the charge.

Decoding the 2025 Multifamily Investment Landscape: My Top 10 Picks

Las Vegas, Nevada: The Diversification Dynamo

Often typecast solely by its entertainment prowess, Las Vegas has undergone a profound economic metamorphosis, making it a compelling candidate for multifamily investment opportunities in 2025. Over my ten years, I’ve watched Las Vegas shed its one-dimensional image to become a diversified hub for technology, logistics, professional services, and even advanced manufacturing. This strategic pivot, coupled with Nevada’s investor-friendly tax environment (no state income tax), continues to draw significant inbound migration from higher-cost coastal states, fueling an insatiable demand for quality rental housing. The city’s population growth consistently outpaces the national average, ensuring a steady stream of new renters.

For investors, Las Vegas presents a robust value proposition. While median property prices hover around $425,000, the blend of strong occupancy (projected 92% in Q1 2025), attractive cap rates (5.7-6.2%), and a healthy price-to-rent ratio around 19 offers a compelling blend of cash flow and appreciation potential. The revitalization of downtown areas and continued infrastructure investments further solidify its long-term appeal. The absorption of new units remains strong, indicating that demand continues to soak up new supply effectively. As an expert, I see Las Vegas as a strategic location for real estate portfolio diversification, offering resilience beyond its traditional allure.

Atlanta, Georgia: The Southern Economic Juggernaut

Atlanta isn’t just a regional powerhouse; it’s a global economic force that consistently ranks among the best real estate markets 2025. With its strategic location, world-class airport, and a diverse job market spanning fintech, media, logistics, healthcare, and corporate headquarters, Atlanta’s economic engine shows no signs of slowing. This translates directly into robust demand for multifamily housing. The city continues to attract corporate relocations and expansions, bringing high-paying jobs and a constant influx of residents seeking opportunity.

The metro Atlanta market is characterized by strong population growth and an impressive ability to absorb thousands of new rental units quarter after quarter. Despite ongoing development, the demand side remains potent, supported by an appealing cost of living relative to other major U.S. cities. For investors, a median property price around $410,000, an occupancy rate projected at 89-90%, and a cap rate of approximately 5.8% present an attractive entry point. The price-to-rent ratio of around 16 signifies strong rental viability. The sheer scale and dynamism of Atlanta’s economy make it a foundational pillar for any serious commercial real estate investing strategy. The city’s continued investment in public transit and urban renewal projects further enhances its long-term desirability for both residents and investors.

Charlotte, North Carolina: Banking on Growth

Charlotte has earned its reputation as a premier banking and financial services hub, driving phenomenal population and job growth throughout the Carolinas. This robust economic foundation fuels an exceptionally strong demand for rental housing, positioning Charlotte as a perennial top-tier growth market real estate. The city’s appeal extends beyond finance, with burgeoning tech, healthcare, and advanced manufacturing sectors contributing to a diversified and resilient job market. It offers a high quality of life with a relatively affordable cost of living, attracting young professionals and families alike.

With median property prices in the $385,000-$415,000 range, Charlotte offers an accessible entry point compared to many other major metros. The multifamily market here is characterized by strong performance metrics: occupancy rates are anticipated to remain high at 92-93% in 2025, with cap rates around 5.6%. A healthy price-to-rent ratio of 17-18 indicates strong cash flow potential. Charlotte’s consistent urban development, coupled with strategic infrastructure investments, ensures its continued trajectory as a magnet for both residents and investors. This market perfectly illustrates how strategic investment in high-growth corridors yields consistent returns.

Tampa, Florida: Sunshine and Stability

Florida’s narrative of inbound migration remains incredibly strong, and Tampa is consistently at the forefront of this trend. Beyond the allure of no state income tax and moderate property taxes, Tampa boasts a rapidly diversifying economy that moves far beyond tourism, encompassing healthcare, technology, logistics, and professional services. This economic maturation, combined with its attractive lifestyle, ensures a steady influx of new residents, creating a perpetually strong demand for housing.

The Tampa multifamily market is projected to continue its robust performance into 2025. Median property prices are around $375,000, making it relatively affordable for investors eyeing strong returns. Occupancy rates are forecast to hold firm at 91-92%, with cap rates remaining competitive at approximately 5.6%. A compelling price-to-rent ratio of 14 highlights Tampa’s excellent cash flow potential for rental property yield. The city’s proactive stance on urban revitalization, particularly in its downtown and waterfront districts, further enhances its long-term appeal and ensures sustained demand for premium rental units. For investors seeking passive income real estate with robust appreciation potential, Tampa is an undeniable frontrunner.

Denver, Colorado: High-Altitude Resilience

Denver’s economy and population demonstrate remarkable resilience and consistent growth, making it a compelling choice for investment property analysis. The city’s strategic position at the foot of the Rocky Mountains, combined with a vibrant tech industry, aerospace sector, and a strong professional services base, continues to attract a highly educated workforce. This creates consistent demand for housing, even amidst periods of increased supply. Denver’s quality of life and access to outdoor recreation also act as powerful magnets for new residents.

While median property prices are higher, around $595,000, reflecting its desirability and robust economy, Denver’s market metrics remain attractive for long-term investors. Occupancy rates are projected at a solid 90-91% for 2025, with cap rates around 5.3%. The price-to-rent ratio of 23 indicates strong long-term appreciation prospects, even if initial cash flow is tighter. Denver’s ability to consistently absorb new multifamily units, even at higher price points, underscores the depth of its demand. Investors with a long-term horizon seeking real estate wealth building in a dynamic, high-growth environment will find Denver to be an exceptional play.

Nashville, Tennessee: The Booming “It City”

Nashville’s transformation from a regional music hub to a national economic powerhouse has been nothing short of spectacular. This “It City” continues to draw major corporate relocations, most notably Oracle’s massive campus, alongside organic growth in healthcare, technology, and entertainment sectors. This diverse economic growth driver has led to sustained population growth, making Nashville a consistently strong performer for multifamily real estate. The city’s vibrant culture and burgeoning job market appeal to a broad demographic, from young professionals to established families.

The Nashville market offers compelling investment opportunities with median property prices around $465,000. Projected occupancy rates for 2025 remain healthy at 89-90%, with attractive cap rates of approximately 5.6%. The price-to-rent ratio of 19 signifies a balanced market with both solid cash flow and appreciation potential. My experience shows that properties in well-located submarkets of Nashville, especially those near employment centers and entertainment districts, continue to command premium rents and exhibit strong tenant retention. For investors focusing on apartment complex investing in markets with robust long-term outlooks, Nashville is an indispensable part of the conversation.

San Diego, California: Limited Supply, Premium Demand

San Diego offers a unique proposition: a market with high barriers to entry, limited developable land, and strict zoning regulations, creating an inherent supply constraint that, when coupled with strong demand, drives premium rental rates and consistent appreciation. The city benefits from a diverse economic base, including a significant military presence, burgeoning biotech and life sciences industries, and a robust technology sector. Its unparalleled quality of life, mild climate, and coastal access make it a perpetually desirable place to live.

While median property prices are significantly higher, around $890,000, reflecting its premium status, San Diego’s multifamily market remains highly attractive for investors seeking high-value real estate investments. Occupancy rates are consistently among the highest in the nation, projected at an impressive 95-96% for 2025. Cap rates, while lower at approximately 4.7%, are offset by strong rent growth potential and significant long-term capital appreciation. Average rents in the $2,600-$3,100 range underscore the premium nature of this market. For sophisticated investors looking for long-term hold strategies and wealth generation in supply-constrained, high-demand markets, San Diego stands out.

Salt Lake City, Utah: Silicon Slopes Ascendant

Salt Lake City has transformed into the “Silicon Slopes,” a rapidly growing tech hub attracting major corporations and startups alike. This economic dynamism, coupled with a highly educated and youthful workforce, strong family values, and a relatively affordable cost of living compared to coastal tech centers, ensures sustained population growth and a robust demand for multifamily housing. The city also benefits from strategic infrastructure investments and a high quality of life, including access to world-class outdoor recreation.

The Salt Lake City multifamily market offers an enticing blend of growth and relative affordability. Median property prices are around $535,000, presenting a strong value proposition for investors. Occupancy rates are projected at an excellent 94-95% for 2025, reflecting strong absorption and tenant demand. Cap rates around 5.6% provide attractive cash flow, while a price-to-rent ratio of 25-26 indicates robust long-term appreciation potential. This market is a prime example of how investing in regions with strong population migration and burgeoning tech sectors can yield exceptional returns for real estate market trends 2025 followers.

Columbus, Ohio: The Midwest’s Emerging Powerhouse

Columbus, Ohio, represents an increasingly attractive proposition as an emerging Midwest market that offers a compelling blend of solid growth, economic diversification, and superior affordability. Home to The Ohio State University, a significant economic and talent engine, Columbus boasts a resilient economy driven by technology, healthcare, logistics, and a growing financial sector. Its strategic location and proactive urban development initiatives continue to attract businesses and residents, making it a standout for multifamily investment opportunities.

With median property prices around $285,000, Columbus offers one of the most accessible entry points for investors on this list. This affordability, combined with strong market fundamentals, makes it a compelling choice for maximizing rental property yield. Occupancy rates are projected to remain high at 92-93% in 2025, and cap rates are exceptionally strong, often exceeding 6.5-7%. A low price-to-rent ratio of 15 underscores its cash flow superiority. Columbus perfectly exemplifies how to find high-growth markets that are still overlooked by some, offering significant upside for those who act decisively. Its consistent job growth and ongoing urban revitalization ensure long-term stability and growth.

Dallas, Texas: The Megacity of Opportunity

Dallas Fort-Worth is not just one of the nation’s largest apartment markets; it’s a sprawling economic engine driven by unparalleled corporate relocations, diverse job growth across multiple sectors (energy, tech, finance, aerospace), and the persistent draw of no state income tax. This continuous influx of residents and businesses ensures a perpetually strong demand for housing across its vast metropolitan area. My experience in Texas confirms its status as a consistently top-performing state for real estate.

The Dallas multifamily market continues to absorb a significant volume of new units, underscoring the sheer scale of its demand. Median property prices are around $400,000, offering competitive value within such a dynamic mega-market. Occupancy rates are projected at a solid 90% for 2025, with attractive cap rates ranging from 5.1-5.6%. A price-to-rent ratio of 18 further highlights its balanced investment profile. Dallas’s robust infrastructure, diverse economic base, and continuous population expansion make it a cornerstone for any serious real estate portfolio diversification strategy. It’s a market where consistent growth is the expectation, not the exception.

Capitalizing on the 2025 Multifamily Resurgence

The landscape of multifamily real estate in 2025 is ripe with opportunity for the discerning investor. These ten cities, each with its unique economic drivers and demographic tailwinds, represent the vanguard of where smart capital is flowing. From the diversified entertainment economy of Las Vegas to the robust financial engine of Charlotte, and the emerging tech hubs of Salt Lake City and Columbus, the common thread is sustainable demand driven by jobs, population growth, and a compelling quality of life.

My decade in the trenches has taught me that successful real estate investment is less about timing the market and more about time in the market, guided by rigorous data analysis and expert insights. Understanding these specific real estate market trends 2025 and pinpointing the geographic sweet spots is the key to unlocking significant returns and building lasting real estate wealth.

Are you ready to position your portfolio for exceptional growth and capitalize on these prime multifamily investment opportunities? Don’t let 2025 pass you by without strategically expanding your footprint in these top-performing markets.

Connect with a seasoned expert today to craft a tailored multifamily investment strategy that aligns with your financial goals and harnesses the immense potential of the evolving commercial real estate landscape. Let’s explore how these cities can become the bedrock of your next successful investment venture.