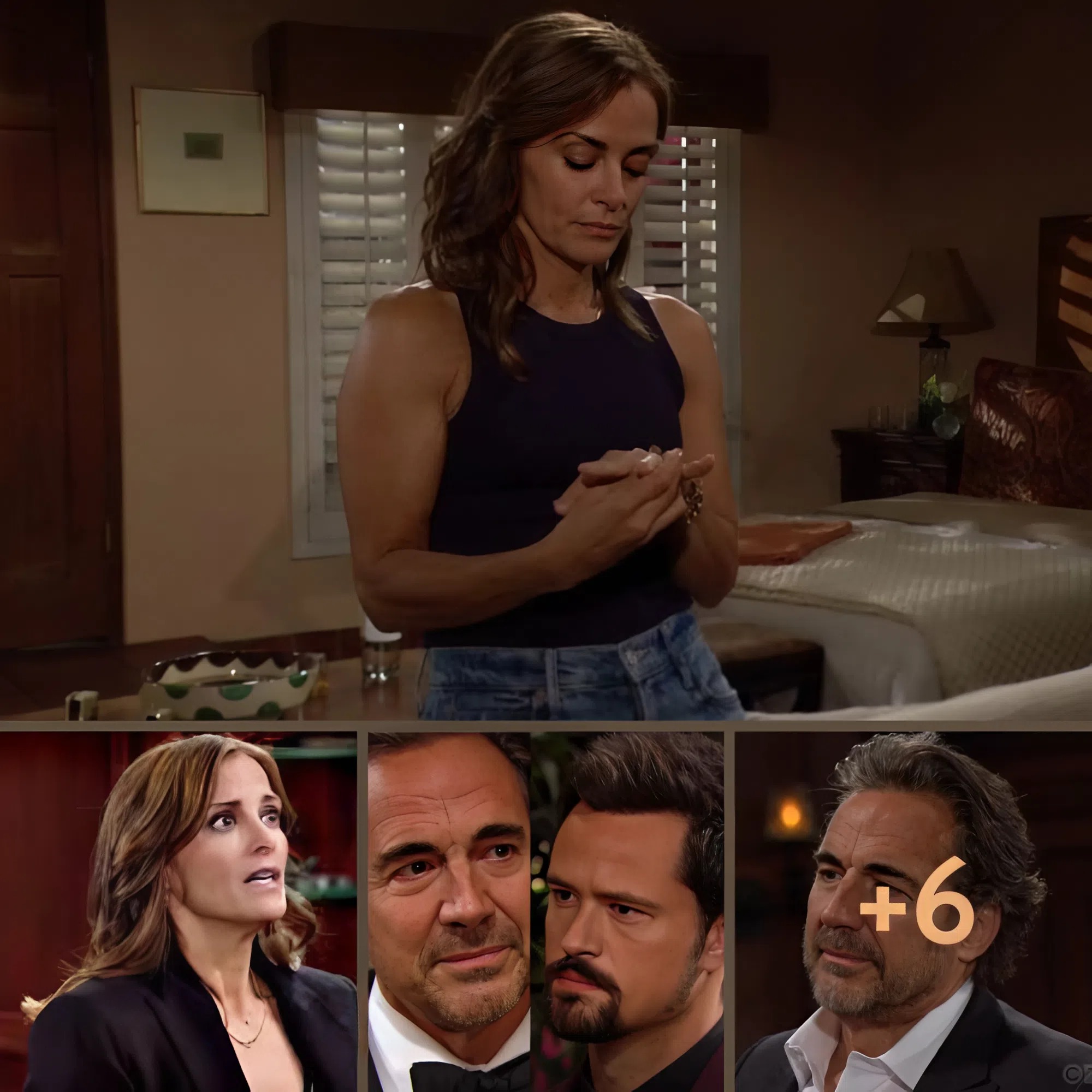

Jacqueline MacInnes Wood Steps Back Into Steffy’s Shoes

Fans of The Bold and the Beautiful have reason to celebrate. Jacqueline MacInnes Wood is officially back on set, returning to her iconic role as Steffy Forrester Finnegan after taking maternity leave earlier this year. Supervising producer Casey Kaspryzk shared the exciting news on X (formerly Twitter) on September 9, posting a photo of the Steffy and John “Finn” Finnegan family. “Excited to have Jacqueline MacInnes Wood back on set and taping her first scenes at our new studio!” Kaspryzk wrote.

Wood, who has portrayed Steffy intermittently since 2008, returns amid high drama for both the Forrester and Spencer families. Her character is set to face fresh challenges, including a tense storyline involving Luna Nozawa (Lisa Yamada) and Will Spencer (Crew Morrow), which promises to stir up chaos and reshape Steffy and Finn’s lives.

Fans Flood Social Media With Excitement

The announcement sparked an outpouring of excitement from fans. Social media was abuzz with reactions, with viewers expressing joy at seeing the “Sinn Family” reunited on screen. One fan commented, “She looks great, and it’s so good to see the Sinn Family all together again!” Another wrote, “Yay! Can’t wait for her to be back on my screen!”

Other fans emphasized their love for the family dynamic, sharing messages like:

- “Now THIS is what we like to see! Love Sinn and their babies! More of them!

- “I’m so happy!!!! #boldandbeautiful tears of joy!!!!”

- “Omg!! Yes, finally! Can’t wait to have JMW back on our screens!”

The warm reception reflects the strong connection Wood has built with audiences over the years.

A Star Behind and Beyond Steffy

Jacqueline MacInnes Wood is no stranger to acclaim. Her portrayal of Steffy has earned her four Daytime Emmy Awards, solidifying her status as a fan favorite. Beyond B&B, Wood is recognized for her roles as Olivia Castle in Final Destination 5 and Samantha Lear in the Hulu series South Beach.

Off-screen, Wood has been busy raising her family with her husband, Elan Ruspoli, a talent agent with Creative Artists Agency. The couple has welcomed five children: Rise Harlen (March 2019), Lenix (February 2021), Brando Elion (May 2022), Valor James (August 2023), and their newest addition born in July 2025.

What’s Next for Steffy and Finn?

With Wood back in action, viewers can expect Steffy to face both personal and professional upheaval. The upcoming episodes promise high-stakes drama, intricate family dynamics, and heartfelt moments as Steffy navigates the fallout from Luna and Will’s scheme. Finn’s role alongside her will also come under scrutiny, testing the strength of their bond and the stability of the Forrester and Spencer households.

Fans are especially eager to see how the “Sinn Family” dynamics play out on screen, given their reputation as one of B&B’s most beloved pairings. Wood’s return signals a renewed focus on Steffy’s storylines, offering both nostalgia and fresh excitement for longtime viewers.

A Highly Anticipated Return

The actress’s return is expected to air later this fall, giving audiences something to look forward to as The Bold and the Beautiful continues to weave its complex narrative web. Fans are already counting down the days, eager to witness the emotional highs and dramatic twists that Steffy and Finn will encounter.

Wood’s comeback isn’t just a return to work; it’s a celebration of family, resilience, and the enduring appeal of a character that has captivated audiences for nearly two decades. As social media buzzes with anticipation, one thing is clear: Steffy Forrester’s story is far from over, and Jacqueline MacInnes Wood is ready to lead the way.

Navigating the 2025 US Housing Market: 10 Critical Pitfalls First-Time Homebuyers Must Master

The dream of homeownership remains a cornerstone of the American spirit, a testament to security, stability, and wealth building. Yet, for many venturing into the market for the first time, especially in a dynamic landscape like 2025, the journey can feel like navigating a complex maze. After a decade immersed in real estate, guiding countless first-time buyers through myriad transactions, I’ve observed recurring missteps that can turn a joyous occasion into a stressful ordeal. The 2025 housing market, influenced by evolving interest rates, persistent inventory challenges, and technological shifts, demands an even sharper approach.

This isn’t just about avoiding simple errors; it’s about strategizing like a seasoned investor, even when you’re just starting out. Let’s unravel the ten most common, yet entirely avoidable, mistakes that first-time homebuyers often make, equipping you with the insider knowledge to secure your slice of the American dream with confidence and foresight.

Mistake #1: Skipping the Mortgage Pre-Approval Process

In a competitive 2025 market, a pre-approval letter isn’t just a formality; it’s your golden ticket. Many eager buyers jump straight into house hunting, only to find themselves sidelined when they fall in love with a home they can’t afford, or worse, lose out on an accepted offer because their financing isn’t in order. This oversight can lead to profound disappointment and wasted time.

What is Mortgage Pre-Approval?

Mortgage pre-approval is a comprehensive evaluation by a lender (a bank, credit union, or mortgage broker) to determine how much they’re willing to lend you for a home purchase. It’s a deep dive into your financial health, assessing your credit score, income, debt-to-income (DTI) ratio, employment history, and assets. The lender then issues a conditional letter specifying the maximum loan amount, often with an estimated interest rate. This isn’t a guaranteed loan, but a strong indication of your borrowing power, pending a final property appraisal and underwriting.

Undeniable Benefits of Early Pre-Approval

Establishes a Realistic Budget: This is foundational. Before stepping foot into an open house, you’ll know your true purchasing power, preventing you from fixating on properties outside your financial reach. This clarity helps you focus your search efficiently.

Boosts Your Negotiating Power: In a market where multiple offers are common, a pre-approved buyer signals serious intent. Sellers and their agents know you’re financially vetted, reducing their risk and making your offer more appealing, often even over a slightly higher bid from an unapproved buyer. This can be crucial when negotiating price, terms, or even contingencies.

Expedites the Closing Process: With much of your financial documentation already scrutinized, the financing aspect of the closing process can proceed much faster. This not only eases stress but can also be a critical factor if a seller is looking for a quick close.

Proactively Identifies Credit Issues: The pre-approval process forces a credit check. If there are any inaccuracies, forgotten debts, or areas for improvement in your credit report, you’ll discover them early enough to rectify them before they derail your home loan application. This foresight can save you thousands in interest over the life of the loan.

The Modern US Pre-Approval Process

Research & Compare Lenders: Don’t just go with your current bank. Explore different lenders, compare interest rates, fees, and customer service reviews. Mortgage brokers can be excellent resources as they work with multiple lenders to find you the best fit.

Gather Essential Documentation: Be prepared. You’ll typically need:

Photo ID (Driver’s License or Passport) and Social Security Number.

Proof of Income: Recent pay stubs (30-60 days), W-2 forms (past two years), and if self-employed, two years of tax returns and profit/loss statements.

Asset Verification: Bank statements (past 60-90 days) for checking, savings, and investment accounts, demonstrating funds for down payment and closing costs.

Debt Information: Statements for credit cards, auto loans, student loans, and any other significant debts.

Submit Your Application: This can often be done online, by phone, or in person. Be thorough and honest.

Credit Check & Underwriting Review: The lender will pull your credit report. Their underwriting team will then review all submitted documents to assess your risk profile.

Receive Your Pre-Approval Letter: If approved, you’ll get a letter outlining the loan amount, type, and estimated interest rate, valid for typically 60-90 days.

Mistake #2: Underestimating the Total Cost of Homeownership

Many first-time buyers focus solely on the list price and potential mortgage payment, overlooking a crucial truth: the cost of owning a home extends far beyond these figures. In 2025, with fluctuating energy costs and potential inflation in service prices, accurately budgeting for all expenses is more vital than ever. Failing to do so can lead to immediate financial strain, depleting your savings and turning the dream into a burden.

Unveiling the “Hidden” Costs

Closing Costs: These are a significant upfront expense, separate from your down payment, typically ranging from 2% to 5% of the loan amount. They include:

Lender Fees: Loan origination fees, underwriting fees, discount points (optional, to lower interest rate).

Third-Party Fees: Appraisal fees, credit report fees, survey fees, title search, title insurance (owner’s and lender’s), attorney fees (in attorney-review states), recording fees, escrow fees.

Prepaid Items: Property taxes, homeowners insurance premiums (often 6-12 months), and sometimes HOA dues, paid in advance at closing.

Property Taxes: These are not a one-time fee; they’re recurring and can vary dramatically by state, county, and even municipality. Assessed annually or semi-annually, they fund local services like schools, police, and infrastructure. Research the specific property’s tax history and current assessment to get an accurate estimate. Property taxes can be a substantial monthly expense, often rolled into your mortgage payment (escrow).

Homeowners Insurance: Mandatory for virtually all mortgage lenders, this protects against perils like fire, theft, and natural disasters. Premiums vary based on location, home value, deductible, and coverage limits. In areas prone to specific risks (e.g., hurricanes, earthquakes), separate policies may be required, significantly increasing costs.

Homeowners Association (HOA) Fees: If you’re buying a condo, townhouse, or a home in a planned community, expect monthly or annual HOA fees. These cover maintenance of common areas, amenities (pools, gyms), and often external repairs. Failure to pay can lead to liens or even foreclosure. Review the HOA’s financial health and rules before you buy.

Utility Connection & Initial Setup: Connecting electricity, water, gas, internet, and sometimes sewer can incur initial setup fees from utility providers.

Private Mortgage Insurance (PMI): If your down payment is less than 20% of the home’s purchase price, your lender will likely require PMI. This protects the lender, not you, in case you default. It’s an additional monthly cost that can amount to 0.3% to 1.5% of the original loan amount per year, though it can often be cancelled once you reach 20% equity.

Anticipating Maintenance and Repair Expenses

Beyond the “hidden” costs, a home requires ongoing care. As a rule of thumb, budget 1% to 3% of your home’s value annually for maintenance and repairs. For a $400,000 home, that’s $4,000 to $12,000 per year – a significant sum.

Routine Maintenance: Landscaping, gutter cleaning, HVAC filter replacements, pest control.

Periodic Upgrades: Exterior painting (every 5-10 years), roof replacement (every 15-30 years), appliance upgrades.

Emergency Repairs: Leaky pipes, broken water heater, electrical issues, sudden HVAC failure. These unexpected expenses are why an emergency fund (beyond your initial savings) is non-negotiable.

Mistake #3: Neglecting Thorough Neighborhood Due Diligence

“Location, location, location” isn’t just a cliché; it’s the bedrock of real estate value and your quality of life. Many first-time buyers fall in love with a house, only to realize later that the surrounding area doesn’t align with their lifestyle or future aspirations. In 2025, with remote work shifting dynamics and community values taking precedence, understanding your chosen locale is paramount.

Key Factors When Evaluating a Locality

Safety and Crime Rates: This is often a top priority. Utilize local police department websites, neighborhood statistics portals (e.g., NeighborhoodScout, Niche), and local news archives to understand crime trends. Drive or walk around the neighborhood at different times of day and night.

Commute Times and Accessibility: How long will it take to get to work, schools, and essential services? Consider traffic patterns during rush hour. Evaluate proximity to major highways, public transportation (buses, subways, commuter rail), and ride-sharing accessibility.

Proximity to Essential Amenities and Services: How close are grocery stores, pharmacies, hospitals, doctors’ offices, and childcare facilities? Do you have easy access to parks, recreational facilities, shopping centers, restaurants, and cultural attractions that align with your interests?

School District Quality: Even if you don’t have children, school district ratings significantly impact property values and resale potential. Research public and private school performance ratings.

Noise Levels and Traffic Flow: Spend time in the neighborhood during different parts of the day. Is it near a busy road, airport flight path, train tracks, or industrial areas? How much street parking is available?

Community Demographics and Culture: Does the community feel like a good fit? Are there active neighborhood associations, community events, or shared interests among residents? Talk to potential neighbors.

Future Development Plans and Their Impact: This is where an expert eye truly helps. Investigate municipal development plans. Are there approved or proposed infrastructure projects (new roads, public transit lines, commercial centers) that could enhance or detract from the area? Conversely, are there plans for high-density housing, industrial expansion, or zoning changes that could alter the neighborhood’s character and property values? A new park could boost value; a new landfill, less so.

Understanding these elements can prevent buyer’s remorse and ensure your home is not just a structure, but a sanctuary within a community that supports your lifestyle.

Mistake #4: Overlooking the Importance of a Professional Home Inspection

Buying a home without a thorough inspection is akin to buying a used car sight unseen – a gamble with potentially catastrophic financial consequences. In 2025, with an aging housing stock in many desirable areas, comprehensive inspection is non-negotiable. Many first-time buyers, eager to close or in a hot market, waive this crucial step, often regretting it bitterly.

What Does a Home Inspection Cover in the US?

A qualified home inspector performs a non-invasive, visual examination of the physical structure and major systems of a home, from the roof to the foundation. This isn’t an appraisal or code enforcement, but a detailed assessment of a home’s overall condition and safety. Key areas covered typically include:

Structural Components: Foundation, crawlspace, basement, attic, framing, walls, ceilings, floors.

Exterior: Roof (shingles, flashing, gutters), siding, windows, doors, chimney, deck, porch, grading, drainage.

Interior: Walls, ceilings, floors, windows, doors, stairs.

Plumbing System: Water supply, drain, waste and vent systems, water heater, fixtures, faucets.

Electrical System: Service entrance, main panel, branch circuits, outlets, switches, light fixtures.

HVAC System: Heating, ventilation, and air conditioning units, distribution systems, thermostats.

Built-in Appliances: Dishwasher, oven/range, microwave, garbage disposal.

Insulation and Ventilation: In attics and unfinished spaces.

The inspector will identify significant defects, safety concerns, and potential issues that require further evaluation by specialists.

Common Issues Uncovered in US Homes

Water Damage & Drainage Issues: Leaky roofs, faulty gutters, poor exterior grading leading to basement flooding or foundation issues.

Foundation Problems: Cracks, settling, signs of movement, which can indicate structural instability.

Outdated Electrical Systems: Knob-and-tube wiring, insufficient amperage (60-amp service in older homes), ungrounded outlets, overloaded circuits – all major safety hazards.

Aging HVAC Systems: Furnaces or AC units nearing the end of their lifespan, inefficient operation, or requiring costly repairs.

Plumbing Woes: Galvanized pipes, polybutylene piping (prone to leaks), low water pressure, faulty water heaters.

Roofing Problems: Missing or damaged shingles, inadequate flashing, signs of leakage, nearing end of life.

Pest Infestations: Termites, carpenter ants, rodents, or other pests that can cause significant damage.

Unpermitted Renovations: Work done without proper permits can lead to safety issues and legal complications down the line.

How to Find a Reliable Home Inspector

Seek Referrals: Ask your real estate agent, friends, family, or colleagues for recommendations, but always verify.

Verify Credentials & Experience: Look for inspectors who are certified by reputable organizations like the American Society of Home Inspectors (ASHI) or the International Association of Certified Home Inspectors (InterNACHI). Ensure they are licensed in your state (if required) and have substantial experience.

Review Sample Reports: A good inspector provides a detailed, easy-to-understand report with photos. Ask to see a sample to gauge its comprehensiveness and clarity.

Check Client Reviews: Online reviews (Google, Yelp, Angi) offer insights into an inspector’s professionalism, thoroughness, and communication skills.

Discuss Scope and Specializations: Confirm what the inspection covers. If the home has specific features (e.g., a septic system, well water, old oil tank), ask if they offer specialized inspections or can recommend a specialist.

Attend the Inspection: Being present allows you to ask questions in real-time, gain a deeper understanding of the home’s condition, and learn about its various systems.

A robust inspection report provides leverage for negotiation (repairs, credits, or price reduction) or, critically, offers an “out” if significant issues are found that you’re unwilling to tackle.

Mistake #5: Emptying Your Savings for the Down Payment

While a larger down payment generally means a smaller mortgage and lower monthly payments, depleting your entire financial reserves to achieve this is a perilous strategy. Many first-time buyers, especially in a competitive market, stretch themselves thin, only to find themselves vulnerable to unexpected homeownership costs.

The Balancing Act: Down Payment vs. Emergency Funds

Your down payment is crucial, but equally vital is maintaining a robust emergency fund. Ideally, you should have at least 3-6 months’ worth of living expenses plus an additional buffer specifically for unexpected home repairs or maintenance. Think of the water heater that decides to quit the day after closing, or the AC unit that fails during a summer heatwave. Without adequate savings, these sudden expenses can force you into high-interest debt or worse.

Recommendation: Aim for a down payment that allows you to avoid Private Mortgage Insurance (PMI) if possible (20% down), but not at the expense of your financial safety net. If a 20% down payment is out of reach, lower your down payment and accept PMI, knowing you can often cancel it later, rather than sacrificing your emergency fund.

Government Programs and Alternative Down Payment Sources

The good news is that numerous programs exist to help first-time homebuyers with down payments, reducing the pressure to exhaust your savings. In 2025, these programs continue to evolve and remain invaluable resources.

Federal Housing Administration (FHA) Loans: Offer low down payment options (as little as 3.5%) and more flexible credit requirements, making homeownership accessible to a wider range of buyers.

VA Loans: Exclusively for eligible military service members, veterans, and surviving spouses, VA loans require no down payment and often come with competitive interest rates and no PMI.

USDA Loans: Designed for rural and some suburban areas, these loans offer zero down payment options for qualifying low-to-moderate income borrowers.

State and Local Down Payment Assistance (DPA) Programs: Almost every state and many local municipalities offer programs (grants, deferred loans, or low-interest loans) to help first-time buyers with down payments and closing costs. These often have income limits and specific property requirements.

“Good Neighbor Next Door” Program: HUD offers a significant discount (50%) on homes to law enforcement officers, teachers, firefighters, and EMTs in revitalization areas.

Employer Assistance Programs: Some companies offer home buying assistance as an employee benefit.

Gifts from Family Members: Funds gifted by family can be used for a down payment, but lenders require a “gift letter” to confirm the funds are not a loan that needs to be repaid.

401(k) Loans or Withdrawals: While possible, this should be approached with extreme caution. Taking a loan against your 401(k) requires repayment with interest, and a withdrawal incurs taxes and potentially penalties, significantly impacting your retirement savings. Consult a financial advisor.

Exploring these avenues allows you to build equity without sacrificing your financial resilience.

Mistake #6: Overlooking Long-Term Resale Potential

For many first-time buyers, a home isn’t just a place to live; it’s a significant investment. However, a common mistake is prioritizing immediate gratification over a property’s long-term resale value. While you might love a quirky design or a niche location, consider if a future buyer will share that same enthusiasm. A home that doesn’t appreciate well can trap you or make it difficult to move up the property ladder.

Key Factors Affecting Resale Value in the US Market

Location, Location, Location (Revisited): Still the most critical factor. Proximity to strong school districts, major employment hubs, desirable amenities (parks, shops, restaurants), and efficient transportation links (highways, public transit) consistently drives value. A growing local economy and population also signal strong potential.

Neighborhood Stability and Growth: Is the neighborhood improving, declining, or stable? Look for signs of investment, well-maintained homes, and active community organizations. Future development plans (as discussed in Mistake #3) can also significantly impact this.

Curb Appeal and Exterior Condition: First impressions matter. A well-maintained exterior, attractive landscaping, and a cohesive architectural style contribute significantly to perceived value.

Functional Layout and Universal Appeal: While personal preferences are fine, overly unique or highly specialized layouts can deter future buyers. Open-concept living, a reasonable number of bedrooms/bathrooms, and flexible spaces (e.g., a home office nook) are generally desirable. Avoid properties with odd configurations that would require extensive renovations to appeal to a broader market.

Quality of Construction and Maintenance: A well-built home with a history of good maintenance will always command a higher price. Buyers want peace of mind regarding major systems (roof, HVAC, plumbing, electrical).

Desirable Upgrades and Features (with ROI): Certain upgrades, like updated kitchens and bathrooms, energy-efficient windows, and smart home technology, offer a good return on investment. Be wary of highly personalized or luxury upgrades that may not appeal to a broad buyer pool or for which you won’t recoup the cost.

Economic Trends and Interest Rates (2025 Context): While beyond your control, understanding broader market forces is crucial. Sustained low interest rates tend to boost demand and prices, while rising rates can cool the market. A robust local job market and economic growth are strong indicators of future property appreciation.

Thinking ahead about who might want to buy your home in five, ten, or even twenty years can guide your initial purchase toward a more sound investment.

Mistake #7: Falling in Love with a Home Beyond Your Budget

The emotional pull of a beautiful home is powerful, and it’s easy to let feelings override financial realities. This is a classic trap for first-time buyers, especially when viewing aspirational properties. Getting swept away by a stunning kitchen or a sprawling backyard that’s well outside your pre-approved limit can lead to overextending your finances, deep regret, or losing out on viable options because your expectations are now unrealistic.

Practical Tips for Staying Within Budget During House Hunting

Define Your “Must-Haves” vs. “Nice-to-Haves”: Before you start looking, create a clear list. Distinguish between non-negotiable features (e.g., specific number of bedrooms, a certain school district, commute time) and desirable but not essential elements (e.g., a gourmet kitchen, a large yard, a finished basement). Prioritizing helps you make rational choices.

Strictly Adhere to Your Pre-Approval Limit: Your pre-approval isn’t a target to hit; it’s a ceiling. Aim to stay comfortably below it, leaving room for unexpected closing costs or initial repairs. Remember, lenders approve based on maximum capacity, not necessarily what’s most comfortable for your lifestyle.

Utilize Online Affordability Tools: Before you even contact an agent, use online mortgage calculators to estimate monthly payments (including principal, interest, taxes, and insurance – PITI) at various price points. This helps you visualize the real cost of ownership.

Avoid “Just Looking” at Out-of-Budget Homes: This is critical. Once you see what “more money” buys, it’s incredibly difficult to appreciate homes within your actual budget. Instruct your real estate agent to only show you properties that genuinely align with your financial parameters.

Focus on Value and Potential, Not Just Perfection: Many homes have “good bones” but need cosmetic updates. Buying a slightly less polished home within your budget and making strategic improvements over time can be a much smarter financial move than stretching for a turnkey property that leaves you house-poor.

Maintain a Rational Perspective: It’s okay to feel excitement, but approach each viewing with a critical eye. Ask yourself: “Does this property meet my core needs within my budget, or am I just admiring its aesthetics?”

Remaining disciplined and pragmatic during the house hunt ensures your dream home doesn’t become a financial nightmare.

Mistake #8: Not Fully Understanding the Legal and Contractual Aspects

The US real estate market, while generally robust, is a maze of contracts, disclosures, and local regulations. For a first-time buyer, the sheer volume of paperwork and legal jargon can be overwhelming, leading to a tendency to gloss over critical details. This mistake can expose you to significant financial risks, unexpected liabilities, and even future legal disputes.

Common Legal Pitfalls in US Real Estate

Title Defects: These are issues with the legal ownership of the property, such as undisclosed liens (e.g., unpaid taxes, contractor bills), easements (another party’s right to use part of your property), boundary disputes, or previous fraudulent transfers. A thorough title search and owner’s title insurance (highly recommended) are crucial protections.

Zoning Violations & Unpermitted Renovations: Previous owners might have made additions or alterations without obtaining necessary permits or in violation of local zoning laws. This can lead to fines, forced removal of structures, or difficulty selling the property later. Your home inspector may flag unpermitted work, and your attorney or agent should advise on researching permits.

Undisclosed Property Defects: Sellers are legally required to disclose known material defects (e.g., lead paint, asbestos, structural issues, past water damage). However, some may not disclose everything, or issues might be unknown to them. Your inspection and due diligence are your best defenses.

Homeowners Association (HOA) Documents: For properties with an HOA, you’re bound by their Covenants, Conditions, and Restrictions (CC&Rs). Failing to review these documents thoroughly can lead to unwelcome surprises regarding rules on renovations, parking, pets, rental restrictions, or escalating fees.

Complex Purchase Agreements and Contingencies: The purchase agreement is a legally binding contract. Understanding every clause, particularly contingencies (e.g., financing, inspection, appraisal), earnest money clauses, and closing date specifics, is vital. Misinterpreting these can cost you your earnest money deposit or force you into a bad deal.

Property Line Disputes: Sometimes fences or landscaping may not align with official property lines, leading to potential disputes with neighbors. A property survey can clarify boundaries.

The Indispensable Role of Professionals

Navigating these legal complexities requires expertise.

Experienced Real Estate Agent: A good agent will guide you through the process, explain standard contract terms, and flag potential issues. They advocate for your interests.

Real Estate Attorney: In many states (particularly “attorney states” like NY, NJ, MA, etc.), an attorney is mandatory for closing. Even where not required, hiring one is a wise investment. They review contracts, conduct due diligence on the title, ensure all legal requirements are met, and protect your interests during negotiations.

Title Company/Escrow Agent: These professionals handle the transfer of title and manage the escrow account, ensuring funds and documents are exchanged properly.

Never sign anything you don’t fully understand. Ask questions, seek clarification, and ensure your legal rights are protected at every stage.

Mistake #9: Rushing the Decision

Buying a home is arguably the largest financial decision most people make in their lifetime. Yet, under pressure from a competitive market, a persistent agent, or even their own eagerness, many first-time buyers rush into a commitment without proper deliberation. This impulsive behavior is a recipe for buyer’s remorse and significant long-term consequences.

The Dangers of Hasty Decisions

Overpaying: Rushing often means less time for market research, comparative analysis, and thoughtful negotiation. You might agree to an inflated price or waive critical contingencies that could have saved you money or protected you from hidden issues.

Missing Red Flags: Speed can lead to overlooking critical findings from the home inspection, appraisal issues, or concerns about the neighborhood that a more deliberate process would have revealed.

Settling for Less: You might settle for a home that doesn’t truly meet your needs or desires, simply because you feel pressured to make a decision or fear missing out on any property.

Financial Strain: A rushed decision might lead you to disregard your budget, accept unfavorable loan terms, or underestimate ongoing costs, all of which create financial stress.

Knowing When to Walk Away from a Deal

Sometimes, the best decision is to walk away, even after investing time and emotional energy. Trust your gut and lean on your contingencies.

Significant Undisclosed Property Concerns: If the home inspection reveals major, costly issues (e.g., foundation damage, severe mold, major system failures) that the seller is unwilling to address or credit, and these issues exceed your comfort level or budget.

Appraisal Gap You Can’t Afford: In a hot market, a home might appraise for less than your agreed-upon offer. If you don’t have the cash to cover the “appraisal gap” (the difference between the offer and the appraised value) and the seller won’t renegotiate, it’s time to reconsider.

Seller’s Lack of Fair Bargaining or Transparency: If the seller or their agent is difficult to work with, unwilling to provide requested documents, or appears to be hiding information, it’s a major red flag.

Changes in Your Personal Financial Circumstances: A job loss, unexpected medical expense, or other major life event can drastically alter your financial capacity. Don’t push forward with a purchase that is no longer prudent.

Feeling Coerced or Pressured: If you feel an agent, seller, or anyone else is pushing you into a decision you’re uncomfortable with, pause. Your long-term happiness and financial well-being are paramount.

Title Issues or Legal Complications: If title search reveals insurmountable liens, boundary disputes, or other legal entanglements that cannot be resolved satisfactorily.

Patience is a virtue in real estate. There will always be another home. Waiting for the right opportunity, and being prepared to walk away from a problematic one, is a sign of a smart, well-informed buyer.

Mistake #10: Neglecting to Plan for Your Future Needs and Goals

A home is more than just a place to live; it’s a canvas for your life’s unfolding story. Many first-time buyers make the mistake of purchasing a home based solely on their immediate needs, failing to consider how their life might evolve over the next 5, 10, or even 20 years. This short-sightedness can lead to outgrowing your home quickly, needing to move sooner than planned, or facing costly renovations to adapt it to changing circumstances.

Considering Long-Term Family and Lifestyle Needs

Family Growth or Shrinkage: Are you planning to start a family, or will your current family grow? Will you need more bedrooms, a larger yard, or proximity to good schools? Conversely, if you’re an empty-nester or downsizing, consider a home that accommodates fewer occupants without excess space.

Aging Parents or Multi-Generational Living: The trend of multi-generational households is on the rise. Does the home offer space for an aging parent, perhaps a first-floor bedroom and bathroom, or the potential to add an accessible in-law suite?

Work-Life Evolution: With the continued prevalence of remote and hybrid work models in 2025, do you need a dedicated home office space? Will your career path require specific amenities, or could it lead to a relocation in the future?

Accessibility and “Aging in Place”: Consider the home’s long-term accessibility. Are there many stairs? Are doorways wide enough? While you might not need these features now, a home that can be easily adapted (or already offers) single-level living, walk-in showers, or wider hallways can save significant expense and stress down the line.

Lifestyle Changes: Do you envision hobbies that require specific spaces (e.g., a workshop, a large garden)? Will your social life change, requiring proximity to urban centers or quiet suburban retreats?

Financial Stability for Future Upgrades: Can your future budget accommodate potential renovations, energy efficiency upgrades, or technological advancements that might become standard?

By envisioning your life five, ten, and fifteen years down the road, you can select a home that grows with you, minimizing the need for costly moves or extensive remodels. This foresight transforms your first home purchase into a true long-term investment in your future.

The journey to homeownership in 2025 is an exciting one, full of potential and new beginnings. By proactively avoiding these ten common mistakes, you’re not just buying a house; you’re making a strategic investment in your future, securing a foundation for your dreams, and ensuring your transition into homeownership is as smooth and successful as possible.

Ready to navigate the 2025 housing market with unwavering confidence and make a truly informed decision? Don’t leave your most significant investment to chance. Reach out to a trusted real estate expert and lender today to build your personalized strategy and unlock the door to your dream home.